Investment Rundown

Insight Enterprises (NASDAQ:NSIT) saw in their last earnings report a decline in the sales for the business, a 15% decline YoY to be exact. This sort of decrease doesn’t bode well for the long-term outlook, as demand within their industry is growing strongly. If NSIT isn’t able to keep up with the industry CAGR then it might be better for investors to look elsewhere.

With the company providing software solutions and related services they have a massive market to address. The need for business to streamline their operations and grow margins will always be a priority and that provides NSIT with ample market opportunities. The company maintains a solid target for 2027, where they see EBITDA margins growing from the TTM of 4.73% to 6.5% – 7% instead. In their presentation of the last report NSIT expects there to be some decrease in the outstanding shares and the EPS guidance wasn’t revised downwards either, with the p/e sitting quite low at around 14 I think NSIT is a hold at these levels and potentially a buy when they start showing sales growth again on a consistent basis.

Company Segments

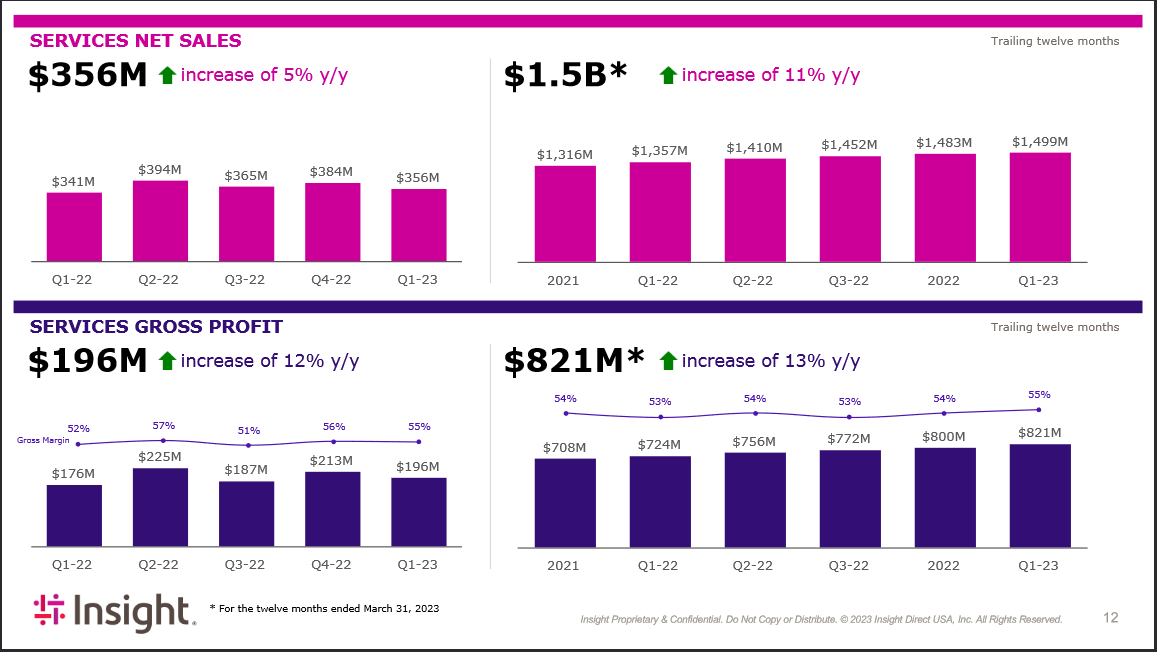

Insight Enterprises operates through various segments that contribute to its overall business operations. One of these segments is the Connected Workforce, which focuses on delivering comprehensive solutions for modern workplaces. Their offerings encompass end-user devices, collaboration tools, security solutions, mobility solutions, and managed services. Insight Enterprises aims to optimize digital workplaces, boost productivity, and facilitate remote work capabilities. Looking at the service segment from the last report the company actually saw growth here both in terms of sales and margins. Gross margins managed to reach 55%, up from 52% the year prior.

