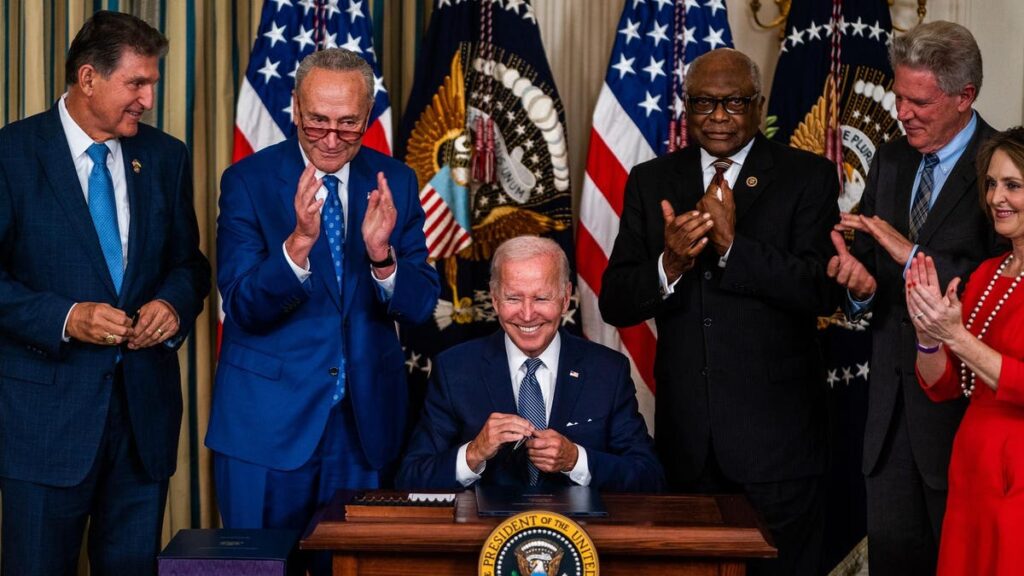

On August 16, 2022, President Biden signed the Inflation Reduction Act, which affects tax, energy, and healthcare laws. Its tax measures primarily include:

- a corporate alternative minimum tax;

- an excise tax on corporate stock repurchases;

- increased funding for the IRS;

- extensions of Affordable Care Act credits; and

- green energy credits.

Corporate AMT

The IRA imposes an AMT in section 55 on corporations that have average annual adjusted financial statement income that exceeds $1 billion over three years. The threshold is lowered to $100 million for corporations with a foreign-owned parent. S corporations, regulated investment companies, and real estate investment trusts are not subject to the AMT. The AMT equals 15 percent of adjusted financial statement income, minus an alternative minimum foreign tax credit.

Issued in December 2022, Notice 2023-7 provides significant interim guidance on application of the corporate AMT. Issued in February, Notice 2023-20 provides guidance for insurance companies. Released in June, Notice 2023-42 provides penalty relief for corporations that did not include the AMT in their quarterly estimated payments.

Proposed regs (REG-134420-10) released earlier this month revise the consolidated return regs to reflect previous legislative changes to the corporate AMT, including the IRA amendments. The regs include a reference to section 55(a) as amended, and provide guidance on computing consolidated estimated taxes that include the new AMT.

Excise Tax on Stock Repurchases

The IRA imposes a 1 percent excise tax in section 4501 on the fair market value of stock repurchased by a covered corporation, which is a corporation whose stock is traded on an established securities market. A repurchase is a redemption as defined in section 317(b) or an economically similar transaction. A redemption is an acquisition by a corporation of its stock from a shareholder in exchange for property.

The amount subject to excise tax is reduced by the FMV of stock issued by the covered corporation. Special rules apply to affiliated and foreign corporations.

The tax does not apply to repurchases:

- that are part of a reorganization in which no gain or loss is recognized by the shareholder;

- when the corporation contributes repurchased stock or stock of equal value to an employee retirement or stock ownership plan;

- when the total amount repurchased during the year is less than $1 million;

- performed by a securities dealer in the ordinary course of business;

- made by RICs or REITs; or

- that are treated as dividends.

Section 4501(f) authorizes the Treasury secretary to issue regs that prevent the abuse of the exceptions, address special classes of stock, and provide rules for the treatment of foreign corporations. Notice 2023-2, released in December 2022, provides guidance on calculating and reporting the excise tax. Released in June, Announcement 2023-18 clarifies that taxpayers will not be required to report or pay the tax before proposed regs are issued.

Increased Funding for the IRS

The IRA increased the IRS budget by roughly $80 billion over 10 years. The funding is generally earmarked for four categories: about $45.6 billion for enforcement, $25.3 billion for operations support, $4.8 billion to modernize technology, and $3.2 billion for taxpayer services.

Additional items include funding for a study on creating a free e-file system and more funds for the Treasury Inspector General for Tax Administration, the Treasury Office of Tax Policy, the Tax Court, and the Treasury Department.

On June 3 President Biden signed the Fiscal Responsibility Act (P.L. 118-5). It rescinds $1.4 billion of the IRA’s funding for IRS enforcement and operations support. Not explicitly included in the act is a “gentleman’s agreement” between Biden and House Speaker Kevin McCarthy, R-Calif., that will repurpose an additional $20 billion of the funding over the next two fiscal cycles.

ACA Subsidy Extension

The IRA extends the ACA premium tax credits in section 36B for three years, through 2025.

Green Energy Tax Credits

The IRA creates, extends, or modifies credits designed to reduce emissions and encourage the use of green energy. In connection with producing clean energy and reducing emissions, the IRA:

- extends the period to build or place in service new wind, biomass, geothermal, solar, and other energy facilities to 2025, but reduces the base credit amount;

- extends the credit to 2025 for investment in property related to the production of clean energy;

- provides a credit for solar and wind facilities used in connection with low-income housing;

- extends the credits for carbon oxide sequestration; and

- creates a new credit for zero-emissions nuclear power.

To facilitate the production and use of clean fuel, the IRA extends the credits for biodiesel fuels and creates new credits related to sustainable aviation fuel and clean hydrogen.

The IRA extends and modifies credits for individuals to build energy-efficient homes, or to install heat pumps and energy-efficient windows and doors. It also extends the residential clean energy credit to 2032 and increases the energy-efficient commercial building deduction.

The IRA increases and modifies the credits related to plug-in electric vehicles and creates a new credit for purchasing pre-owned clean vehicles and placing commercial clean vehicles in service. It also extends the credit for installing charging equipment.

The IRA modifies or creates credits related to investment in clean energy manufacturing and energy security, Superfund sites, and clean electricity and transportation.

Guidance related to green energy credits has been issued on:

As the IRA enters its second year, taxpayers anticipate additional guidance on its implementation. (Additional coverage: Lauren Loricchio, “Taxpayers Await More Guidance a Year After IRA,” Tax Notes Today Federal, Aug. 16, 2023.)

Read the full article here