Taxes

Workers in Washington state saw a new deduction in their paychecks last month: a tax on wages meant to help pay for the cost of long-term care. The first-of-its-kind tax in the U.S. was created in 2019. However, under the program’s timeline, workers began making payroll contributions in July of…

Rewards earned from staking cryptocurrency are to be included in a taxpayer’s gross income when received. For those who follow the taxation of digital assets the position taken in IRS Revenue Ruling 2023-14 comes as no surprise. The ruling formalizes the position the IRS has taken at least since the…

A large portion of my client base involves small business owners with financial troubles due to a failure of paying taxes. As a result, I find that often taxpayers hope that if they ignore IRS Notices the debt will disappear. Unfortunately, this does not occur and results in the taxpayer…

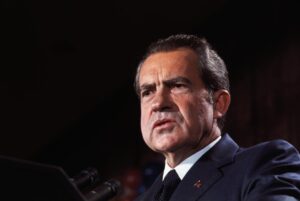

On July 30, 1973, Tax Analysts accused President Richard Nixon of playing fast and loose with the tax laws. In a 16-page study released to the public and submitted directly to the IRS, the fledgling nonprofit questioned the deductions that Nixon had taken for donating his official papers to the…

The IRS is clearly serious about moving its Strategic Operating Plan forward. The plan, which was released in April, has been described by the agency as an “ambitious effort to transform the tax agency and dramatically improve service to taxpayers and the nation during the next decade.” This week, the…

Small and medium-sized enterprises (SMEs) play a vital role in the European Union (EU) economy, driving innovation, employment, and economic growth. These enterprises form the backbone of the EU’s business landscape, comprising 99% of all businesses in the region and accounting for more than half of Europe’s GDP. SMEs employ…

The provisions of the Corporate Transparency Act affect virtually every LLC in the United States. Yet many small- to medium-sized businesses remain unaware of the CTA or its new reporting requirements. The CTA is administered by the Financial Crimes Enforcement Network and it is through FinCEN that businesses will report…

Golf season is in full swing in parts of the U.S. — but a U.S. Senator is making golf news this week. Senator Ron Wyden (D-OR), the chair of the Senate’s finance committee, has introduced two bills targeting The PGA Tour and its tax-exempt status. The bills are called the…

The past two months have made clear that President Joe Biden’s approach to making higher education more affordable isn’t working. First, bipartisan majorities of both the U.S. House and Senate voted to block his debt cancellation policies. Then, shortly after Biden thwarted that effort with his veto pen, the Supreme…

Establishing a streamlined transfer pricing approach for baseline distribution — originally seen as the least controversial aspect of the OECD-brokered two-pillar global tax reform — has hit a roadblock that will be difficult to resolve. First proposed in a 2019 OECD consultation document, a project awkwardly dubbed amount B was…