Service Segment (Q1 Report)

Another segment is Cloud + Data Center Transformation, dedicated to assisting clients with their cloud computing and data center transformation initiatives. Insight Enterprises provides a range of services including consulting, design, implementation, and management for cloud solutions, data center infrastructure, hybrid IT environments, and cybersecurity. Their expertise helps organizations harness cloud technologies, optimize resource utilization, and ensure data security and compliance.

Earnings Highlights

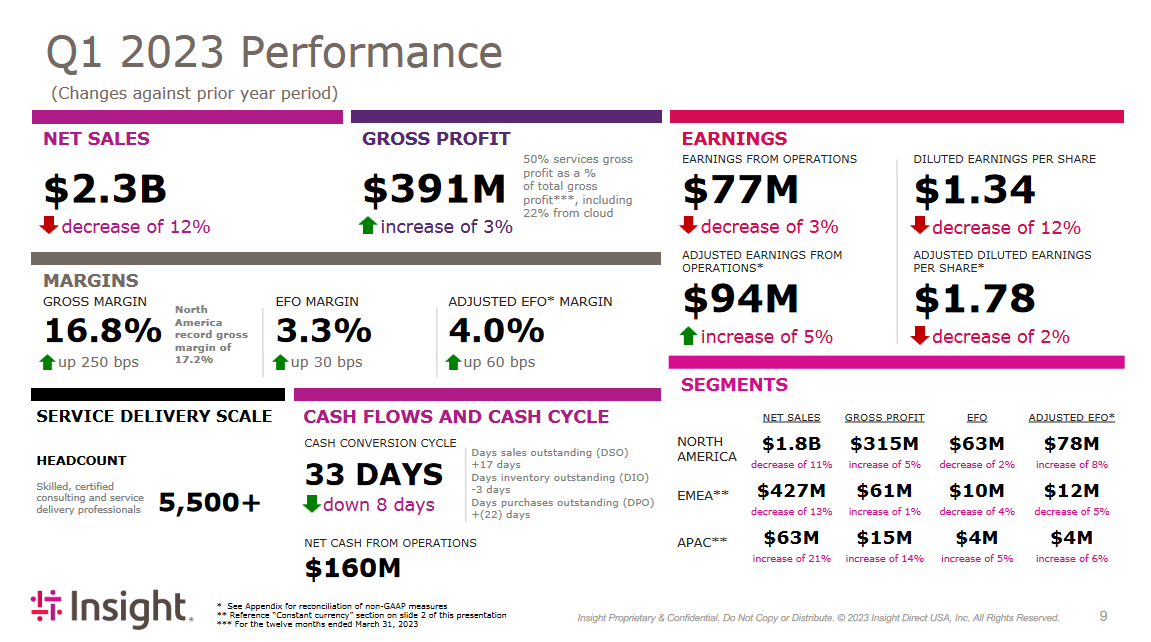

Looking at the last report from the company they noted a quite severe decline in sales, a 15% decline is not something you can brush away. The expectations of the company for lower sales and results were within their estimates. The CEO Joyce Mullen noted the following regarding the quarter and their performance, “Our first quarter results were in line with our expectations, in a market that was even more volatile than we had anticipated. We are pleased with our gross margin performance”. Going forward margin preservation will be crucial if they want to keep investors interested in the business. They have ambitious growth targets regarding margins for 2027, and bumps in the road like this won’t make it any easier to achieve those targets.

Q1 Sales (Investor Presentation)

Some parts of the report shone brighter than others though. Seeing a strong margin expansion in the North American market is reassuring given the sheer size of it. It shouldn’t be left unsaid either that the APAC segment in the company saw a strong increase in sales, 21%. The growing demand for IT services and software solutions in the Asia Pacific region is a strong market opportunity for NSIT to tap into, and right now we are seeing some of the results of it.

