Investment thesis

According to Forbes, Arista Networks (NYSE:ANET) will likely benefit from the secular favorable trend related to generative artificial intelligence [AI]. The stock price suggests the market agrees with the statement. ANET stock price rallied about 35% year-to-date, but I would like to warn potential investors that they missed the train.

Seeking Alpha

My analysis suggests that the strong revenue growth momentum is cooling down, and the gross margin has been under pressure for a long time. The trend of gross margin shrinking remained during recent quarters. Also, my valuation analysis suggests the stock is substantially overvalued at current levels. On the other hand, I do not know how long will the AI mania last. Therefore, I assign ANET a neutral rating.

Company information

Arista Networks is a leading provider of cloud networking solutions for Internet enterprises, cloud service providers, and next-generation data centers. With a focus on delivering high-performance, low-latency solutions, Arista Networks enables enterprises to build and manage modern, efficient networks that meet the demands of today’s digital age.

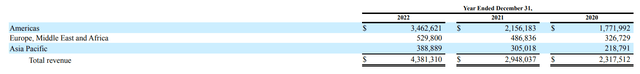

The company’s fiscal year ends on December 31 with only one reportable segment. ANET disaggregates revenue by geographic area, with about 80% of sales attributable to both Americas, according to the company’s 10-K report for the year ended December 31, 2022.

ANET’s latest 10-K report

Financials

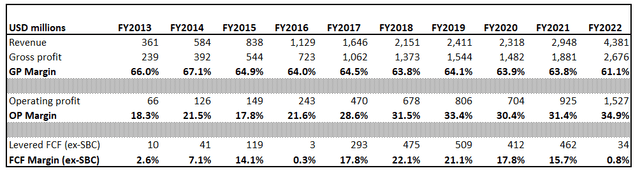

Let me start the financial analysis by zooming out to look at long-term trends. The company’s revenue increased more than tenfold over the past decade, meaning a staggering 28% 10-year revenue CAGR. As ANET’s business scaled up, the gross margin did not expand. On the other hand, operating margin improved significantly from 18% in FY 2013 to 35% in FY 2022. For me, this indicates the company has successfully managed its growth.

Author’s calculations

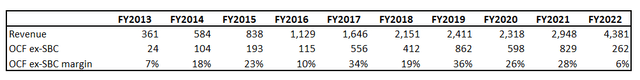

Free cash flow [FCF] margin without stock-based compensation [SBC] has been somewhat volatile over the decade, peaking at 22% in FY 2018. Since then, the FCF ex-SBC margin has been declining steadily. Operating cash flow [OCF] also has been very volatile over the past decade with no stable pattern. As a conservative investor, I prefer investing in businesses with more predictable cash flow margins.

Author’s calculations

The company’s balance sheet is a fortress with very high liquidity metrics and a solid net cash position. ANET’s stellar free cash flow metrics between FY 2017-2020 allowed the company to improve its net cash position significantly. A solid net cash position is a big advantage for a company since it unlocks more opportunities to fuel further growth, which is especially crucial in the current environment of tightening credit.

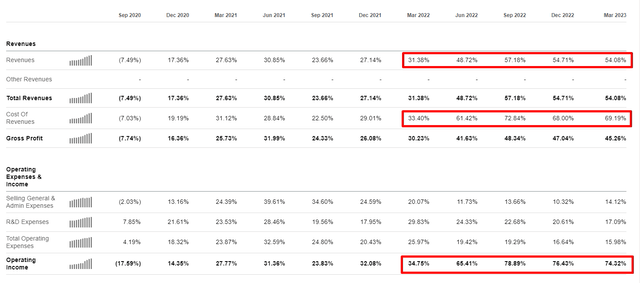

Now let me narrow down to the dynamics of the recent quarter to understand how the company perform under a challenging macro environment which started to unlock in early FY 2022. As you can see from the below table, the company’s sales gained strong momentum since the beginning of 2022 and have been increasing more than 50% YoY in three quarters in a row. What I see as a red flag here is that the cost of revenue has been growing even faster than the top line. It means the management has much room to improve supply chain efficiency. On the other hand, operating income significantly outpaced revenue in growth, meaning high efficiency in managing overheads.

Seeking Alpha

The upcoming quarter’s earnings are expected to be released on August 2. Consensus estimates forecast quarterly revenue at $1.38 billion, meaning YoY growth will decelerate to about 31%. Sequentially, revenue is expected to be almost flat, with almost invisible growth. It indicates that the recent peak momentum for ANET revenue growth is in the rear mirror.

