Venture investments into fintechs headquartered in North America dipped to $24.39 billion in 2022, a decline of 34% from the year prior, according to S&P Global Market Intelligence’s recently released Global Fintech Funding Trends report.

After a promising start to the year, funding began a precipitous decline in Q3 as interest rates and macroeconomic concerns increased in unison. Investments plummeted from $18.02 billion in H1 to $6.37 billion in H2. Notably, the number of fintech funding rounds in North America increased in 2022, rising by 5%. But following the funding trend, the number of rounds sank by roughly a third in the second half compared to H1.

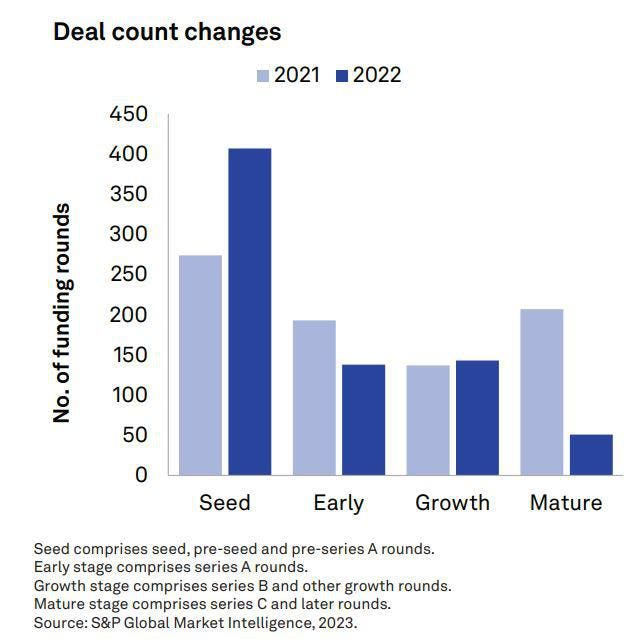

Mature-stage companies hit hardest while seed-stage companies see greater activity

The most dramatic pullback in 2022 was seen with mature-stage companies, which sank from 207 funding rounds in 2021 to 51 in 2022. Average round size for mature-stage companies dropped from $121 million in 2021 to $47.6 million in 2022. Nine-figure funding rounds were far fewer in 2022, dropping 53% from 2021 to 68. And unlike 2021, which saw 40 funding rounds at or above $250 million, only 15 such rounds took place in 2022. Just two of those rounds — Pie Insurance Holdings Inc. and Avant LLC — occurred in the second half of 2022.

Conversely, the number of funding rounds into seed-stage companies increased by an impressive 49% to 407 rounds in 2022, with average deal size posting a modest 9% lift. Capital remains flowing into the next wave of industry disrupters — an encouraging sign for continued innovaiton.

US HQ’d startups dominate North American fintech funding

US-headquartered startups, unsurprisingly, dominate North American fintech funding, accounting for 97% of the total raised in 2022, up from 93% in 2021. In fact, the top 25 fintech capital raisers in North America were all US-headquartered companies. Crypto-oriented investment and capital markets technology vendors featured prominently, with large rounds from players such as Fireblocks Inc. ($550 million), FTX US ($400 million), PrimeBlock ($300 million) and Genesis Digital Assets ($250 million).

Still, all fintech segments in the US posted year-over-year funding declines in 2022, with the largest drops in digital lending (-48%) and banking technology (-43%). After earning the top spot in 2021, payments ($5.12 billion) was displaced by investment and capital markets technology ($6.98 billion) as the largest fundraising category for US fintechs in 2022.

Infrastructure-oriented payments startups are top-of-mind

We anticipate infrastructure-oriented payments startups will be top of mind for investors as they seek out vendors with slower burn rates and more deeply embedded customer relationships. This trend was already becoming apparent in the second half of 2022, especially with payments startups targeting B2B use cases. ConnexPay LLC, which helps enterprises connect customer and supplier payments, raised $110 million in October; Denim, a payments platform for freight brokers, picked up $126 million in September; and PayIt LLC, a payments platform for government agencies, raked in $80 million in August. Additional examples of recent momentum in the B2B payments arena include Nitra Inc. ($62 million, October), Mesh Payments ($60 million, October) and Balance Payments Inc. ($56 million, July).

Read the full article here