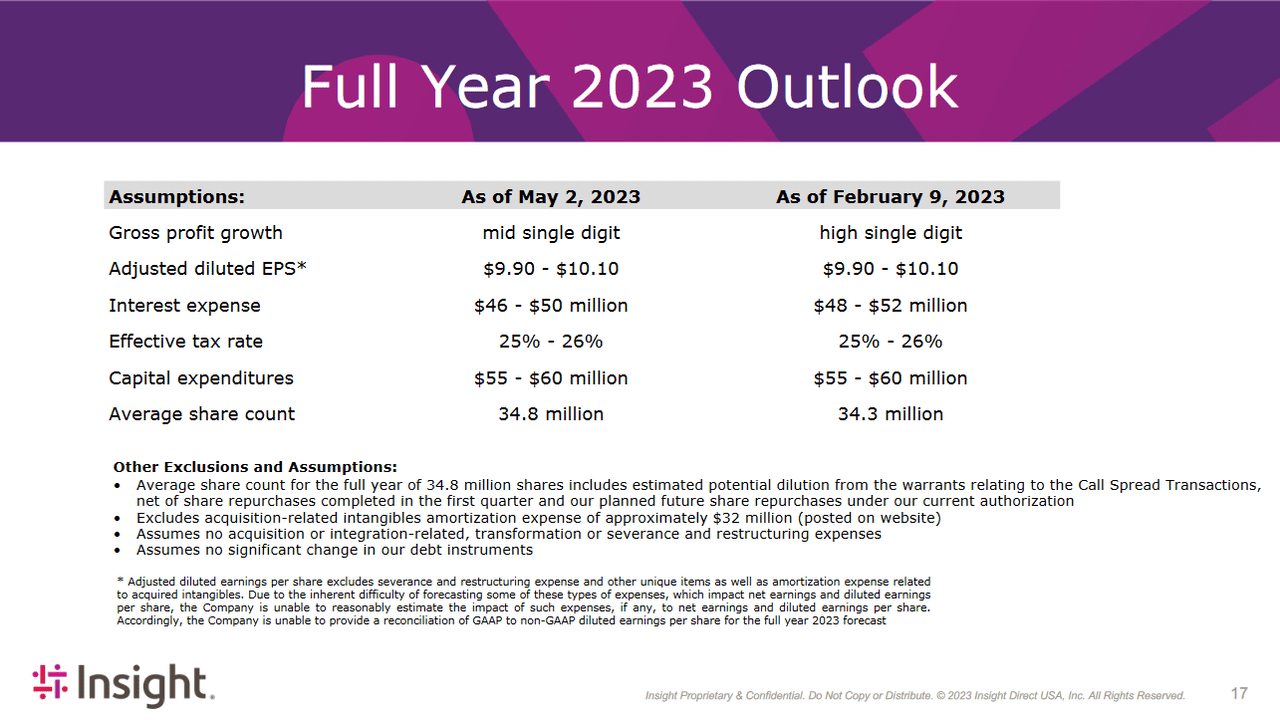

The operating cash flows for NSIT reached $160 million for the quarter which will help to continue buying back shares. As stated before, the estimated outstanding shares for 2023 is 34.8 million which would be a yearly decline of 6%. Without a dividend this is currently the only way NSIT is distributing profits to their shareholders and seeing ambitious buyback targets like this makes it easier to have a positive look at the long-term outlook of an investment here. I want to also mention though that this targeted amount of buybacks has been revised slightly, the target back in February was 34.3 million instead. But as NSIT experienced a very volatile last quarter which seemed to be the driving force for the declining sales, a more realistic buyback amount like this seems appropriate in my opinion.

2023 Outlook (Investor Presentation)

Looking at the coming quarter I think the margin preservation we talked about before will be in the spotlight. If NSIT is able to grow gross profits despite having lower sales then that solidifies them as a more consistent and stable investment opportunity. Trading under the sector average p/e is also an added bonus as the fundamentals of the business like the robust margins and the strong state of the balance sheet further help a bullish thesis. Where I make my point about NSIT being a hold right now though, is because of the lack of growth the sales had. If NSIT managed to grow despite a volatile industry environment then I would be all for a buy at these prices. Where I think NSIT could help itself grow through times like these is to establish more partnerships and offerings really. That will help create a stronger foundation of sales for the business.

Risks

I think that going forward being aware that NSIT is quite susceptible to economic cycles is important, their hardware segment particularly. Their high-end tech products would have a much more difficult time getting sold if we experience a slowdown or a downturn in the cycle. A key metric to watch for this will be the inventories, if they seem to steadily increase whilst revenues stagnate then the risks are mounting.

