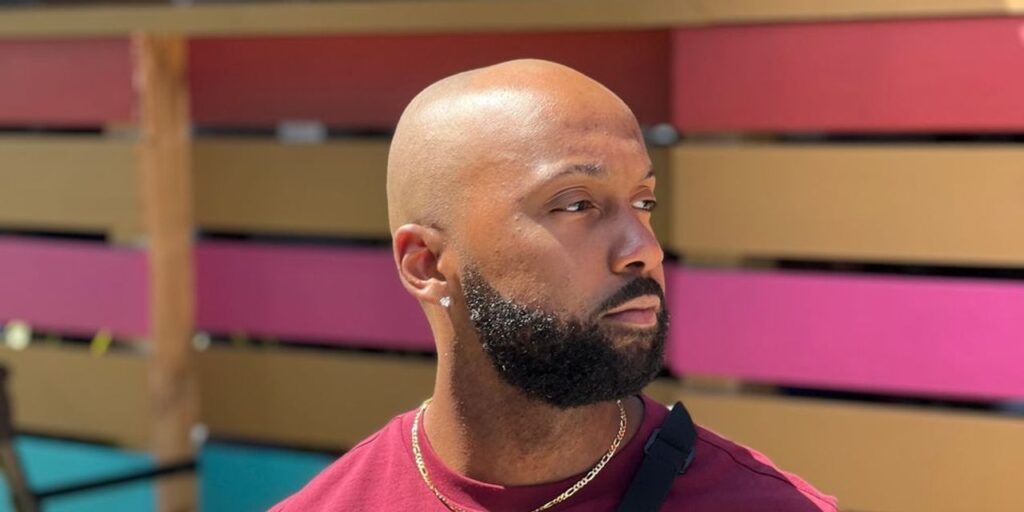

As student-loan payments are set to resume, Houston-based house hunter Meshawn Cisero is looking over his budget with a fine-toothed comb and cutting expenses as he gears up to pay over $400 a month for his student debt.

The 33-year-old, who works as a program manager at a startup, has cut back on traveling, going out with friends, ordering food from delivery apps, sharing streaming accounts with other people, and even is holding off on buying a new car. “I’m gonna have to cut back some more, especially when the student-loan payments start again,” he added.

Cisero graduated in 2012 from a private college, Bentley University in Waltham, Mass., with a degree in business management and $40,000 in student-loan debt. He moved from Boston to Houston the following year in search of a city with a lower cost of living.

During the pandemic, when student-loan payments were paused, he put the money he saved on his student-loan bill towards a down payment on his future home. He wasn’t alone: In a January report by the Jain Family Institute, the pause in monthly repayments allowed borrowers to budget more towards buying a home.

Cisero also used some of that money to pay other debt, such as credit-card debt. “I felt really good about it,” he said.

But payments on student loans are expected to resume in October and interest on federal student loans will start accruing again in September. Cisero said that while the resumption of payments isn’t going to derail his plans to buy a home, it’s made his financial situation a lot tighter.

His student-loan debt is the second highest monthly bill he will have outside his rent, or his future mortgage, he said. With the payment pause ending, “it’s definitely going to be an adjustment, because now I’m potentially taking on a mortgage in a couple of months. So it does impact my discretionary income,” he added.

Real-estate agents are worried about how that could hurt prospective home buyers.

With mortgage rates at or near 7%, taking on a home loan is already an expensive proposition to many home buyers like Cisero. And in some markets, home prices continue to rise and competition for homes is back.

For the typical American family earning $75,000 a year, which is about 51% of all households, they can only afford 23% of all homes listed for sale on the market, a big drop from five years ago.

With student-loan payments resuming, that not only adds an additional recurring monthly payment that increases their expenses, it also means that buyers could be rethinking homeownership in hopes of waiting the market out.

“‘Student-loan debt remains a significant obstacle for millions of Americans wishing to become homeowners, and with mortgage rates on the rise, the impact of student debt will become even more acute.’”

“Student-loan debt remains a significant obstacle for millions of Americans wishing to become homeowners, and with mortgage rates on the rise, the impact of student debt will become even more acute,” the National Association of Realtors said in a statement.

The NAR said it has proposed a range of ways that different groups can address the burden of student debt: Employers could sponsor student-debt relief programs with support from the federal government through tax benefits, to allow student-loan borrowers to refinance their debt into lower rates, and to standardize mortgage underwriting guidelines related to student-loan debt.

“Millennials shrunk as a share of buyers this year, and first-time buyers dropped to their lowest share of buyers ever recorded in 41 years of data,” the NAR stated. “Urgent action is needed to ensure a generation of Americans has access to the American dream and the opportunity to build wealth and achieve financial security through homeownership.”

First-time buyers made up 26% of all home buyers, down from 34% last year, the NAR said. Of this group, 70% of younger millennials, 46% of older millennials and 21% of Generation Xers were first-time home buyers.

The typical home value rose 1.4% in May, according to real-estate company Zillow

Z,

The company also estimated the average home in Houston to be around $265,733, up 1% over the last year.

When do payments resume?

After being frozen for over three years, payments are expected to resume in the coming months. Specifically, interest on federal student loans will begin accruing again on Sept. 1 and payments will start coming due in October, according to the Department of Education’s website.

During the years student-loan payments were paused, borrowers used the opportunity to take on more auto loans, credit-card debt, and mortgages, with little effect on loan delinquencies, according to a recent paper by economists at the University of Chicago.

Referring to the paper, Mike Pierce, executive director at the Student Borrower Protection Center, told MarketWatch that it was “the clearest sign yet, that the promise of debt relief, and push for expanded homeownership rise and fall together.”

The oft-cited opposition to canceling federal student debt is that taxpayers could be on the hook for debt borrowers have an obligation to repay. Others also argue that forgiveness now creates a moral hazard, where younger generations may take on riskier choices with the belief that the government will cancel debt again in the future.

Pierce also called for debt cancellation as a measure, one which is still being worked through the courts. The Supreme Court has yet to make a decision on the Biden administration’s proposal to forgive student loans. The president had said the government will cancel up to $20,000 in debt for a large share of borrowers.

“If we cancel student debt, we build a stronger middle class,” Pierce argued. “If we fail to do so, we box out millions of people from our primary driver of wealth-building and economic mobility.”

What impact could it have on buying a home? Taking out a mortgage could become harder if borrowers struggle to make student loan payments once the freeze ends.

If a borrower doesn’t pay on their student loans, that will negatively impact their credit score. Their credit score is a major factor that mortgage lenders look at before they determine whether the borrower can take out a loan, and for how much.

Not paying on student loans and defaulting on them could lead to even harsher consequences, including having borrowers’ wages garnished.

Cisero, who is looking to buy a townhouse, plans to purchase a home near Houston in an affordable neighborhood. He’s been to open houses and plans to buy later this year. He estimates his monthly payments will be about $3,200 a month for his home. He has been paying around $1,700 for his current home, which is a rental.

“It’s just kind of pricey, but it’s something I was able to budget for,” Cisero said, about his future mortgage payment. “Not the most ideal — I wish it was cut in half — but right now it’s where I’m at in the process.”

Read the full article here