If you receive Social Security benefits, the portion of those benefits which will be taxable depends on your income. The taxable portion is between 0% and 85% of your benefits.

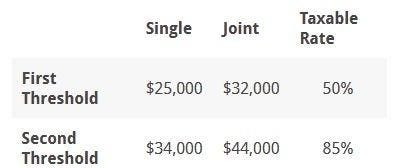

To calculate how much is taxable, you compare your so-called provisional income to two thresholds. Those are:

Provisional income below the first threshold is not taxable. Then, amounts over the first threshold are taxable at the 50% rate and amounts over the second threshold are taxable at the 85% rate, but there is a total maximum taxable cap of 85% of benefits.

You can see how if you have any other source of income other than Social Security, it is likely that some of your Social Security benefits will be taxable. However, these thresholds weren’t always quite so restrictive. We can blame inflation for how it works today.

The first 50% threshold

Originally, Social Security benefits were explicitly excluded from federal taxable income.

However, when Ronald Regan took office in 1981, Social Security was going to run out of money as early as August of 1983. To address this, he appointed a National Commission on Social Security Reform chaired by Alan Greenspan.

The final effect of this committee was the Social Security Amendments of 1983. It passed with bi-partisan support and created the first 50% threshold. It also gradually increased the full retirement age from 65 to 67 over a 22-year period.

The legislation resolved the short-term financing issues without fixing the underlying problem. The legislation was an immense act of compromise . Even though Alan Greenspan chaired the committee, he was critical of the act, stating, “Do I like the present Social Security system? No. If you asked me whether it would be necessary in the ideal society, I’d say no. Our type of economy is far removed from where I would like to see it, but you have to be careful about moving from one type of society to another.”

Many seniors were upset. They complained, as they do today, that the money was originally removed from their pay as a tax, so it shouldn’t be taxed again when it is paid in benefits.

Back in 1983 when the $25,000 single and $32,000 married limits were set, there was the intent that it would only affect high-income earners. Adjusted for inflation, those limits would be $67,118 and $85,912 in 2021.

Because they aren’t inflation adjusted, more and more Social Security benefits have been taxed over time.

In 1983, the average Social Security benefit was $440.77 per month or $5,289.24 for the year. In 1983, a single filer with this average benefit could have an additional $22,355.38 in income to have a provisional income of exactly $25,000 (22,355.38 + 5,289.24/2) and still be under the limit and have none of their Social Security taxed.

In 2021, the average Social Security benefit was $1,658.03 per month or $19,896.36 for the year. The 1983 income of $22,355.38 is equivalent to $60,018.41 by the end of 2021 after adjusting for inflation. When that same average filer tried to file today, their provisional income would be $69.966.59 ($60,018.41 + $19,896.36/2). From the inflation alone over these 38 years, this filer would see that the maximum taxable benefits of 85% is taxed.

The second 85% threshold

Social Security has oscillated between being solvent in the short-term and facing a terminal problems in crisis mode. Because the system is forgotten when it is not in a crisis, congressional representatives have not taken the time to reinvent the system for the long term.

The second 85% threshold was first put into law in Social Security Act Amendments of 1993. It passed with only Democrat support and a tie-breaking vote cast by Vice President Al Gore. The Republicans did not support raising taxes on Social Security for many reasons. Some wanted to privatize Social Security. Some wanted to allow Social Security to invest in a balanced portfolio rather than being restricted to federal treasury bonds. All of these ideas were floated during the next administration.

Some seniors complained, but by 1993 the principle that the federal government could tax Social Security had already been made. Now, we were just arguing about how much. What had began as a “tax on the rich” was now increasingly a tax on lower middle income citizens.

Back when the $34,000 single and $44,000 married limits were set, those limits had the purchasing power of $62,757 and $81,215 in 2021, effectively targeting the same level of high-income as the original 1983 congressmen were.

Meanwhile without an inflation adjustment, the lower limits had drifted down into the middle class.

The $25,000, which was originally in 1983 affecting those making $67,118 in 2021 dollars, was now affecting those earning $46,145 in 2021 dollars.

Meanwhile, the $32,000, which was originally in 1983 affecting those making $85,912 in 2021 dollars, was now affecting those earning $59,066 in 2021 dollars.

In 1993, the average Social Security benefit was $1,288.94 per month or $15,467.28 for the year. In 1993, a single filer with this average benefit could have an additional $26,266.36 in income to have a provisional income of $34,000 exactly (26266.36 + 15467.28/2) and have 29.09% of their Social Security taxed [(34000-25000)*.5].

In 2021, the average Social Security benefit was $1,658.03 per month or $19,896.36 for the year. The 1993 income of $26,266.36 is equivalent to $48,482.39 by the end of 2021 after adjusting for inflation. When that same average filer tried to file today, their provisional income would be $58,430.57 ($48,482.39 + $19,896.36/2). From the inflation alone over these 28 years, this filer would see that the maximum taxable benefits of 85% is taxed.

Over time, more and more Social Security benefits are taxed as inflation-adjustments on both Social Security benefits themselves and other income sources push more taxpayers into these higher tax rates.

Implications

Today these limits are worth their face value. When the average annual wage is $60,575.07 in 2021, it is obvious that a $34,000 top threshold is taxing average people.

There are many different possible solutions to Social Security’s problems. But with an unfunded liability in the trillions of dollars, most amendments depend on either decreasing benefits or raising taxes. Many involve some method of financing the transition from an unfunded benefit to an individually funded benefit.

Alas, legislators are never convinced by a long-term cost-benefit analysis no matter how wonderful the final result would be in twenty years. Because any transition would require a couple of decades, it seems unlikely that we will get any major changes at all.

What is likely is something like an increase in the limit of wages subject to Social Security taxes, or an even higher threshold after which Socials Security is taxed at a 100% rate, or some gradual phasing out of benefits for those in the highest income tax brackets.

Social Security has a number of flaws, to which these static tax brackets can be added:

These issues are not likely to be addressed any time soon.

Read the full article here