Finance

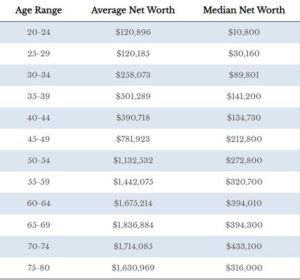

People are naturally curious as to how they compare to others, and wondering how you compare to someone else financially is no different. While understanding where you fall within the national average when it comes to your net worth is useful information, keep in mind that it has no bearing…

The numbers: Construction of new homes rose 1.9% in October, as builders amped up new projects. The pace of construction increased as builders saw a pressing need for more housing units, with the resale market continuing to deal with a shortage. Housing starts rose to a 1.37 million annual pace…

As 2023 winds down to a close, our attention as investors turns to the coming year. What investment vehicles, in which sectors, are going to serve us best in 2024? While none of us have a crystal ball that will reliably show us the future, we can all use some…

Investing in a 401(k) plan is one of the most effective options an investor has to plan for retirement. Tax-deferred growth and relatively high contribution limits enable individuals to amass a more substantial nest egg over their working years. Employer matching contributions, where applicable, represent an additional boost to retirement…

The Financial Crimes Enforcement Network—more commonly known as FinCEN—in close coordination with the Internal Revenue Service Criminal Investigation—sometimes referred to as CI or IRS-CI—issued an alert to financial institutions on fraud schemes related to the COVID-19 Employee Retention Credit (ERC). The alert provides an overview of some indicators associated with…

Thanksgiving is an appropriate time to be thankful for the rich bounty that stocks have given us this year, but it is also a crucial time to consider the “turkey problem” as it relates to investing. Nassim Taleb introduced the world to the “Black Swan” and used this tale to…

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own. The…

This is reprinted by permission from . Entering the holiday season with high-interest debt or financial struggles can put you at risk for a debt hangover that could linger for years. It’s a crossroads that many will unfortunately encounter this holiday season. Credit card balances rose to over $1 trillion…

ChatGPT and generative AI have exploded in popularity. You can use ChatGPT to recommend movies, offer travel plans, and even write songs in the style of Dolly Parton or Taylor Swift. But should you use ChatGPT to help with your investing decisions? ChatGPT has an extensive knowledge of niche finance…

Dividend stocks are a core part of many retirement portfolios. But dividend investing is at a unique point in market history, with T-bills yielding 5%. That raises the bar for “high-yield” stocks, since stocks can fall heavily in price. In this article, I toe the line between yield and stability.…