3D content rendering platform Render Network has relocated from the Ethereum blockchain to Solana in order to benefit from the latter’s high throughput and lower transaction costs.

As per an update in a blog posted to Medium, the Render Foundation said that it had successfully implemented an upgrade to its core infrastructure to Solana from Ethereum.

RNDR token holders can now migrate their tokens from the Ethereum blockchain to the Solana blockchain using the Upgrade Assistant at upgrade.rendernetwork.com.

The Render Network is a decentralized global network of GPUs that come together to offer rendering services for 3D content creators.

The protocol’s foundation said in its blog post that it had set aside up to 1.14 million RNDR tokens worth over $2.6 million at the current price to facilitate the upgrade and cross-blockchain shift.

According to the Render Network Foundation, users will be awarded a share of the 1.14 million tokens based on a points system designed to incentivize upgrading as soon as possible.

“Moving Render’s core infrastructure to Solana is a watershed moment that unlocks major new capabilities like real-time streaming and dynamic NFTs,” commented Jules Urbach, the Render Network’s founder.

“Solana’s incredible transaction speeds, low costs, and commitment to web-scale architecture make it a perfect fit for the Render Network as we continue building a scalable and decentralized metaverse infrastructure,” he added.

A Watershed Moment For the Solana Blockchain Too?

The fact that the Render Network, a protocol boasting one of the crypto industry’s most promising use cases, is moving to Solana is huge news for the blockchain.

Though it saw explosive growth in late 2021 to reach a market cap high of more than $75 billion, as per CoinMarketCap, Solana has largely lived in Ethereum’s shadow for its entire existence.

Its trade value locked was last around $1.7 billion, more than 20x lower than Ethereum’s TVL of more than $60 billion, as per DeFi Llama.

As recently as last November, analysts had declared the blockchain a failed project thanks to the collapse of a few key protocols running on it that had liquidity ties to failed crypto exchange FTX and its ex-CEO Sam Bankman-Fried (SBF).

SBF had been a big proponent of the blockchain and his also failed hedge fund Alameda had been a major provider of liquidity there.

Where Next for Solana (SOL)?

The fact that major protocols like the Render Network are opting to utilize Solana’s underlying blockchain infrastructure rather than more trusted networks like Ethereum suggests belief in Solana’s future is returning, a bullish sign for the coin.

As Ethereum continues to struggle with scaling issues (like high fees and slow transactions), rival protocol’s like Solana may continue to steal market share.

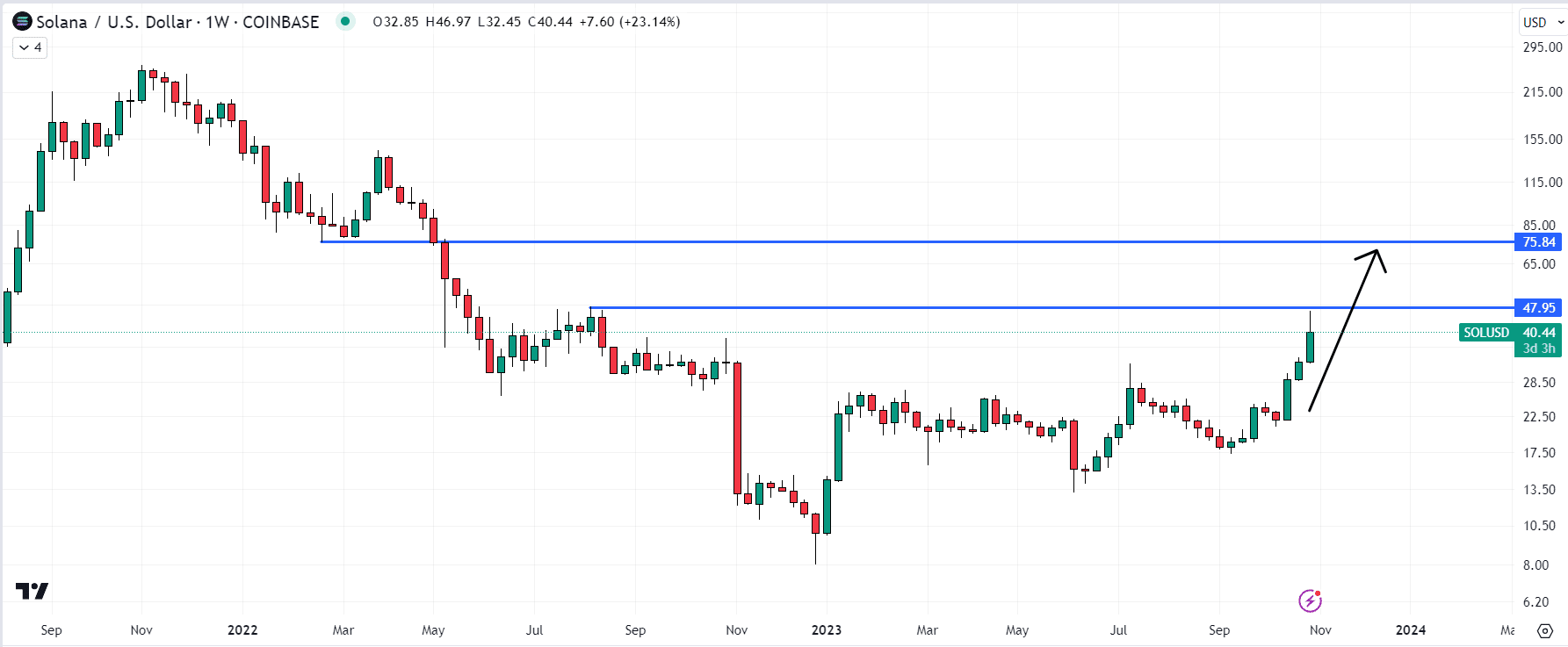

Solana’s native SOL token recently vaulted to 14-month highs above $40, and could be in for further swift gains assuming it can break above key resistance around $48.

But Solana does have one problem.

Ethereum layer-2 scaling solutions like Arbitrum, Polygon and Optimism offer equally cheap and fast transactions, but also the underlying security of the older and more widely used Ethereum network.

Solana may struggle to one up these protocols and take a more serious swipe at Ethereum’s market dominance in the space.

Read the full article here