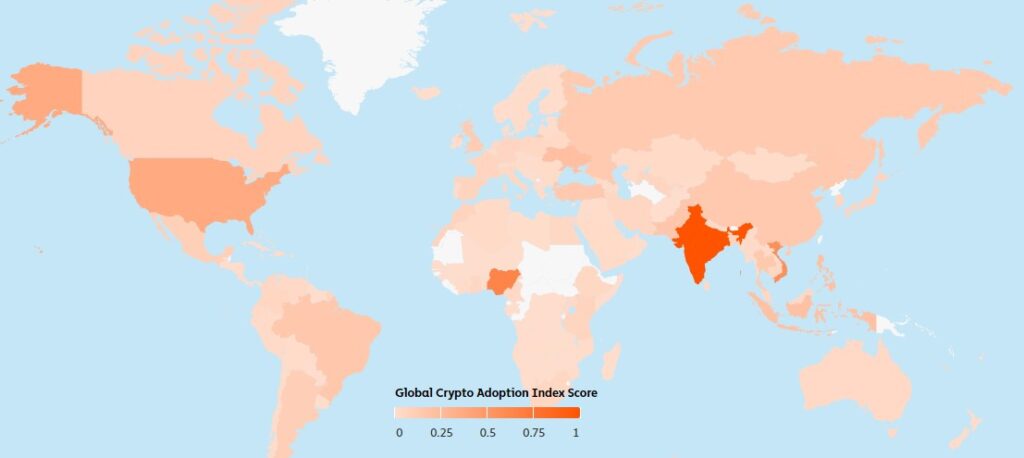

In the era of financial digitalization, the Chainalysis Global Crypto Adoption Index for 2023 stands as a pivotal resource, charting the nuanced ways countries are embracing cryptocurrency based on their unique socio-economic factors.

As the digital realm undergoes rapid transformations, this year’s index especially highlights the prominence of Central and Southern Asia, renowned for its robust economic growth and rich cultural heritage.

Furthermore, the insights from industry expert Kim Grauer provide an added layer of depth, analyzing the unique factors driving adoption and helping to unravel the complexities of this digital revolution.

A Closer Look at the Index’s Methodology

The index is constructed from five sub-indexes, each shedding light on different facets of crypto adoption:

- Centralized Exchange Activity: Assesses cryptocurrency value at centralized exchanges, emphasizing countries where this activity stands out against their average wealth (PPP per capita).

- Retail Value on Centralized Exchanges: Measures crypto activities of individual users at centralized platforms, spotlighting countries with smaller retail transactions relative to average wealth.

- P2P Exchange Volume: Prioritizes emerging markets, focusing on countries where a significant part of residents’ wealth is channeled into P2P crypto trades.

- Value from DeFi Protocols: Ranks countries by DeFi transaction volume, highlighting those with active residents in the DeFi sector in relation to their wealth.

- Retail Value from DeFi Protocols: Concentrates on non-professional users in DeFi, identifying countries with notable smaller transactions compared to their average wealth.

Summary of the 2023 Global Crypto Adoption Index Top 20:

With countries like India, Vietnam, and the Philippines occupying prominent positions, the Central & Southern Asia and Oceania region is in the top 10.

Central & Southern Asia and Oceania in the Spotlight

- India:

- Position: 1st in Central & Southern Asia and Oceania

- Notable Rankings:

- 1st in centralized service value

- 1st in retail centralized service value

- 1st in DeFi value

- Vietnam:

- Position: 3rd Overall

- Significant performance in centralized service and DeFi rankings.

Global Standouts

- Nigeria:

- Position: 2nd Overall

- Dominating in Sub-Saharan Africa

- Leads in P2P exchange trade volume.

- United States:

- Position: 4th Overall

- 2nd in centralized service value received.

- Ukraine:

- Philippines and Indonesia:

- Positions: 6th and 7th respectively

- Pakistan: 8th

- Brazil: 9th

- Thailand: 10th

Other Notable Mentions:

- China: 11th, majorly due to its centralized service ranking.

