It’s been about 11 months since I wrote a bullish article on AMMO Inc. (NASDAQ:POWW), and my gosh the shares have plummeted in price since. Specifically, they’re down about 53% against a gain of about 12% for the S&P 500. The company has reported results since, obviously, so I thought I’d eat some much needed humble pie today while checking those results, and comparing them to the current valuation. Obviously the market considers this company to be troubled. I’d remind investors that even challenged companies can be great investments over time if you buy them at the right price. Thus, I’m going to treat this company like one that I’m coming to for the first time, and I’ll answer the question whether to buy, avoid, or try to sell. If I determine it’s (still) a buy, I’ll hang on, or may add more. If it’s either an “avoid” or “sell”, I’ll take my lumps, hopefully learn something, and move on.

I’ve been told by some of my younger readers that my writing can be a bit “extra.” Given that I want to give you readers the chance to get as little exposure to this as possible. I’ll do that in this instance by providing you a “thesis statement” that gives you the gist of my thinking in a handy, easily digestible paragraph. You’re welcome. I’m buying more AMMO Inc. today for a few reasons. The latest financial performance was not as good as it was last year, but wasn’t egregiously bad by any means. Against the backdrop of a strong balance sheet, and “not terrible” financial results are a few very relevant facts in the bull’s favour. First, insiders own a material amount of this company. Second, the company may (repeat “may”) buy back a material amount of stock over the next 8½ months. Finally, the shares are very close to an all-time low valuation. It seems that the market has thrown in the proverbial towel on this one. We’re told to “buy when others are fearful”, and all indications are that fear of this going concern is at a maximum at the moment, so I’ll be buying more today.

Financial Snapshot

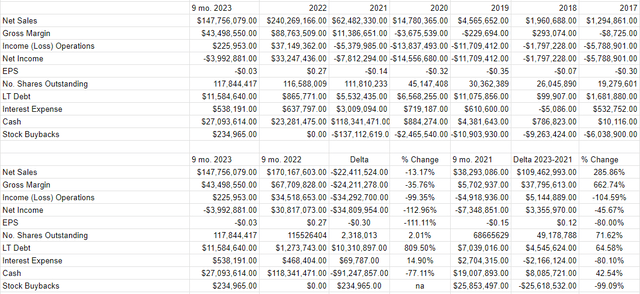

It’s difficult for me to write about the most recent financial results, because they’re “good” or “bad” depending upon your comparison point of reference. For instance, if we compare most recent results to the same time last year, things look pretty rough. Revenue is down about 13% and net income has swung from about $30.8 million to a loss of just under $4 million. As revenue was declining, expenses were spiking, notably “Corporate General and Administrative” (up 63%) and employee salaries (up 44%).

If we compare the most recent three quarters to the same time in either 2021 or 2019, for instance, the picture looks far less dour. This is for the very obvious reason that this is basically a different company today than it was then. Revenue is about 285% higher than it was in FY 2021, and net income is higher by about $3.3 million. So, whether the current period is “good” or “bad” depends on your frame of reference in my view. What’s more relevant is the price that people are willing to pay for such performance. If the market is too pessimistic, that presents opportunity to investors (more on that below). Throughout all of this, though, the company has had a rock solid balance sheet, which obviously helps reduce the impact of the vagaries of the business cycle. In particular, they currently have about $11.6 million of debt, and about $27 million in cash. Thus, I’m not overly worried about imminent bankruptcy here, and I can tolerate losses over the medium term.

AMMO Inc. Financials (Ammo Inc. investor relations)

It’s now time to write about the stock, as a thing distinct from the underlying business. There are a few relevant factors in this instance in my view. The first is the potential buyback, the second is the level of insider activity, and finally, we need to review the valuation the market is applying to the shares.

