Ted Frank wants to protect consumers and investors from the plaintiff lawyers who purport to speak for them. He is not a popular figure in the litigation bar.

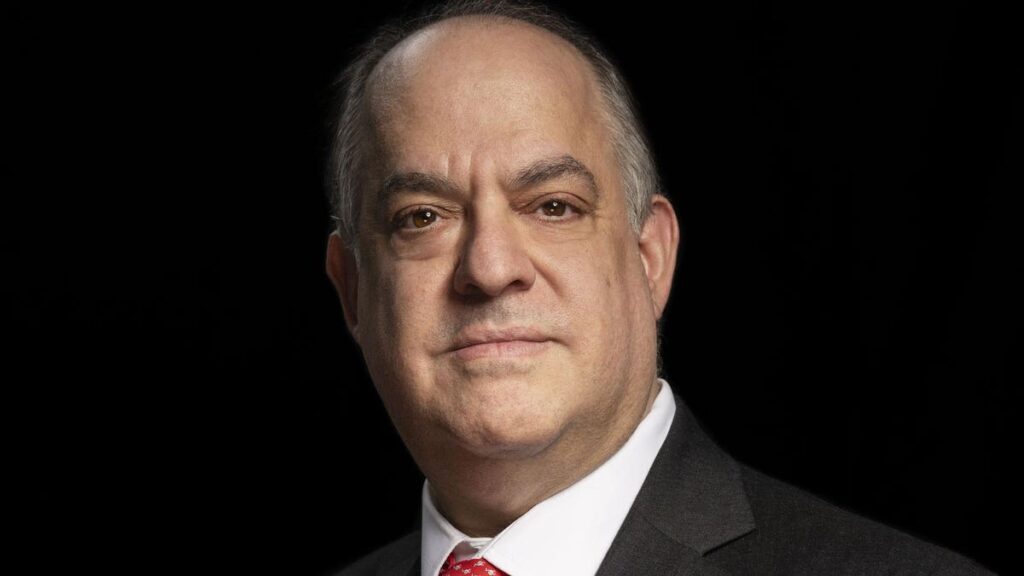

Quixotic quest: make the lawyers filing class actions more interested in the welfare of their clients than in lining their own pockets. The crusader on this mission: Theodore H. Frank, the 54-year-old co-founder and lead actor at a nonprofit called the Hamilton Lincoln Law Institute.

The class lawsuit industry is a peculiarly American one in which law firms collect fees for bringing cases against corporations on behalf of thousands or millions of victims. The misdeed alleged might be charging an impermissible overdraft fee, issuing a merger document that is insufficiently wordy or leaving too much air at the top of a cereal box.

Then, long before any witness is called to the stand, the case is settled. The settlement typically has the corporation agreeing to pay rewards to a few named plaintiffs working with the lawyers and a tiny recompense to the millions of consumers or investors who are in the class. This resolution is accompanied by a very generous contribution to the bank account of the plaintiff law firm.

That’s when Ted Frank or one of the six lawyers working with him jumps in. They ask the judge overseeing the litigation to reduce the pay to the plaintiff lawyers, increase the compensation to the victim class or just throw the whole case out. As often as not, they get a result. Frank says that Hamilton Lincoln’s Center for Class Action Fairness has participated in 125 cases and won at least a partial victory in a comfortable majority.

In August Frank’s institute scored a win in the Seventh Circuit when an appeals court threw out a $57 million payday for the lawyers who won $181 million on behalf of consumers who overpaid for broiler chicken. If the lower court goes along, grocery store customers will get a larger share of that $181 million. If you bought raw chicken between 2012 and 2019, submit a claim at overchargedforchicken.com.

A case that had Frank handling an oral argument before the U.S. Supreme Court in 2018 will finally draw to a close in October, when a district court is expected to approve a settlement of litigation over the way Google used search query data between 2006 and 2013. The original deal had Google buying peace by dishing out money to charities, paying victims nothing and rewarding the plaintiff law firms with $2 million. The Supreme Court bought Frank’s argument that this sort of settlement was unacceptable and kicked the matter back to lower courts. In the updated settlement, something like $16 million will be disbursed to the small fraction of web surfers who heard about the case and sent in claims before the July 31 deadline.

What does Hamilton Lincoln extract from such interventions? Not much. “We saved [class members] tens of millions in one case. We asked for $199,000. The court said, ‘Okay, here’s $12,000.’ After two appeals, we got that increased to $34,000.”

Most of Hamilton Lincoln’s $1.2 million budget comes from donations. Frank pinches pennies. The institute is named after Hamilton and Lincoln in large part because the web address containing the acronym HLLI could be had without paying off a domain squatter. The lawyers mostly work out of their homes, Frank in Houston and the others in five other states.

