The DNP Select Income Fund (NYSE:DNP) is a closed-end fund, or CEF, that can be employed by those investors who are seeking to earn a high level of income. The fund’s current 8.57% current yield stands as a testament to this simple fact. This is certainly a much higher yield than the 1.50% current yield of the S&P 500 Index (SPY), although it is not particularly high compared to many other closed-end funds. For example, there are a number of income-focused closed-end funds that boast yields well in excess of 10% right now.

The difference, of course, is that most of these funds with remarkably high yields are investing in fixed-income securities while this one is focusing its efforts on common equities. That distinction is something that certain people may find attractive, as common equities have more upside potential than fixed-income securities. In the current market, though, debt seems to be a better place to be considering how attractive yields are for any new buyer of debt.

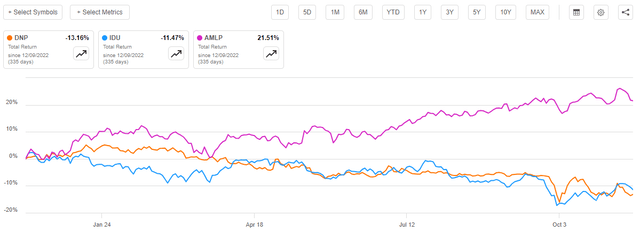

As regular readers will no doubt recall, we have discussed this fund before, but it has been quite a while. My previous article on this fund was published on December 9, 2022. The fund’s performance since that time has been very disappointing, as its share price has fallen by 18.89% compared to a 10.50% gain in the S&P 500 Index (SP500) over that same period:

Seeking Alpha

The fund’s performance was quite disappointing even after we consider the distribution payments that offset some of the decline in the share price. When we do that, the fund’s investors still lost 13.16%, which is obviously far worse than the S&P 500 Index delivered.

With that said, I did suggest in the previous article that the DNP Select Income Fund was substantially overpriced at the end of last year so it would probably be best to sit on the sidelines for a while. Investors who took that advice obviously did not lose money on this fund.

As the price has fallen quite a bit since that time, it may be a good idea to revisit the fund and see if purchasing its shares could make any sense today.

About The Fund

According to the fund’s website, the DNP Select Income Fund has the primary objective of providing its investors with a high level of current income and long-term growth of income. The website goes into more detail and makes a very important point:

The DNP Select Income Fund Inc. is a diversified, closed-end investment management company that first offered its common stock to the public in January 1987. The Fund’s primary investment objectives are current income and long-term growth of income. Capital appreciation is a secondary objective. DNP has outstanding Floating Rate Mandatory Redeemable Preferred Shares, secured borrowings and secured notes to leverage the common stockholders’ investment.

The Fund seeks to achieve its investment objectives by investing primarily in a diversified portfolio of equity and fixed-income securities of companies in the public utilities industry. The Fund’s investment strategies have been developed to take advantage of the income and growth characteristics, and historical performances of securities in the public utilities industry.

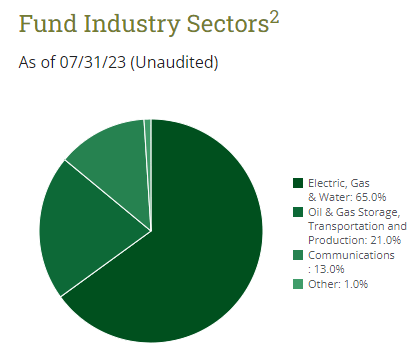

The fund’s webpage specifically states that this fund invests specifically in the utilities sector. In fact, only 65% of the fund’s portfolio is invested in that specific sector although the remainder is mostly invested in things that are pretty similar:

Duff & Phelps

Most people consider electric, natural gas, and water distribution operators to be utilities. These are the regulated companies that bring electricity, water, and natural gas to your homes and businesses. We can see that these companies only account for 65.0% of the portfolio. In addition, we have a 13.0% allocation to communications companies. While it is certainly true that some people would have called the local phone company a “utility” fifty years ago, it is pretty rare that the cable company or your Internet service provider would be considered to be such. After all, there is a bit more competition in this area than most regulated utilities possess, and some telecommunications companies such as Comcast (CMCSA) even own media production companies, which are certainly not utility businesses. Finally, the provision of television or Internet services to a home is hardly a necessity even though modern life would certainly be very different for many people without these services in their homes.