- United Kingdom: 14th

Globally, Grassroots Adoption Is Down: Despite a global decline in grassroots crypto adoption, Lower Middle Income (LMI) countries show promising resilience, especially after major events like the unexpected downfall of FTX in 2022.

Spotlight on LMI Countries

The World Bank classifies countries based on their Gross National Income (GNI) per capita. LMI countries, including India, Nigeria, and Ukraine, have a GNI per capita of between $1,086 and $4,255.

The impressive crypto recovery in LMI countries is a notable revelation from the index. LMI nations are dynamic, with booming industries and significant growth potential.

They house 40% of the global population, and their growing interest in crypto signals a promising trajectory for digital assets.

Exclusive Insights from Kim Grauer: The Global Crypto Landscape

In an exclusive interaction, Kim Grauer, Director of Research for Chainalysis, shared her rich insights with CryptoNews, shedding light on the widespread adoption of cryptocurrency, its broader implications, and the essential role of regulatory frameworks.

Here are the salient points from their interaction:

1. Global Resonance of Crypto Adoption

Embracing the Crypto Wave: “We are consistently amazed at the sheer scale of crypto adoption across the globe. Almost every nation reflects statistically significant adoption of cryptocurrency,” stated Kim.

She further emphasized the distinctive roles crypto plays in different countries.

In nations battling high inflation, crypto emerges as a solid store of value. Conversely, in some regions, it’s a key financial tool, perhaps ushering people into a prevalent game.

India’s Pivotal Role: “India’s position is particularly noteworthy,” Kim remarked. The nation isn’t just leading in grassroots adoption, as the Global Crypto Adoption Index indicates.

Still, it’s also the second-largest global crypto market in raw transaction volume, surpassing numerous affluent countries.

What’s even more commendable, according to Kim, is that India’s meteoric rise in the crypto sphere is happening amidst a regulatory and taxation milieu that’s not always industry-friendly.

2. The Broader Implications and LMI Countries’ Role

A Shift from the Peak: Kim pointed out, “Grassroots adoption of crypto might not be at its zenith, but the striking trend is the increasing adoption in lower middle income (LMI) countries.”

A significant number of nations ranking high on the Global Crypto Adoption Index fall under the LMI category.

She underscored the fact that LMI countries have witnessed a substantial resurgence in grassroots crypto adoption over the preceding year.

LMI’s Steady Rise: Notably, as per Kim’s insights, LMI is the singular category of nations whose total grassroots adoption still surpasses the levels seen in Q3 2020, right before the recent bull market surge.

“This is a trend that demands the industry’s undivided attention,” she asserted.

Understanding Regional Specificities: Kim highlighted the importance of recognizing how crypto addresses the distinct needs of different regions.

“Central & Southern Asia stands out as a region reinforcing the belief in cryptocurrency’s potential. Each country here has unique economic requirements, and varied crypto platforms and assets have evolved to address these specificities,” she elaborated.

3. An Appeal for Nuanced Regulation

The Need for Tailored Approaches: Kim stated, “Given the diverse ways in which countries are embracing cryptocurrency, it’s imperative for regulators to approach the landscape with a nuanced perspective. This calls for a deep understanding, and it invariably will influence every region.”

Kim wrapped up her insights by stressing the importance of an informed and flexible approach to the ever-evolving world of cryptocurrencies.

Conclusion: The Evolving Narrative of Global Crypto Adoption

In wrapping up the Chainalysis Global Crypto Adoption Index for 2023, the data underscores an undeniable shift towards digital financial systems. The most poignant takeaway is the ascendance of LMI countries, accounting for a significant portion of global crypto adoption, especially with India’s leadership in several categories.

On the numerical front, it’s remarkable that LMI nations, representing 40% of the global population, have consistently showcased higher adoption rates than what was observed in Q3 2020.

This suggests that while high-income countries steadily integrate crypto into their systems, developing nations are truly propelling the digital currency revolution.

As the world steps into 2024, all eyes will be on the evolving crypto landscape. With the momentum garnered over the past year, LMI countries are poised to play an even bigger role, possibly shaping the future trajectory of global cryptocurrency adoption.

Read the full article here