Valuation

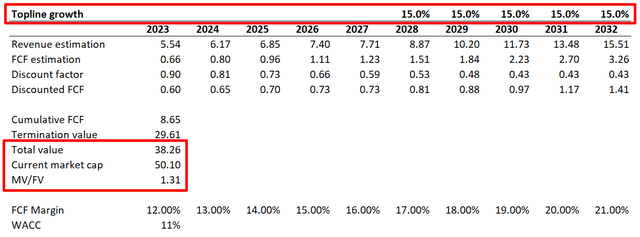

I implement the discounted cash flow [DCF] approach to value Arista Network’s business. I use the estimation of finbox.com for the company’s WACC, which I round up to 11%. I use revenue consensus estimates described in the “Financials” section and expect annual revenue growth to be 15% for years beyond FY 2028. I use 12% for the FCF margin, an average of the past decade, and expect it to expand by one percentage point yearly.

Author’s calculations

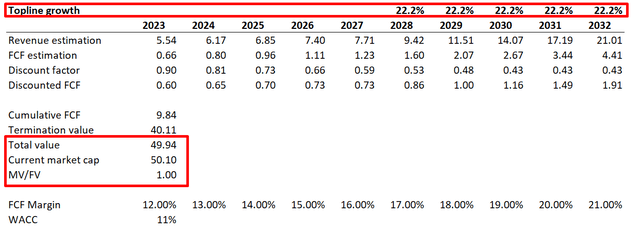

As you can see from the above calculations, the business’s fair value is about $38 billion, substantially lower than the current market cap. To match the current market cap, the company’s revenue should grow 22.2% between FY 2028 and FY 2032. It might be a way too optimistic assumption.

Author’s calculations

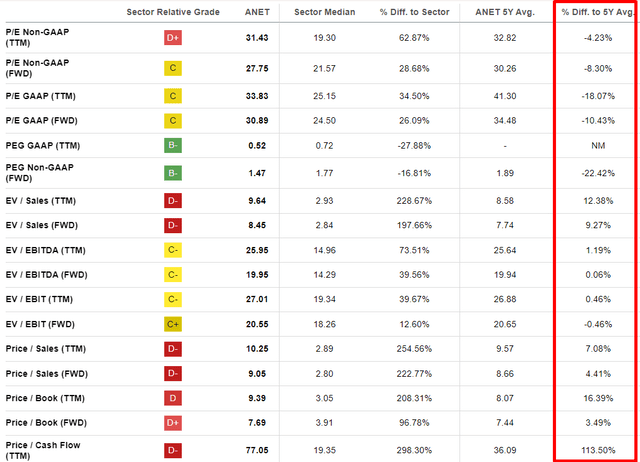

Let me also look at the multiples to cross-check my DCF analysis. According to Seeking Alpha Quant valuation grades, ANET has a “D+” valuation grade, meaning there is little upside potential, if any. Also, the stock currently trades at multiples, mostly near the 5-year average, which for me, also indicates there is no undervaluation.

Seeking Alpha

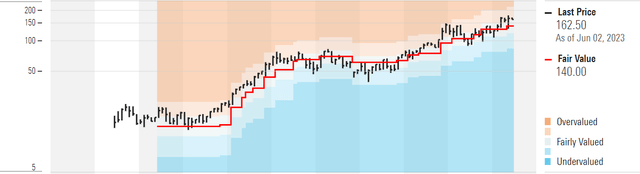

To add more evidence to my fair value analysis, please also let me share the opinion of Morningstar Premium regarding ANET stock fair price. According to this resource, the stock currently trades at a substantial premium. On the below chart, you can see how did, historically, ANET stock price follow Morningstar’s fair value estimations.

Morningstar Premium

Overall, in my opinion, the stock is overvalued despite vast prospects related to the adoption and expansion of AI reach, where ANET is anticipated to be one of the major beneficiaries.

Risks to consider

The main risk for ANET is the possibility of a general economic downturn which will mean a sharp decrease in demand for the company’s products. On the other hand, as we have seen in the “Financials” section, the company is in a firm financial position, meaning ANET is ready to face temporary storms.

I also do not like the history related to the litigation with Cisco Systems (CSCO) about intellectual property and antitrust claims. Arista agreed to pay $400 million to settle the case, which means the company acknowledged patent infringement. The litigation looks to be an old story, but for me, this indicates that the possibility of new litigation is not equal to zero.

Arista Networks also faces significant concentration risk, as several large customers account for much of the company’s revenue. This concentration makes Arista vulnerable, as any loss or decline in business with these key customers could have a material adverse effect on the company’s financial performance.

Bottom line

To conclude, I believe that ANET stock is a hold. I think so because the stock is overvalued, according to my analysis. On the other hand, I do not recommend selling because I am unsure how long the AI frenzy will last. I will add the company to my shortlist and will look at how the nearest quarters will unfold. The most crucial points for me would be the gross margin dynamics and the pace of revenue deceleration.

Read the full article here