This article was first posted in Outperforming the Market on June 5, 2023.

Several members of Outperforming the Market have asked me about Super Micro Computer Inc. (NASDAQ:SMCI), which I have done a deep dive on. In this article, I will introduce SMCI and cover various aspects of the company, including its segments and products, competitive landscape and advantages, amongst others.

Business segments

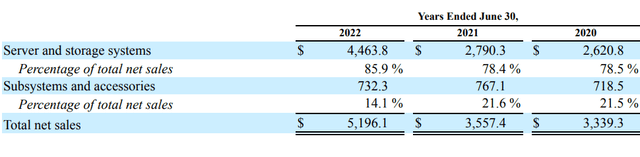

SMCI’s core business is its server and storage systems segment, which makes up almost 80% of revenues. SMCI sells accelerated compute platforms and some of its key product lines include its SuperBlade and MicroBlade system families that is meant to share common computing resources and reduce the space and power needs compared to standard servers.

The more exciting product line of SMCI resulting in the recent share price rally is its GPU or accelerated systems to cater to the increasing demands for the generative AI applications, and data center optimized server systems that bring about improved scalability and performance-per-watt and better thermal architecture.

On top of its server and storage business, SMCI has a subsystems and accessories segment, which makes up 20% of revenues. Most of the subsystems and accessories sold by SMCI are meant to be integrated into complete server and storage solutions. Some of the products sold here include server boards, chassis, power supplies and other accessories.

In FY2022, there was an increase of 60% from the prior year in the server and storage systems segment. This came from SMCI’s large enterprise and datacenter customers.

Product mix of SMCI (SMCI IR)

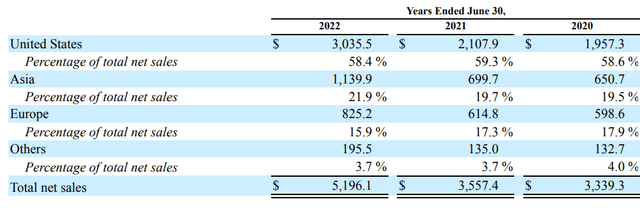

In terms of geographical mix, the United States make up almost 60% of its revenues, while Asia and Europe take up around 20% and 15% respectively. SMCI highlighted that China makes up only 3% of its revenues.

Geographical mix (SMCI IR)

Highly competitive industry

I would note that SMCI is operating in an industry that is “highly competitive, rapidly evolving and subject to new technological developments, changing customer needs and new product introductions”, in the words of SMCI in its latest annual report.

SMCI competes with global technology vendors like Cisco (CSCO), Dell (DELL), HP (HPQ), and Lenovo (OTCPK:LNVGY).

SMCI also competes with original design manufacturers (“ODMs”) that are able to offer low-cost manufacturing due to their scale like Foxconn, Quanta Computer, and Wiwynn Corporation.

Lastly, SMCI competes with OEMs, such as Inspur.

With so many large companies with strong brand names competing against SMCI, it is operating in a highly competitive industry.

To succeed, it needs to:

- Be the first to market with new emerging technologies.

- At the same time, be cost effective and its products need to have high performance, efficiency and reliability.

The need to be first and better

SMCI stated that the key for it to increase its sales and profits is that it needs to be “among the first to market with new features and products”.

As a result of its leading indicators of success is that it needs to be able to introduce new products as quickly to the market as possible, delivering the latest application-optimized server and storage solutions.

Thus, SMCI works closely with the microprocessor and key component vendors like Nvidia, Intel, AMD, Samsung and Micron, among others, to ensure that they are able to introduce new products that are in-line with these major players.

However, I think that this competitive advantage is not a sustainable one in the long-term. Even if SMCI is able to be the first player to market a new product with new features, given the highly competitive market, other competitors will catch up in a matter of time. In addition, from the recent quarterly results, we can see that SMCI is experiencing a component shortage as a result of a supply chain bottleneck, and this is limiting its near-term growth.

Divergence between commentaries from Nvidia and SMCI

As mentioned in my article on Nvidia (NVDA), management commented that they have already procured substantially higher supply for the expected accelerated, visible demand in the second half of 2023.

In SMCI’s 1Q23 results, this was said by the management team, which highlights that while demand may be high, the business is constrained by supply chain bottlenecks:

We note that our shipments against a record backlog may be constrained by supply chain bottlenecks due to high demand for our advanced AI server platforms.

In terms of next quarter outlook, SMCI is guiding for revenues of $1.8 billion at the mid-point, which is up 12% on a year on year basis and up 38% sequentially. Take note that June is a seasonally strong quarter so there are seasonal factors to take into account there but management says that backlog orders for new platforms remain strong and they are working to ease their key supply constraints.

When you compare this to Nvidia’s commentary about doubling in the next quarter relative to its prior quarter, this tells us that the competitive dynamics are catching up to SMCI as Nvidia is able to procure supply from SMCI’s competitors as SMCI solves its supply constraint issue.

Thus, what this highlights to me from the channel check between Nvidia and SMCI is that firstly, Nvidia has a way stronger bargaining power over its suppliers, secondly, the suppliers are easily replaceable given the competitive nature of the industry, and lastly, that while SMCI has some upside from the exponential growth from Nvidia, this is shared between other competitors in the industry.

Foxconn sees similar scenario to SMCI

One of SMCI’s largest competitors also saw AI driving strong server demand.

While their full year revenue is expected to be flat, servers was a strong segment for them as there will likely be a “triple-digit increase” in second half of 2023.

