Thesis

The Invesco BulletShares 2025 High Yield Corporate Bond ETF (NASDAQ:BSJP) is an exchange traded fund. The vehicle is a term fund, having a termination date in December 2025. Term funds are tricky vehicles, since lack of maturity matching with the collateral pool can generate significant mark to market risks. Not here. The entire collateral pool (with one exception) is set to mature before December 15, 2025. That translates into the fund taking only credit risk – i.e. the probability that individual issuers in the underlying collateral pool will default, and the fund will incur a loss.

As per its literature:

The Fund will invest at least 80% of its total assets in corporate bonds that comprise the Nasdaq BulletShares USD High Yield Corporate Bond 2025 Index. The Index seeks to measure the performance of a portfolio of US dollar-denominated, high yield corporate bonds with effective maturities in 2025. The Fund does not purchase all of the securities in the Index; instead, the Fund utilizes a “sampling” methodology to seek to achieve its investment objective. The Fund and the Index are rebalanced monthly. The Fund has a designated year of maturity of 2025 and will terminate on or about Dec. 15, 2025. See the prospectus for more information.

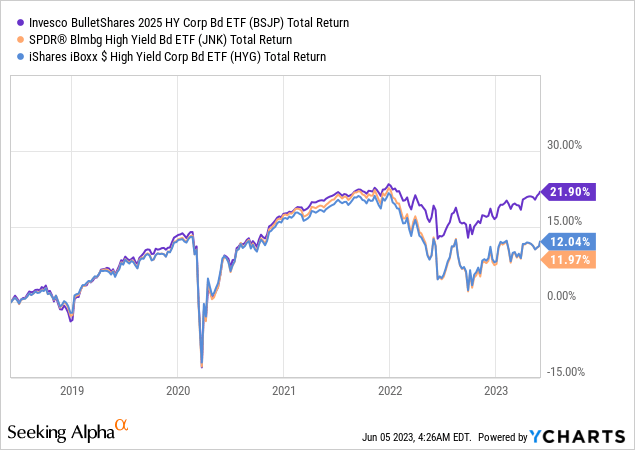

The fund has a classic high yield build, with even ‘BB’ and ‘B’ buckets, and no excessive risk via ‘CCC’ assets. There is nothing unusual about this name, and its performance benchmarks favorably with the largest junk funds in the space (non-leveraged ones):

We can observe an interesting analytical aspect regarding BSJP – as we approach the maturity date of the underlying collateral, the fund will tend to hold up much better during risk-off environments due to its ‘pull to par’ feature. We can see how the SPDR Bloomberg Barclays High Yield Bond ETF (JNK) and iShares iBoxx $ High Yield Corporate Bond ETF (HYG) had much larger drawdowns in 2022 due to their longer duration. Each day that passes by sees BSJP’s duration being chipped away, so absent any collateral defaults we should expect an 8% annualized return here.

This vehicle is appropriate for somebody who has a shorter time horizon and likes the reduced duration profile for this fund. The collateral build which we analyzed below is a classic one, with no risk outliers. We like this fund, and investors already in the name should Hold, while new money would be well served to wait for a dip on the back of a risk-off move.

Analytics

- AUM: $0.5 billion

- Sharpe Ratio: 0.52 (3Y)

- Std. Deviation: 5.9 (3Y)

- Yield: 8.1%

- Premium/Discount to NAV: n/a

- Z-Stat: n/a

- Leverage Ratio: 0%

- Composition: Fixed Income – U.S. HY

- Duration: 1.8 yrs

- Expense Ratio: 0.42%

Holdings

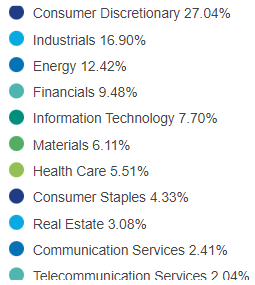

The fund is composed of corporate bonds, with a diversified sectoral allocation:

Sectors (Fund Fact Sheet)

We can see the largest industry is represented by ‘Consumer Discretionary’ at 27%, followed by ‘Industrials’ at 16.9%. The fund is tilted towards its largest sector. We do not usually like to see more than 20% in any one industry.

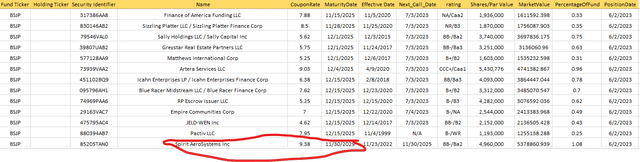

We parsed through the entire collateral pool, and there is only one asset which has a maturity date longer than December 2025:

Collateral (Fund Website)

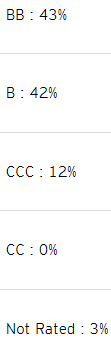

The fund is a classic high yield one, with even allocations in the ‘BB’ and ‘B’ buckets:

Ratings (Fund Fact Sheet)

There is nothing unusual here in terms of collateral composition, or risks taken. The more conservative funds in the space are tilted towards ‘BB’ names, while the very risky ones have significant ‘CCC’ buckets. This vehicle has a very balanced build.

Conclusion

BSJP is a fixed income exchange traded fund. The vehicle has a term maturity in December 2025, meaning that an investor will get their money back upon the fund’s maturity date. This is a well-constructed term fund, with virtually all of the collateral pool having a maturity date before the fund’s termination date. This build ensures a matching market risk profile, with an investor taking only credit risk. Credit risk is the probability that companies in the collateral pool will default until the fund maturity date. The matching of the collateral pool translates into an ever decreasing duration for this name, with the fund having held up much better during the 2022 sell-off when compared to other unleveraged peers. An investor is very well compensated here with an 8.1% yield to take a normalized risk profile in the high yield space. We like this fund, and investors already in the name should Hold, while new money would be well served to wait for a dip on the back of a risk-off move.

Read the full article here