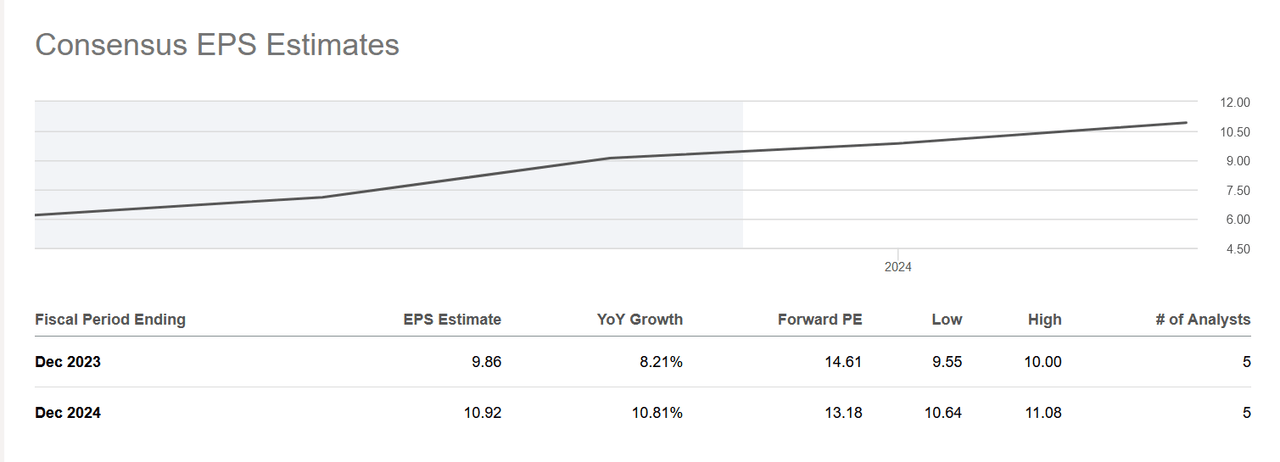

With NSIT I think the risk here that presents itself is that 2023 will turn out to be a very difficult year where NSIT doesn’t grow at the estimated pace the market has. The EPS of 2023 is around $9.86 right now and I think the last quarter helped solidify the margins of the business at least, but not so much about the overall growth of EPS. With declining sales also came declining EPS.

EPS Estimates (Seeking Alpha)

With an FWD p/e of around 15 right now it makes NSIT out to be a fair-valued business right now in my opinion. They are trading below the sector’s average p/e of 22 but with a disappointment in coming reports, their p/e might go up to reflect the revised EPS outlook. Where I think investors will need to keep an eye on is the North American market. This represents the largest source of revenue for their business, and even though they are seeing growth in the Asia Pacific, it doesn’t seem substantial yet to help offset losses in other markets.

Final Words

I think NSIT offers an interesting opportunity right now for investors seeking some exposure to the software solutions industry. With a focus on developing their client’s digital journey and making their business run more efficiently, they offer a valuable service, margin expansion. With a more streamlined business model often comes stronger margins too. The p/e of 15 seems very fair right now and does encompass some of the risks associated with the company. I can see a scenario where if they surprise on a report and prove that they can consistently make improvements then a higher multiple might be appropriate. Looking at the p/fcf it looks intriguing too, a multiple of 8 I think is quite low, and levered FCF has steadily been trending upwards, which I think would make NSIT look even better in the coming quarters, if the share price remains the same. But the company is trading a little high based on its p/b which on a forward basis is 2.74. I would prefer something lower, closer to 1.5 if I were to make a buy case here.

The company had a difficult first quarter of the year but I think the outlook still remains quite solid for the company. But in order to have my hold rating improve to a buy rating, NSIT would need to show more consistency in growing their sales even when times are volatile. It’s great to see NSIT preserve margins the way they did, and even maintain a strong outlook regarding buying back shares. The coming quarters could lead to me rating them a buy instead, but until then I will rate them as a hold.

Read the full article here