The iShares Interest Rate Hedged Corporate Bond ETF (NYSEARCA:LQDH) is a pretty interesting ETF in that it is structured to avoid any duration risk. This means the sensitivity of the portfolio to a change in rates should be around zero, at least in direct terms. LQDH is priced based on the value of corporate bonds, which is hedged from interest rate risk is dependent only on credit quality. Credit spreads are historically low right now where they should usually come up in a recession. We think the economy is quite bad right now and would pay more attention to the credit quality of corporations. Given the levity of the market around credit quality and economic conditions, we’d caution away from LQDH.

LQDH Breakdown

The effective duration of the ETF is almost zero due to the IR risk hedges. Consequently, the expense ratios are a little on the high side for a corporate bond ETF, but not by that much. 0.44% expense ratio is very decent, where 0.2% is waived until February 2027. The net ratio is 0.24%.

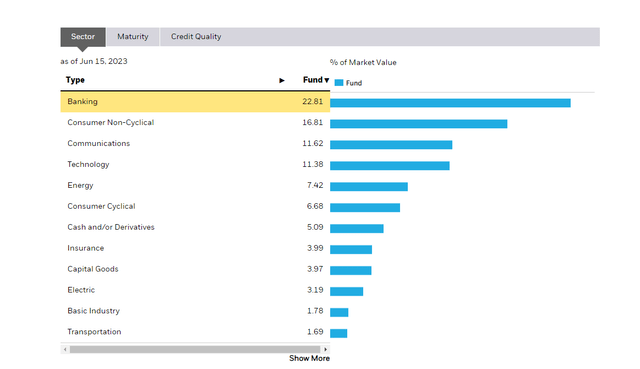

The sectoral exposures are those you’d expect for fixed income. A lot of banking and consumer non-cyclical exposures. Communications and Technology feature quite highly as well. While banking is a little concerning, based on the data in the index underlying LQDH, most of it is in the large full-service banks, so it’s actually not a concern at all since these are too big to fail. The rest are asset heavy and at least not heavily cyclical.

Sectors (iShares.com)

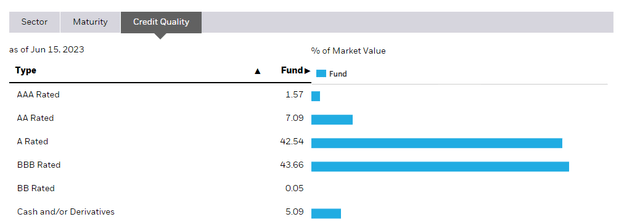

Credit quality is critical, because with duration risk hedged that’s the main concern that is left.

Credit Quality (iShares.com)

It’s all investment grade but not Treasury-equivalent, with most being around the A and BBB rating. There is some default risk in these assets.

Bottom Line

There are a couple of concerns we have over LQDH. In general there is the concern that there is a maturity wall coming for corporations. While there is already a lot of variable rate debt in the system, passing the maturity wall will mean the fixed debt matches up to current, higher rates. In other words, the effects of higher interest rates has yet to fully appear in corporate earnings. Then there is the issue of higher rates on the demand side, where credit crunch and evidently falling rates in good expenditure and rising inventory levels should start to have an effect on corporate earnings from the demand side too. In a lot of industries that are just one level downstream from commodities, the spectre of deflation is an emerging concern.

Moreover, there are technical considerations that have us questioning value in corporate credit. That is that credit spreads, which usually widen in a situation of economic concern, are at very normal levels even though we are still in an exceptionally uncertain time with the possibility of a dragged out (even if not deep) recession as the economy is weaned off an abundance of liquidity. Credit spreads were higher in mid 2022 when the rate hikes started, and we are not that far above levels in 2016 around the Trump election. The situation now is more concerning than then, and credit spreads should be higher, with corporate credit broadly probably deserving a lower valuation. Therefore, we’d be concerned about value in the LQDH portfolio.

Finally, there is the question of whether you really want to shy away from longer duration instruments. Duration exposure, to which LQDH is hedged, may actually enhance returns if we are in a noticeable recession, as the flight to credit and also to longer duration credit (as rates will have likely peaked) could drive returns.

While LQDH offers a hedged exposure at a very cheap maintenance price thanks to the low expense ratio, it doesn’t hit the right buttons considering the economic makeup. Not terribly interesting, although not a too major source of concern either for more passive holders.

Read the full article here