Investment thesis: Not long ago, it seemed that Nokia (NYSE:NOK), as well as Ericsson (ERIC), were set to beat out embattled Huawei for the lead in global 5G contracts. Under US pressure, many markets were shut for Huawei, which last decade seemed to emerge as a dominant 5G equipment provider. The main argument was that China could engage in unsavory spying and data collection activities through such infrastructures.

It is unclear whether or not it is the case with 5G networks, but generally speaking, the world has become just as disenchanted with relying on US & European products, services, and institutions in the past year as it has become with China. The weaponization of our dominance on the global scene, which intensified last year within the context of the ongoing confrontation with Russia, seems to be causing some blowback in much of the rest of the world. It is possible that the same treatment that Huawei has been receiving, mostly in the Western World, the likes of Nokia will also receive in much of the Developing World. While things have been going Nokia’s way lately with positive financial results, as well as improving future contract prospects, things may take a negative turn, with some early signs already emerging that this may be the case in some key markets.

Nokia posted decent financial results lately, while 5G contracts trends are going in its favor.

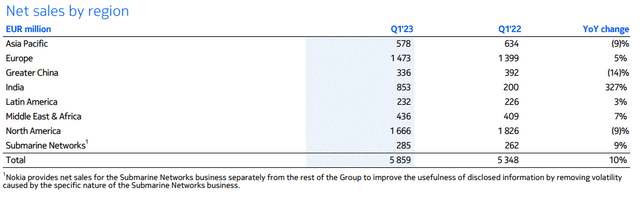

For the first quarter of the year, Nokia posted a profit of 279 million euros which is attributable to its shareholders, on revenues of 5.86 billion euros. The profit margin is therefore on the thin side at just under 5%. Revenue growth Y-O-Y was 10%, while profits increased by 14%.

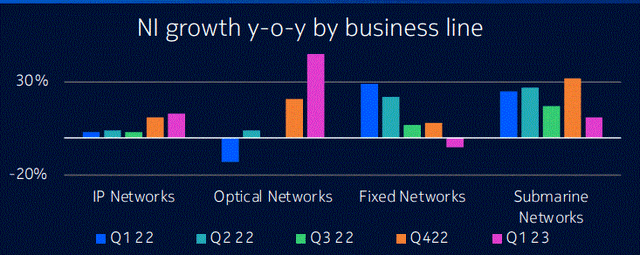

Looking at segment-specific sales growth, Things are overall headed in the right direction.

Sales growth (Nokia)

The growth in optical networks in India, where Nokia is seeing most of its growth is by far the brightest spot in its current performance. India is emerging as a pivotal market for Nokia, having accounted for all of the growth in sales that Nokia achieved in the latest quarter, compared with the same quarter from last year.

Nokia

As of now, Nokia’s Chinese competitors Huawei and ZTE are not able to compete in the Indian market, due to government restrictions, giving it a clear edge in the market. It is the perfect example of how Nokia has been benefiting from the geopolitical trends of the past few years. Within the wider global market, it seems that Nokia is beating out competitors in terms of sales at the moment.

The geopolitical winds may be turning against Nokia:

As is increasingly the case these days, as Nokia’s own sales results illustrate, geopolitical factors and trends can have a greater impact on a company’s financial results and its outlook than many other factors that we are traditionally used to watching. The India situation is a case in point. Without it, Nokia would have seen no increase in sales in the past year. The factors that prompted countries like India and others to shut out Chinese telecommunications equipment providers have been arguments in regard to national security, with suspicions that China is using such infrastructure in place for spying.

The argument has worked to some extent, with many countries, especially in Europe but also elsewhere banning Huawei from participating in contract tenders. A recent decision by Malaysia to keep the bidding open for new 5G infrastructure for all equipment providers, despite intense pressure from the US and the EU is indicative in my view of the tide starting to turn.

Most countries may have misgivings about relying technologically on China. However, the past year seems to have soured the environment for Western & allied players as well. It is happening in the realm of finance but also in terms of technology, as a result of the overly aggressive weaponization of such assets and levers that were laid bare by the Russia-NATO alliance confrontation over Ukraine. The years of efforts to curb China’s technological rise may ring alarm bells as well. The efforts of BRICS nations to lessen their reliance on the US & EU global financial system tend to make the news in this regard, however, for obvious reasons, namely that they are facing coercion in this regard, nations such as China & Russia are also striving to lessen their technological reliance on the Western World. Nations that aspire to become BRICS members such as Iran are finding themselves in a very similar situation.

It is not unreasonable to assume that countries like India are watching and learning from what they are seeing, and concluding that at some point in the future, they will face similar financial & tech pressures. While India decided to rely on non-Chinese providers for 5G telecommunications equipment, it does not mean that it is likely to be much more at peace with the Western choice than it would be with the alternate Chinese option. In fact, it seems that local 5G equipment providers are set to emerge in India, which might put an end to Nokia’s long-term ambitions to dominate the Indian market. It is more than likely that India will do its best to nurture its own rising tech companies. In other words, Nokia may be free from Chinese competition in India, perhaps indefinitely, unless a major rapprochement between the two rising powers will take place soon. It does not mean that it has the market to itself, with only other Western and Asian allied providers as competitors, given that Indian companies are rising in the domestic market. For smaller nations around the world, the Malaysian model, of hedging bets and allowing all potential providers to play a role might emerge as a favored option, in the absence of local players emerging.

Investment implications:

I bought some Nokia stock, precisely on the assumption that the global geopolitical situation is set to help it gain global market share and I last added more last fall. Ordinarily, if I were to believe in the long-term prospects of a company, I tend to add more shares when the stock price goes down as it has in the past few months.

Seeking Alpha

At this point, I no longer think that geopolitical trends are headed in Nokia’s direction. It trades at a decent P/E ratio of 9 currently as I write this, which makes it a decent potential buying opportunity. It even has a semi-decent dividend yield, which I do not believe is in imminent danger of disappearing since its financial results are in no way indicative of it happening. My current position in this stock is equivalent to about 1.5% of my overall stock portfolio, therefore it in no way represents a potential overweight situation for me personally if I were to add to my current position.

I am not selling currently, because I do believe that this stock has the potential to go above $5/share going into a potential global economic recovery in the next few months or years. The dividend of about 2% does sweeten the prospect of waiting patiently for that to happen. But I will not be buying any more Nokia stock for the foreseeable future either, because the odds of this stock performing well in the next few years have declined compared with the last time I covered it. I will just hold for now and look for an advantageous exit point in the coming months or years unless future developments will prompt me to change my reasoning.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here