What do consumers get out of class actions? Precious little. In one outlandish but not atypical case, lawyers went after the Subway chain on the theory that variations in the length of “foot-long” sandwiches caused damage. The company and the lawyers came up with a settlement that benefited nine named sandwich buyers, did nothing for the millions of anonymous customers in the class and paid off the plaintiff lawyers. Frank busted that deal up by getting the Seventh Circuit U.S. appeals court to decree that an appropriate percentage fee for a $0 class benefit would be $0.

Common ploy that plaintiff lawyers use to settle cases: offer the victims discount coupons, while the lawyers get cash. A lawsuit claiming that Samsung washers were defective came to a settlement. Most of the 2.8 million victims were to get a rebate that they could only use by gritting their teeth and buying another Samsung appliance. The plaintiff lawyers, postulating that every member of the class would use the rebates, valued their accomplishment at $65 million and wanted a $6 million fee. Frank’s organization argued that the rebates were close to worthless and got the fee cut to $3.8 million.

The Subway and Samsung interventions didn’t make class members any richer, but they did have the salutary effect of reducing the incentive for plaintiff lawyers to file nuisance cases with the aim of being paid to go away. “We want to deter counterproductive class actions but encourage the good ones that win the class some money,” Frank says. Class suits do help to discipline miscreants, he concedes, but this answer to corporate ills is an expensive one, draining the economy to pay lawyers on both sides.

What do investors get out of class actions? Sometimes, a lot. The litigation over securities violations involving Petrobras, the Brazilian oil producer, delivered a $3 billion pot, from which plaintiff lawyers wanted to pull a $299 million fee; Frank’s objections got $95 million of that fee re-routed to the victims.

Sometimes, securities litigation is just the movement of hot air. Plaintiff lawyers used to have a thriving business blocking corporate mergers by alleging deficiencies in the disclosure document. The defendant would pay the ransom, rewriting a document and handing a check to the lawyers. Frank’s group challenged one of these vacuous class actions and in 2016 won an appeal in the Seventh Circuit. Judge Richard Posner’s opinion called the disclosure lawsuits “no better than a racket.”

The Center for Class Action has had a disproportionate number of its victories in the Seventh Circuit, which sits in Chicago. One reason for that is that Posner, who retired in 2017, was the standard bearer of the “law and economics” movement, which says that jurists should think about the economic consequences of their decisions. The second most famous proponent of that philosophy, Frank Easterbrook, is also on the Seventh Circuit. Ted Frank, after getting his law degree from the University of Chicago, clerked for Easterbrook.

Contrast what comes out of federal courts elsewhere. Pending now in Virginia, which is part of the Fourth Circuit, is a case against Altria Group, the company that sells Marlboro cigarettes. Altria evaporated $12 billion of its shareholders’ money by investing in Juul, the vape company later found to have allowed its products to fall all too easily into the hands of minors. On the theory that the law provides a remedy for such mistakes, six plaintiff law firms filed shareholder derivative cases against Altria and its officers and directors.

It is, of course, absurd to think that officers and directors approving a bad acquisition will personally cough up $12 billion to reimburse shareholders. So the cases, now consolidated, came to a proposed settlement in February. Altria insiders are chipping in not a dime. Instead, the company is to spend between $100 million and $107 million on anti-tobacco campaigns and another $10 million on a monitor to oversee that effort. The plaintiff law firms pocket $15 million.

What a farce. “The company is out $130 million plus whatever they paid their own lawyers,” Frank says. “The end result is that shareholders are worse off.” He would dearly love to get the settlement thrown out but has probably arrived on the scene too late to have the case reopened.

There will be other opportunities to reduce the economic absurdities in American law. What’s the deadweight loss of class actions—costs beyond the reimbursement of victims? “Billions of dollars a year,” Frank says.

It’s Not All Chicken Fees

The Center for Class Action Fairness remains focused on fees in case settlements, such as the $57 million billed by lawyers litigating poultry prices. But the parent organization, Hamilton Lincoln Law Institute, has broadened its reach into such matters as free speech, fiduciary standards and affirmative action. “People are more interested in the First Amendment than the esoterics of 23(e)(2)(c)(ii),” Ted Frank says, referring to the rule on class action procedure.

HLLI is contesting rules limiting what doctors and pharmacists can say about Covid. It is also suing to stop a U.S. Labor Department rule that allows pension managers to favor nice-guy companies, despite a statute mandating that pensioners’ financial interests come first. “People in the Biden Administration are going off on their own ideological agenda,” Frank says. “The separation of powers is important. This is not a monarchy.”

Hamilton Lincoln will probably join an amicus brief in the litigation involving the Thomas Jefferson High School for Science & Technology in Alexandria, Virginia. The controversy there has to do with the school’s decision to eliminate an entrance exam because too many Asians were getting in.

The affirmative action debate is already crowded, but there is something to be said for weighing in: It increases an organization’s visibility. Frank had a brief moment of fame this summer after the Supreme Court forbade race discrimination at Harvard. He pointed out an absurdity in one of the dissenting opinions, the assertion that having a physician of the right race would double a high-risk baby’s chance of survival.

MORE FROM FORBES

Read the full article here