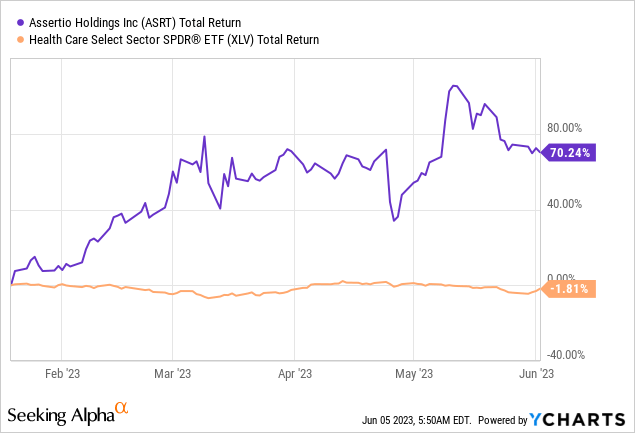

You’re reading my 4th article on Assertio Holdings, Inc. (NASDAQ:ASRT) – all of my previous articles including the one published last month have been bullish, and while the Healthcare sector (XLV) hasn’t performed the best YTD, the stock has looked solid since my first article appeared in mid-January:

In this article, I’ll update my previous thesis and try to figure out the future path for ASRT by looking at its fundamentals and technicals.

The Company

Assertio Holdings is a $350-million market-cap pharmaceutical company that operates with a non-personal promotional approach. Their products are tailored to meet the unique needs of patients; the primary sales focus is on nonsteroidal anti-inflammatory drugs [NSAIDs], which include the following varieties:

![ASRT's IR presentation [Q1 2023]](https://logicalbudgetting.com/wp-content/uploads/2023/06/49513514-16859599919690063.png)

ASRT’s IR presentation [Q1 2023]

ASRT operates in a single segment and earns most of its revenue from product sales in the United States. The majority of net sales are generated through 3 major national wholesalers: McKesson Corp (MCK), AmerisourceBergen (ABC), and Cardinal Health (CAH). The company relies on third-party manufacturers for its products, and each drug is produced in a separate facility.

In Q1 FY2023, Assertio achieved significant progress in executing the new strategy brought on board by CEO Dan Peisert. Despite the loss of exclusivity for some products, net product sales grew by 17.5% YoY; this growth was driven by the success of INDOCIN and the addition of Sympazan to the product portfolio, according to the most recent earnings call transcript.

![ASRT's 10-Q [author's notes]](https://logicalbudgetting.com/wp-content/uploads/2023/06/49513514-168596037409622.png)

ASRT’s 10-Q [author’s notes]

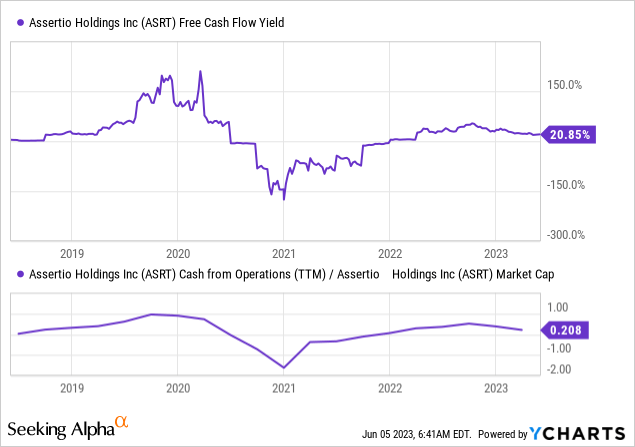

The huge increase in SG&A expenses was by 38% [$2.4 million] driven by legal and professional fees related to the pending merger with Spectrum Pharmaceuticals, so nothing is surprising or shocking here. Despite the paper loss on the income statement, the firm achieved a 7% YoY growth in adjusted EBITDA [driven by additional product net sales] while maintaining a margin of 60%. The stock is yielding over 20% in FCF [TTM] thanks to the solid cash flow generation – I expect this ASRT’s characteristic to only improve as the company gets rid of the debt out of the balance sheet [long-term debt shank by 42.5% QoQ].

