Nam Juny spent three decades exporting used Korean vehicles and car parts all around the world before spotting an opportunity in the nascent global battery market.

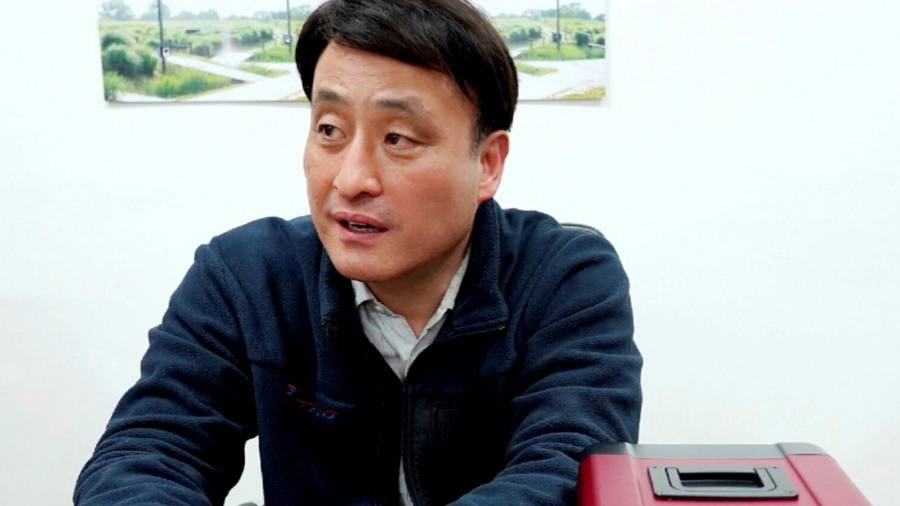

In 2018, the 57-year-old scrapyard owner, a veteran of defunct conglomerate Daewoo’s trading division, founded Bastro, a Seoul-based start-up that repurposes EV batteries for other uses. His logic is simple: an electric vehicle battery dies twice — once when it can no longer power a vehicle, and again when it can no longer power anything else.

The second life is often overlooked. A battery is no longer suitable for use in a vehicle once it has been reduced to about 70-80 per cent of its original capacity. But it will still have the potential to be used for other purposes, ranging from lighting streets and homes to powering appliances and offering energy storage.

Bastro takes EV batteries and turns them into portable power units that homes can rely upon in the event of power cuts. This is an example of “upcycling” — repurposing a battery without breaking it down into its constituent parts rather than “recycling”, which involves dismantling discarded cells and reconstituting them into a fresh supply of metals.

For a “circular economy” in batteries to emerge, they must ultimately be recycled. But Nam argues that battery recycling is a complex, dirty and energy-intensive process that should be delayed for as long as possible.

“I have a principle of ‘10+10’, meaning that the average EV battery should be able to do 10 years in a car, followed by 10 years serving some other purpose,” he told the Financial Times during an interview at his workshop in Seoul. “For batteries to be sent for recycling when they are only halfway through their life is a terrible waste.”

Despite this, it is unclear how regulators will ensure that batteries are made available for “upcycling” before they are eventually dismantled. That may not be a problem right now when the number of used EV batteries is relatively small, but it is likely to emerge as an issue over the course of the decade as EV adoption takes off in Europe and North America.

“This is a huge aspect of the industry that simply hasn’t been worked out yet,” said Tim Bush, a Seoul-based EV battery analyst for UBS.

Many of the challenges faced by Nam in Seoul help to illustrate some of the issues that will probably be faced by the wider industry. One is safety. Bastro’s power units are made from repurposed nickel-manganese-cobalt (NMC) batteries in which the leading Korean battery makers specialise. But NMC batteries have an unfortunate history of catching fire, and all the batteries he uses require exhaustive testing before they can be used by consumers. “If just one of my units were ever to catch fire in someone’s home, we go bankrupt and I go to jail,” he said.

Bush noted that in the future the testing of used EV batteries will have to be instituted on a mass scale not only for safety purposes, but also to establish the value of individual batteries.

“For a car with an internal combustion engine, you have an odometer, and you can look and see how many miles this vehicle has done,” said Bush. “But with a battery, there isn’t necessarily a relationship between the number of miles driven and the state of health of the battery.”

“What’s going to matter is how the battery was charged and the temperatures it was charged under, as well as how the vehicle has been used.”

Nor is it clear who is best placed to capture the value in the upcycled battery supply chain. Battery makers, recyclers, manufacturers, dealers, leasing companies, insurance companies, scrapyard owners and individual vehicle owners may all find themselves jostling for position in this new market.

Individual consumers who have bought their vehicles, for example, may be content to allow EV manufacturers to buy the batteries back off them. Another solution is for the manufacturers to retain ownership of the battery. But if a driver has no stake in the future of a battery, they may have no incentive to take care of it. The fewer batteries are left in a state to be reused, the greater the environmental toll of the EV supply chain as a whole.

In the meantime, Nam is focused on developing his products and expanding his network of scrapyards as he waits for the supply — and demand — for used batteries he has long predicted to materialise.

“We make products out of batteries that still have 70 to 80 per cent of their capacity, but only cost 10 to 20 per cent of what they cost when they were new,” said Nam. “We are turning bronze into gold.”

Read the full article here