Finally, we see that the DNP Select Income Fund has 21.0% of its assets invested in “Oil & Gas Storage, Transportation and Production” companies. These are almost always called “midstream” firms, not utilities. These companies do tend to have the recession-resistant characteristics of most utilities, though. This is due to their business model, which revolves around long-term contracts based on the volume of resources that they handle and not on the value of oil and natural gas. These contracts also include minimum volume commitments that ensure that the company’s handled volumes and cash flows do not decline very much. Even during the pandemic, which saw the market prices of these companies collapse, their cash flows barely budged. Their market prices do tend to correlate with oil prices though so that adds a bit of volatility to this fund.

Unfortunately for this fund, utilities have not been a very good place to be over the past year or two. This may have contributed to the disappointing performance that it delivered since we last discussed it. As we can see here, the U.S. Utilities Index (IDU) has delivered a -11.47% total return since the date that the previous article on this fund was published. This is just a bit better than this fund’s total return over the same period:

Seeking Alpha

This does at least partly put this fund’s performance in perspective, as we could expect that the utility stocks that make up the majority of this fund’s portfolio would deliver a performance that is at least somewhat similar to the utility index. In fact, we do see this, as the fund’s total return has largely tracked the index over the past six months, but the fund did generally hold up better than the fund during the first half of this year.

However, the fund is not entirely composed of utilities. As we saw earlier, 21% of its assets are invested in midstream companies. These companies have held up much better than utilities in the current environment. In fact, the Alerian MLP Index (AMLP) is up by 21.51% on a total return basis since we last discussed this fund:

Seeking Alpha

We would expect the strong performance here to at least partially offset some of the utility weaknesses. This does not appear to be the case though, as the fund’s performance has correlated much more with the utility sector than we would expect from its actual composition.

Admittedly, the Alerian MLP Index does not perfectly track the midstream sector, as the index only includes those midstream companies that are structured as master limited partnerships. It does not include midstream corporations, which are increasingly dominating the sector. The fundamentals of midstream corporations are very similar though so we would normally expect them to deliver a similar market performance to the Alerian MLP Index. In fact, theoretically, midstream corporations should outperform master limited partnerships because it is a lot easier for retirement account investors and investment funds to purchase them. This is one of the reasons that is frequently given by partnerships that try to switch to a corporate structure.

Curiously then, this fund’s market performance seems to completely ignore the fact that some of the things held by it have performed far better than the utility sector. Rather, the market appears to be treating it as a leveraged utility fund, at least based on the performance that we have seen over the past eleven months.

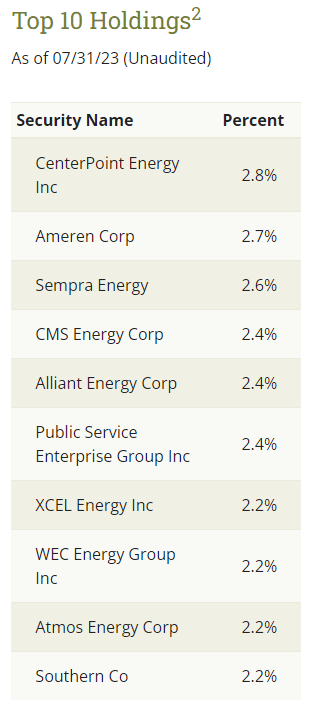

As may be expected, the largest positions in the fund are all large regulated utility companies:

Duff & Phelps

As regular readers likely recall, we have discussed all of these utility companies at one time or another over the past few years. Indeed, perhaps the only exception to this is Southern Company (SO), which I have not explicitly discussed but it tends to get pretty good coverage here on Seeking Alpha so most people who follow utilities in general are probably pretty familiar with it.

There have been quite a few changes here since we last discussed this fund. In particular, American Electric Power Company (AEP), Evergy (EVRG), Eversource Energy (ES), and Dominion Energy (D) have all been removed from the fund’s largest positions list. In their place, we have CMS Energy (CMS), WEC Energy Group (WEC), Atmos Energy (ATO), and Southern Co. I do not object to some of these changes, as WEC Energy Group and Atmos Energy are both among the best companies in the sector while Eversource Energy has suffered severely from debt as rising interest rates have pushed up its interest expenses substantially and the company’s departure from the offshore wind sector has reduced its appeal among green investors (although it was the smart decision).

