Taxes

Wage increases are generally a great thing, but the added benefit of an income increase can be offset by the higher prices of goods in times of high inflation and the possibility of being nudged into a higher tax bracket. This phenomenon is known as tax bracket creep. The result?…

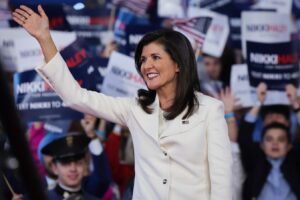

Former South Carolina Governor Nikki Haley, who appears to be winning increasing support among Republicans in the race for her party’s 2024 presidential nomination, is running on a fairly standard GOP tax and budget platform. But it includes important twists and some inconsistencies with her record as governor. She backs…

Mike Resnick of Eversheds Sutherland discusses the effects on taxpayers of the corporate alternative minimum tax and its recently released guidance. This transcript has been edited for length and clarity. David D. Stewart: Welcome to the podcast. I’m David Stewart, editor in chief of Tax Notes Today International. This week:…

Do tax opinions protect you from the IRS? Usually yes, provided that you get one early enough. That generally means having the tax opinion in hand before you file your tax return. Many clients and tax advisers have trouble saying exactly why one should get a tax opinion or how…

Introduction Taxpayers, like all people, are risk averse for the most part; they want to avoid financial uncertainty to the greatest extent possible. This is difficult to accomplish when the Internal Revenue Service (“IRS”) regularly attacks certain issues, often concluding that taxpayers owe additional taxes, penalties, and interest for several…

All across America, voters will be headed to the polls on Tuesday, Nov. 7, 2023. It’s an off-year for elections—the presidential elections aren’t until next year—but there are state and local races, as well as ballot initiatives, to decide. Voters will be pulling the lever to make choices on tax…

Judge David Gustafson injected a good dose of common sense into the ongoing struggle between the IRS and the syndicators of conservation easements. His opinion in Mill Road 36 Henry LLC lays bare the nonsense that has created the syndicated conservation easement industry. The story starts with undeveloped suburban land…

The United States has long seen itself as an open-for-investment free-market bastion. But concerns about national security–and some political grandstanding– could close the doors to foreign buyers, particularly when it comes to farmland. By Kelly Phillips Erb, Forbes Staff The action last week by Arkansas Attorney General Tim Griffin affected…

The Internal Revenue Service on Wednesday opened the portal for car sellers to register with Energy Credits Online – a site that will allow dealers to dole out the federal electric vehicle tax credit of up to $7,500 to buyers as a discount. The move marks the latest step in…

The IRS says that the amount you can sock away for retirement is going up. In 2024, individuals can contribute up to $23,000 to their 401(k) plans in 2024—up from $22,500 for 2023. And those playing catch-up get a boost, too: the catch-up contribution limit for employees aged 50 and…