![ASRT's 10-Q [author's notes]](https://logicalbudgetting.com/wp-content/uploads/2023/06/49513514-16859608359352858.png)

ASRT’s 10-Q [author’s notes]

Based on the strong Q1 FY23 performance, Assertio increased its FY2023 guidance for net product sales and adjusted EBITDA. Net product sales are now expected to be $157 million to $167 million, representing a growth range of 1.2% to 7.7% compared to the previous year. Adjusted EBITDA is projected to be between $90 million and $98 million.

The acquisition of Spectrum Pharmaceuticals and its key asset, ROLVEDON, is expected to be completed in Q3 FY23. Assertio’s strategy has had a profound impact on the balance sheet, with the company transitioning from net debt to net cash, with a positive swing of almost $94 million, the CEO notes during the call. The company extended its maturities, reduced its cost of debt, and acquired new assets with extended patents. The integration of Spectrum into Assertio’s platform is a top priority, aiming to ensure seamless integration and capitalize on business development opportunities. The combined capabilities of both companies in contracting, market access, and promotional platforms strengthen their position and open doors for potential M&A opportunities, particularly in the oncology field, the CEO added.

From what I can see from the company’s financial statements, I have got an extremely positive impression of Assertio’s prospects – both in terms of development strategy and in terms of improving the balance sheet and maintaining sales volumes in the last reporting period.

Valuation & Expectations

I mentioned above that the stock has an FCF yield of >20% [on a TTM basis] – this is mainly thanks to a strong CFO in the last periods. This makes the stock quite attractive in terms of this particular indicator.

The market expects ASRT’s EPS to decline nearly 82% YoY in FY2023, but then rebound strongly, with a compound annual growth rate [CAGR] of 23.7% over the next 3 years:

![Seeking Alpha [author's notes]](https://logicalbudgetting.com/wp-content/uploads/2023/06/49513514-16859619840533183.png)

Seeking Alpha [author’s notes]

As you can see, the P/E ratio forecast for fiscal 2024 is ~9x, which is assumingly well below the industry medians [the forwarding P/Es are at >25x]. Of course, analysts expect the P/E ratio to shrink. In addition, the risks of investing in a small cap like ASRT weigh on the valuation, especially if sales were to decline so sharply [low liquidity – higher likelihood of a sell-off given declining sales]. However, history shows that during a similar period of declining sales a few years ago, ASRT’s P/E ratio went up 2-3 times higher than what the market is currently suggesting.

![YCharts [author's notes]](https://logicalbudgetting.com/wp-content/uploads/2023/06/49513514-16859623202323334.png)

YCharts [author’s notes]

If the company achieves $94 million [the mid-range] in adjusted EBITDA by the end of the year [as guided], EV/EBITDA should now be 3.6-3.7x. That’s about 41% lower than the TTM figure, and it’s at odds with the P/E ratio, where the TTM figure is lower than the figure for the next year.

![YCharts [author's notes]](https://logicalbudgetting.com/wp-content/uploads/2023/06/49513514-16859628048745718.png)

YCharts [author’s notes]

In my opinion, EV/EBITDA gives us a more realistic picture for valuation – from this picture, I conclude that ASRT’s EV/EBITDA multiple should be at least 5-6x at year-end, giving ~60% upside potential. That’s quite a bit.

The Bottom Line

You have to understand that ASRT stock has a lot of risks that you shouldn’t forget. First, it’s a small-cap company – the problem of lack of liquidity is obvious. Second, the technical picture raises a lot of questions. I don’t like the fact that the bulls have lost strength in recent weeks – both RSI and stochastics signal this. At the same time, the price has fallen to a recently broken resistance zone – from a technical analysis perspective, ASRT is in a pretty vulnerable position as far as I can see.

TrendSpider Software, author’s notes

But despite these risks, I think ASRT stock is a rather undervalued company with good growth potential and strong management in the person of a recently hired CEO. I reiterate my previous “Buy” rating and set a 12-month price target of $10.16 per share, implying an upside potential of 60% over the medium term.

Thanks for reading!

Read the full article here