The replacement of four companies in a fund’s top ten list over an eleven-month period is a bit more than we see with many other equity closed-end funds. However, this fund’s 9.00% annual turnover is nowhere near as high as most other equity funds. In fact, this is one of the lowest turnovers that I have ever seen among actively managed equity funds. This turnover suggests that the fund is mostly following a buy-and-hold strategy and that changes are largely attributable to share price fluctuations. After all, if one company’s stock outperforms another then it will naturally account for a larger proportion of the fund’s portfolio over time. For the most part though, a buy-and-hold strategy works pretty well because it helps to keep trading expenses down.

Leverage

As mentioned earlier in the quote from the fund’s website, the DNP Select Income Fund employs leverage as a method of boosting its returns beyond that of any of the underlying assets in the portfolio. I explained how this works in my previous article on the fund:

Basically, the fund borrows money and then uses those borrowed funds to purchase more assets. As long as the purchased assets deliver a higher total return than the amount that the fund has to pay on the borrowed funds, this strategy works pretty well to boost the overall portfolio yield. As the fund is able to borrow at institutional rates, which are much lower than retail rates, this will usually be the case.

However, the use of leverage is a double-edged sword. This is because debt boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage since this would expose us to too much risk. I do not generally like to see a fund employ leverage that accounts for more than a third of its assets for this reason.

As of the time of writing, the DNP Select Income Fund has levered assets comprising 29.04% of the portfolio. This is actually a bit lower than many other closed-end funds and overall is not really too bad. It would ordinarily represent a reasonable balance between risk and reward.

However, the problem here is that the fund specifically states that some of this leverage is in the form of floating-rate preferred stock. As everyone reading this is no doubt well aware, the Federal Reserve has been very aggressively raising interest rates over the past twenty months or so. Today, the federal funds rate is at the highest level that we have seen since early 2001:

Federal Reserve Bank of St. Louis

The effective federal funds rate is at 5.33%, which by itself is higher than the yield of just about every utility stock. The six-month LIBOR is at 5.82722% today. As such, with the possible exception of the midstream companies in the fund’s portfolio, the interest rate that the fund is paying on those floating-rate securities is going to be higher than the yield of anything in the portfolio. The fund therefore needs to depend on capital gains to make up the difference in returns, and it has once again been unable to do that with anything except for the midstream companies.

Thus, while the fund’s leverage is at a reasonable level overall, it does appear that it is more of a hindrance than a help today. This could be one reason why the fund has been underperforming the utility index over the past several months despite the 21.0% allocation to outperforming midstream companies.

Distribution Analysis

As mentioned earlier in this article, one of the primary objectives of the DNP Select Income Fund is to provide its investors with a very high level of current income. In order to achieve this objective, the fund invests in a portfolio of utility companies, midstream companies, and telecommunications companies. Many of these companies have higher-than-average yields, and this fund employs leverage as a method of boosting the effective yield of the assets in the portfolio. This use of leverage is nowhere near as effective at boosting the fund’s returns as it was a few years ago, but it still will boost the yield of a few things held by the fund, such as the midstream companies. The fund collects all of the money that it collects through dividends and distributions and combines it with any capital gains that it manages to realize. The fund then pays out all of this money to its investors, net of its own expenses. We might expect that this would give the fund a fairly high yield.

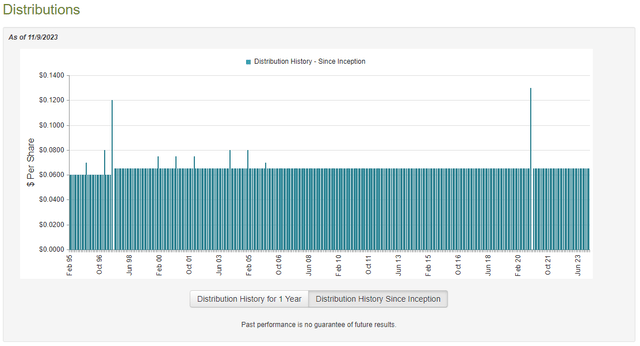

This is certainly the case, as the DNP Select Income Fund pays a monthly distribution of $0.065 per share ($0.78 per share annually), which gives the fund an 8.57% yield at the current share price. This fund has been remarkably consistent with its payout over the years:

CEF Connect

As we can see, the fund has had a very stable distribution for more than two decades. This is almost certainly going to appeal to those investors who are seeking a reasonably safe and secure source of income to use to pay their bills or finance their lifestyles. However, the fund has failed to deliver the distribution growth that its website implies that it is attempting to achieve. It is also curious how this fund has managed to maintain this stability when most other funds have failed to achieve it. Indeed, even the Duff & Phelps Utility and Infrastructure Fund (DPG), which uses a similar strategy to this one and has the same fund sponsor, had to cut its longstanding distribution in the face of rising interest rates.

