Scam victims often don’t know they are being swindled. Maybe they are trusting souls or just fall for a clever pitch. I’m not sure.

Yet scams are on the rise as thieves find new ways to deceive people and take their money. A recent AARP survey found that “financial predators use a playbook to get us into a heightened emotional state,” said Kathy Stokes, AARP director of fraud prevention programs. “They know it’s hard to access our logical thinking when we are panicked, excited or scared. But knowing about specific scams makes it far less likely that we will engage with them.”

That’s right. Like carnival sideshow acts, they get inside our heads. They tell us what we want to believe and scare us into handing over money. Even when a pitch sounds fishy, a large number of people ignore their inner voices of logic.

One third of adults surveyed by AARP “do not know it is a scam when someone directs you to use a cryptocurrency ATM to address some financial concern. In 2022 alone, the FBI says reported losses from fraud involving cryptocurrency reached $2.57 billion, a 183 percent increase from the previous year.”

Using crypto to scam people? Who would’ve thought? Fortunately, there’s much you can do to protect yourself and others. AARP offers this advice:

Gift cards also continue to be a common tool for criminals. About 25% of adults reported being unaware that being asked to make a payment or send money by gift card is a scam.

Peer-to-peer apps like Venmo, Zelle and CashApp are also used in scams. These apps do not offer consumers the same level of fraud protection as credit cards, but our research showed that 63% of adults are not aware of this distinction. These types of apps should be used as they are intended: to provide payment to a known and trusted contact.

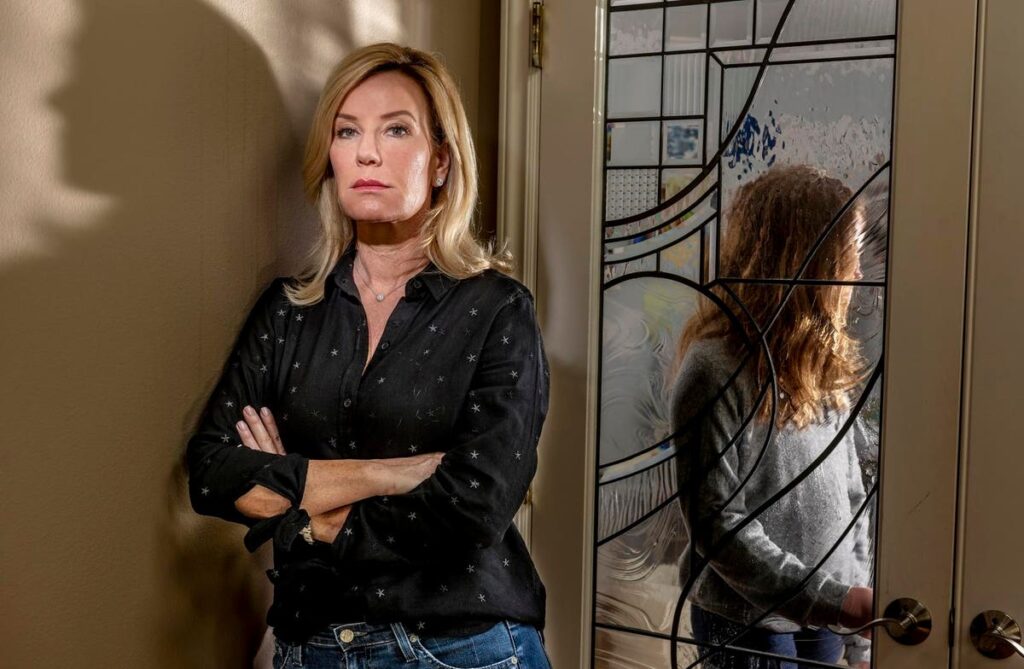

Fraud is Unreported Due to Victim Shaming. Fraud is a severely underreported crime, even as nearly nine in 10 adults feel people should report incidents. Nearly 40% of Americans still don’t understand that victims do not lose money to scams because they are gullible. Victimization from a scam can happen to anyone. These crimes need to be reported.

I can tell you that it’s worthwhile to report fraud. When I was handling an estate matter a few years ago. someone had stolen information from a check in the mail to create fake checks, which were cashed a thousand miles away. I immediately alerted my local police department, whose detectives passed the case along to postal inspectors. A month later, a perpetrator was arrested and charged.

If you know someone who has been a fraud victim, report the crime to local authorities. The best protection against fraud is constant vigilance.

Read the full article here