A Short Note on the Buyback

The company “may” purchase up to $30 million shares of the stock between now and next February. If we assume a stock price of ~$2, that would mean the company could retire up to about 15 million shares. Using the arithmetic skills not so lovingly beaten into me by the good sisters a Holy Spirit School decades ago, I have determined that that would represent about 13% of the current shares outstanding. Thus, I conclude that this buyback would be a significant “deal” as the young people say, assuming it actually happens.

With Apologies to Orwell

All investors are equal, but some are more equal than others. For instance, insiders know more about a given company than any Wall Street analyst ever will. When such people put their own capital to work in a company that I’ve invested in, I find it easier to sleep at night. With that written, just under 25% of this company is owned by insiders.

The most recent purchase seems to have happened back at the end of February of this year, when Jared Smith bought another 55,000 shares. The point is that these people know more about this business than we all do, and the fact that they’ve got faith is a large positive in my view.

So, the people who know this business best own a relatively large stake in it. With all due respect, they know the business better than you or I ever will, and they own a material amount of this thing. Additionally, over the next 8 ½ months, the company may use some of its large cash hoard to purchase shares. I’m a fan of buybacks when they happen at decent valuations, which is what we’re going to explore next.

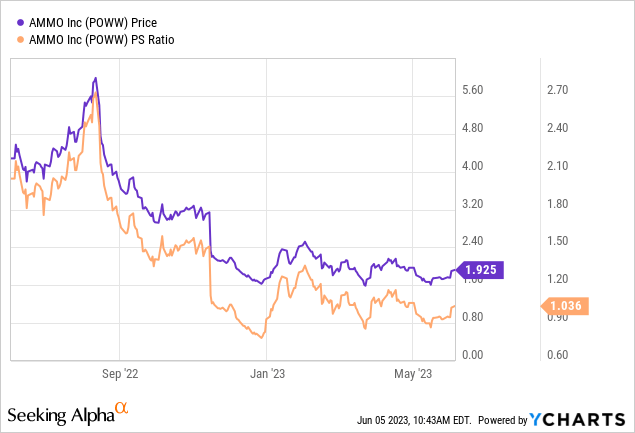

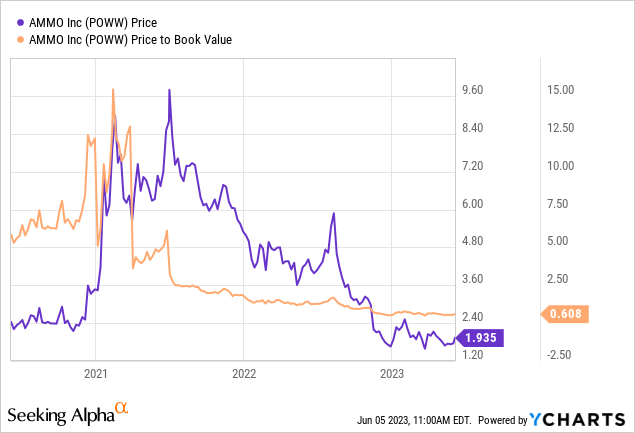

When I write “decent valuations” what I really mean is “cheap.” I like to buy assets that are cheap, and I like it when companies retire shares that are cheaply priced. I measure whether or not something’s cheap in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value like sales, book value, and the like. I want to see a company trading at a discount to both the overall market and its own history. We see from the below that the market is paying near record lows for this business on a price to sales, and price to book basis. Specifically, the market is paying just over 1 times sales, and about .61 times book. This is both objectively and relatively cheap in my view.

While ratios can be instructive, I think it makes sense to also try to work out what the market is “thinking” about a given investment. In order to do this, I turn to books like “Accounting for Value” by Penman, and “Expectations Investing” by Mauboussin and Rappaport. Both of these books introduce the idea that stock price itself is a wealth of information that can tell you about current growth assumptions. The greater the assumptions about future growth, the more risky the investment. Applying this way of thinking to AMMO Inc., at the moment suggests the market is assuming that this company will be bankrupt within the next five years. I consider this to be a massively pessimistic forecast. Given all of the above, I’ll be buying some more today.

Read the full article here