Thesis

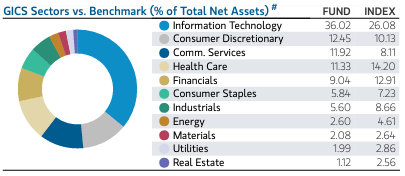

Eaton Vance Tax-Managed Buy-Write Opportunities Fund (NYSE:ETV) is an equity buy write fund. The vehicle has a technology tilt when compared to the S&P 500, a feature which on paper should have helped the fund navigate an astounding 2023 for tech:

Compare (Fund Fact Sheet)

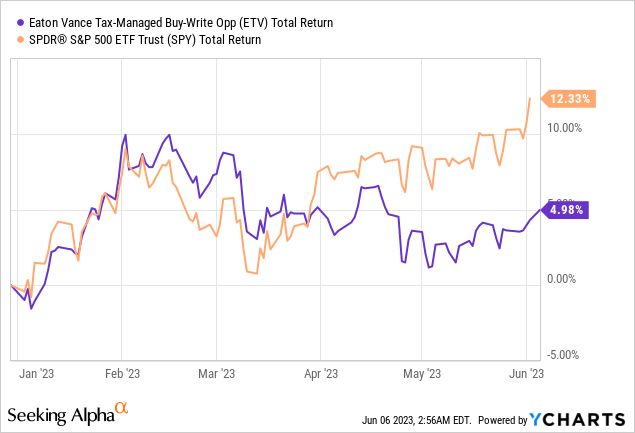

However, ETV is up only 6% this year, when compared to the S&P 500’s total return which exceeds 12%:

In this article we are going to look at some of the structural features for this fund and get behind its lagged performance.

Firstly, let us discuss what the CEF does exactly. As per the fund’s literature:

The Fund invests in a diversified portfolio of common stocks and writes call options on one or more U.S. indices on a substantial portion of the value of its common stock portfolio to seek to generate current earnings from the option premium. The Fund’s portfolio managers use the adviser’s and sub-adviser’s internal research and proprietary modeling techniques in making investment decisions. The Fund evaluates returns on an after tax basis and seeks to minimize and defer federal income taxes incurred by shareholders in connection with their investment in the Fund.

By writing options on the S&P 500 the fund is able to monetize options premiums, which should help the fund (theoretically) outperform in a range bound market.

So, on paper, the build should have helped this vehicle in 2023, a year which has been characterized so far by an outperformance in technology stocks and long periods of time of range bound markets.

Factors behind ETV’s underperformance

1. Premium/Discount to NAV

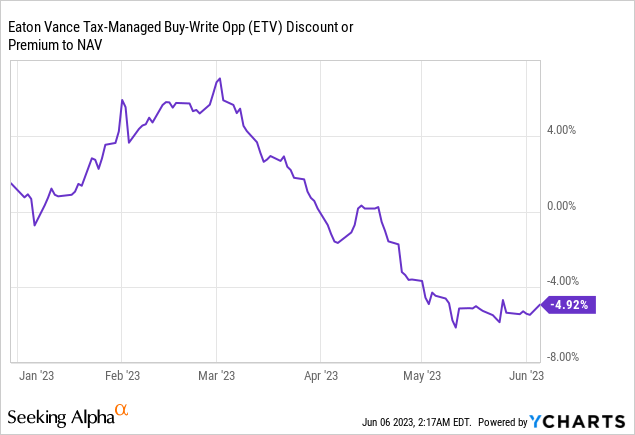

As a closed end fund, ETV has a premium and discount to NAV, which can greatly impact its market price:

We can see from the above graph that the CEF has seen its premium move to a discount this year. The net impact to the fund’s market price is somewhere around -5%, which has negatively affected the fund.

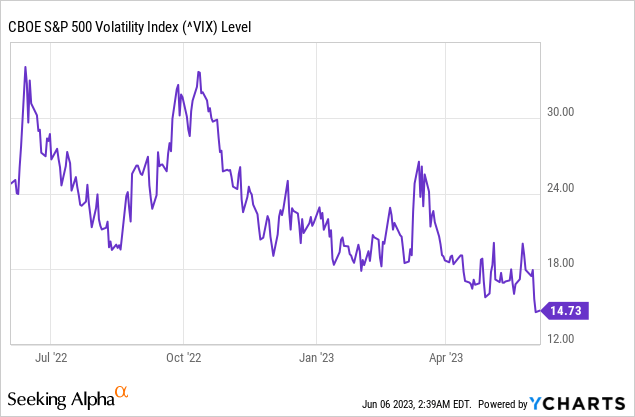

There are several explanations for this feature, the most preeminent one being that volatility, as reflected in the VIX index, has collapsed:

In 2022 we never saw the VIX go below 20 in a sustained fashion. In effect a popular theoretical trade last year was to buy the S&P 500 when the VIX hit 20 and sell the index when the VIX hit 30. That strategy would have generated a total return in excess of 30% last year.

The story is different in 2023, with the VIX now below 15! The VIX is a volatility measure:

The Cboe Volatility Index, or VIX, is a real-time market index representing the market’s expectations for volatility over the coming 30 days.

As a buy-write fund ETV is short volatility. When volatility moves lower there is less and less of an incentive to short it (because you do not get compensated for it). So right now an investor should not really short vol because the downside is bigger than the upside. In our mind this is one of the reasons for the fund moving to a discount to NAV. We would like to see ETV decrease the amount of portfolio covered by options here.

2. Portfolio Coverage / Options Overlay

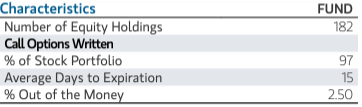

The fund writes options for most of the portfolio:

Options Overlay (Fund Fact Sheet)

We can see from the fact sheet (the fund has removed the options overlay details from its website) that as of the last reporting date the CEF was covering 97% of its portfolio with calls. That is an aggressive stance that works really well in a down market or a range bound one, but penalizes the fund when there are sudden significant moves up in stocks. This is the exact feature that explains the lagging move buy-write funds experience in structural bull markets. They basically give up a lot of the upside by writing calls.

Again it very much depends on how the market moves. Very small gains over long periods of time do not affect the performance here, sudden significant moves do though. Let us take an example. If the market moves by 3% today the fund basically has exhausted its upside. Structurally it will need to wait for another 14 days to be able to capture any further move up. So if in the following period there are significant gains, ETV will not participate. Why? Because it has written call options that are 2.5% out of the money and have a 15 days expiration. So the CEF gets paid a premium but only participates in the first 2.5% of the up move in the two week period.

For the fund to be able to underwrite more of the upside, it needs to decrease the ‘% of Stock Portfolio’ overwritten with call options.

Conclusion

ETV is an equity buy write CEF. The fund has lagged the S&P 500 this year, up only 6% when compared to the 12% return posted by the index. The article analyzes some of the factors behind this underperformance, in light of a curious year which, on paper, should have favored ETV. Around 5% of the underperformance is due to the widening of the discount to NAV for the fund since the beginning of the year. We attribute this move to the incredible collapse in VIX and the unattractiveness of shorting volatility at these very low levels. The market is basically punishing ETV for shorting the VIX at historic low levels (never a good trade to have). The second reason behind the underperformance is represented by how the market has moved. ETV covers 97% of its portfolio with calls that have only 2.5% upside. Sudden moves up that total more than 2.5% in a two week period will result in ETV underperforming. The CEF would need to decrease the portfolio option overlay in order to be able to partake in a higher upside percentage. We own this CEF and are on Hold with respect to the fund, happy with receiving the dividends.

Read the full article here