Furthermore, Foxconn has about 40% market share in the global market for servers and management said they are looking to increase their further.

This highlights to me that Foxconn may be able to handle the supply chain bottlenecks better than SMCI given their size and their tripling of server revenue segment provides further evidence that SMCI is in a highly competitive market.

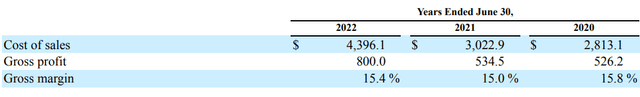

Low margin business

As a result of the highly competitive industry, SMCI has relatively low gross margins, between the range of 15% to 16%.

The company’s cost of sales is relatively high due to high manufacturing costs, including the cost of manufacturing, cost of materials, shipping and manpower.

A large part of the cost of sales is determined by the mix of products which it sells and the cost of materials.

The ability to increase its average selling price to offset the rising cost of materials will determine its ability to maintain or expand gross margins over time. SMCI highlights that they do not currently have any long-term fixed supply agreements and thus, their cost of sales fluctuate with the changing cost of materials. In my opinion, this leaves SMCI’s cost of sales very vulnerable to increases in its cost of materials.

In terms of manufacturing, contract manufacturers are used to manufacture subsystems, but the final assembly and testing is largely done in SMCI’s own manufacturing facilities.

Ablecom and Compuware are two key contract manufacturers for SMCI, and both are related parties of SMCI. The purchases from the two companies by SMCI makes up between 8% to 10% of its total cost of sales.

SMCI Gross Margins (SMCI IR)

Competitive advantage

SMCI needs to be able to be the first to market and deliver at a faster pace than competitors.

One of its key advantages is its in-house Building Block Solutions architecture as well as its in-house design capabilities. What this enables SMCI is that its customers can then choose from a wide range of products that are able to meet their target application requirements.

Asa result of its building block solutions architecture, SMCI is then able to bring new products to market faster than its peers, as it has done with Nvidia’s H100, Intel’s Sapphire Rapids and AMD’s Genoa releases.

Another key differentiator for SMCI is its expertise in high power efficiency and thermal expertise that is able to address these challenges as data centers increasingly take up more power.

As a result, I think that SMCI looks to be able to have some differentiating factors in being the first time-to-market player, and a player with lower TCO costs. This may enable SMCI to gain more new design wins in the future.

Valuation

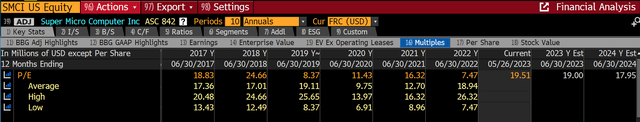

SMCI is currently trading at 18x 2024 P/E. SMCI has been trading at a 6-year P/E average of about 16x P/E, which implies that on a relative valuation perspective, SMCI is trading at a 13% premium to its past valuation.

SMCI valuation (Bloomberg)

Based on the current stock price of around $221 per share, assuming a terminal 2027F P/E of 16x and cost of equity of 10%, SMCI would need to grow EPS at 18% CAGR over the next five years for the stock to be fairly valued today.

SMCI implied 5-year EPS CAGR based on current share price (Author generated)

Risks

Obsolete inventory risk or insufficient inventory risk

SMCI needs to offer customers with more choices in terms of its product portfolio and thus, it needs to maintain a high level of inventory. This high level of inventory is necessary to ensure that SMCI is able to meet the demands of its customers on a timely basis. There is a risk that SMCI is unable to have sufficient inventory levels to meet the needs and demands of its customers.

In addition, if it overestimates the demand for a product, it could lead to excess inventory and thus, lead to a risk of obsolescence of its inventory if it is unable to sell these products.

As a result, SMCI needs to manage its inventory well to ensure that it does not have too much or too little inventory for its business operations.

Cost of manufacturing

As a result of the cost structure of SMCI, it needs to be able to raise its average selling price to offset any changes in the cost of manufacturing, which includes things like cost of materials, amongst others.

If SMCI is unable to raise prices in an environment where the cost of materials is rising, this could lead to downward pressure on its gross margins.

Speed to market

SMCI needs to be one of the first to market new products that are in demand by its customers. The failure to do so will result in loss in market share as other competitors that are faster to develop and market new products will gain market share.

Conclusion

While I think that SMCI plays nicely to the theme of AI and cloud computing given its business involves selling accelerated compute platforms, I am of the opinion that SMCI may not have a sustainable competitive advantage in the space. The industry that SMCI is operating in is filled with large players with plenty of financial resources and strong brand image. While SMCI may have some advantage in the form of its in-house building block solutions architecture and in-house designing capabilities, the highly dynamic and competitive nature of the industry, the need to be the first to market, and the low gross margins that SMCI is earning suggests to me that the industry is one that I do not want to be investing in. Even if SMCI may have the lead today, this lead may be taken over by another player in the near-term.

On top of that, SMCI needs to grow EPS at 20% CAGR over the next five years for its current share price to be regarded as fairly valued. While possible, I think that the risk reward for SMCI is rather low at the current valuation level. Furthermore, SMCI is currently trading at 18x 2024 P/E, which is at a 13% premium to its 6-year P/E average of about 16x P/E.

Thus, I am initiating SMCI with a neutral rating. I would need to see a more sustained competitive advantage and a more favorable industry dynamic for me to be more constructive on the company.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here