As such, we should take a close look at this fund’s finances to determine how well it is able to sustain its distribution at the current price.

Unfortunately, we do not have an especially recent document that can be consulted for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on April 30, 2023. As such, it will not include any information about the fund’s performance over the past six months. This is disappointing, as the past six months have been a much more challenging environment for utility stocks than the first half of this year and it would be nice to see how well this fund managed to perform in that situation. After all, anyone can make money in a bull market, but it takes a great deal of effort to make money in a bear market.

During the six-month period, the DNP Select Income Fund received $15,981,735 in interest and $69,750,988 in dividends and distributions from the assets in its portfolio. However, some of the dividend and distribution income was considered to be a return of capital so it is not investment income for tax purposes. This is one of the inherent advantages that master limited partnerships possess over ordinary corporations. As such, the fund reported a total investment income of $70,182,907 during the period. It paid its expenses out of this amount, which left it with $27,931,178 available for the shareholders. That was, to put it mildly, nowhere close to enough to cover the distributions that the fund actually paid out. Over the six-month period, the DNP Select Income Fund paid out $138,939,891 to its shareholders. This is almost certainly going to concern many investors, as the fund’s net investment income was nowhere close to enough to cover the distribution payments.

However, this fund does have other methods through which it is able to obtain the money that it needs to cover the distribution. For example, it received $15,773,018 in distributions from the various master limited partnerships in its portfolio. That money is not considered to be investment income, but it clearly represents cash coming into the fund that could be paid out. The fund also could have realized capital gains that can be paid out to the investors. These likewise are not considered to be investment income, but they clearly represent money coming into the fund. The fund actually had a great deal of success in this area. It reported net realized gains of $83,241,041 and had another $103,263,605 net unrealized gains during the period. Overall, the fund’s net assets went up by $117,835,652 after accounting for all inflows and outflows during the period. That is much better than the $177,054,032 decline in net assets during the preceding year.

The fund’s net investment income plus net realized gains totaled $111,172,219 over the six-month period. That was not enough to cover the distributions. The fund made up the difference by issuing new shares totaling $42,339,719 to investors via its distribution reinvestment plan and an at-the-market offering. Were it not for this new money, the fund did not bring enough cash to cover its distribution. That is not necessarily sustainable over the long term. The fund’s net unrealized gains were also enough to cover the distribution, but those are not guaranteed to be permanent until the fund sells and realizes the gain.

This fund’s finances appear to be in better shape than many others, but we still need to keep an eye on it. The weakness in the utility sector during the second half of the year may have erased a sizable portion of those unrealized gains and there is no guarantee that investors will keep buying new shares and injecting money just to sustain a distribution.

Valuation

As of November 9, 2023 (the most recent date for which data is available as of the time of writing), the DNP Select Income Fund has a net asset value of $7.52 per share but the shares currently trade for $9.14 each. That gives the fund’s shares a whopping 21.54% premium on net asset value at the current price. That is an enormous premium to pay for any fund, to put it mildly. It is in line with the 21.69% premium that the fund’s shares have had on average over the past month, but the shares are still incredibly expensive.

Conclusion

In conclusion, the DNP Select Income Fund is an interesting fund for income-focused investors. The fund’s performance this year has been rather disappointing as rising yields have crushed the utility sector and with it the fund’s shares. Curiously, the market appears to be ignoring the fact that this fund includes things other than utilities, but the leverage may be a factor there as some of the leverage is floating rate and has become an increasingly large burden on the fund’s net investment income.

The DNP Select Income Fund failed to cover its distribution during the most recently reported period, although it got pretty close. It may not be able to depend on new money forever, though, and given the rising rates over the past month, it seems likely that DNP Select Income Fund will fail to cover the payout over the full-year period. When we combine this with an incredibly high valuation, it is difficult to recommend this fund even though I want to as it does have many good qualities.

Read the full article here