If you feel stressed about the future of your finances, taking control of your money can alleviate that stress and guide you toward a future in which your money continues to grow with you.

The truth is that financially planning for your future does take time, but once you get the bulk of the work done, your financial plan will just need monitoring and small adjustments on your part, when necessary.

A lot of financial planning for the future revolves around setting goals and investing as early as you can. The sooner you get a good grasp on your finances, and the faster you create healthy spending and saving habits, the more money you’ll have at your disposal down the line.

PERSONAL FINANCE: HOW TO SAVE $100 THIS WEEK

Below are 10 tips for how to financially plan for a future without money-related stress.

- Invest early (but it’s also not too late)

- You’re not too young to contribute to your 401k

- Create savings goals, and then save specifically for these goals

- Put your savings in a high-yield savings account

- Pay off debt as fast as you can

- Start putting money toward an emergency fund

- Track your money, know what is coming in and out

- Allow yourself to spend responsibly

- Pay off that credit card bill as soon as possible

- Check in and readjust when necessary

1. Invest early (but it’s also not too late)

Investing your money is a great way to grow your money over time and reach your saving goals. As soon as you begin making a steady income, start looking into investing and a strategy that works for you. If you have been accumulating income for a while but haven’t started to invest yet, it’s not too late.

Investing money for retirement, in the form of a 401k, for example, is important for your financial future, but investing can also be a way to build money for more short-term goals, like buying a house.

One common misconception about investing is that the only way to invest is by picking individual stocks, but this is far from the truth. If you feel confident about a certain company and want to invest in stock, that is just one way to go. A less risky option of investment is putting your money into mutual funds, exchange-traded funds (EFTs) and index funds.

Once you’ve got your investing strategy going, you won’t have to pay much attention to it, and you can just focus on funding your accounts.

NEW TO INVESTING? 3 SOLID CHOICES FOR YOUR PORTFOLIO

2. You’re not too young to contribute to your 401k

Retirement can seem like worlds away when you’re young, but it will come sooner than you think. It is never too early to start saving for retirement. A lot of retirement saving is about creating habits. If you start saving for retirement as soon as you start making a steady income, you’ll create the habit of putting money aside for this purpose. It can be extremely difficult to start putting portions of money away for retirement deep into your career if you have been accustomed to making a specific income. Additionally, waiting too long to start saving for retirement can cause you to make large contributions during the later years of your career in an effort to catch up.

Start saving for retirement as soon as you are able so that you can maximize your contributions early and have plenty of money to support your lifestyle down the line.

3. Create savings goals, and then save specifically for these goals

Saving money can be made easier by creating specific goals for yourself. Having an end goal for your money can act as a motivator to help you save. Many banks allow customers to separate their savings into different “buckets” or categories. For example, one of your savings buckets could be dedicated to money for a future home you want to buy. Another could be money you want to put aside for travel. A third could be savings for a future wedding. Cater these buckets to yourself and things for which you want to save. Depending on your bank, you may be able to create as many different categories as you want while others have limits on the amount of different categories you can create. In general, three to five categories is a good amount to have.

Once you create your different categories, the next step is to automate your accounts. Decide how much you want to dedicate to each account on a weekly, bi-weekly or monthly basis and set up automatic deposits into each of your accounts. This way, you won’t have to worry about adding money manually, and just like your 401k, you’ll get in the routine of saving money without putting much thought into it.

HOW TO SAVE MONEY FROM YOUR SIDE HUSTLE

Remember, you aren’t locked into the amount you set up for automatic deposits, so you can always modify the amounts when needed.

4. Put your savings in a high-yield savings account

Putting your savings in a high-yield savings account is a great way to grow your money. High-yield savings accounts offer higher interest rates for users. If you have your money sitting in an account, put it in one like a high-yield savings account, where it is going to grow, unlike a standard account where the interest rates are going to be a lot lower.

Many high-yield savings accounts have rates around 4%-5% annual percentage yield (APY). This may not seem like a lot, but it can add up over time. For example, if you put $1,000 into a high-yield savings account, that $1,000 will turn into $1,050 in a high-yield savings account at 5% APY. That’s $50 of money you wouldn’t have made if that thousand dollars was sitting in a standard account.

Put your savings into a high-yield savings account and watch it grow. One downside some feel is present with a high-yield savings account is that your money isn’t as readily accessible as it would be in other accounts. In a lot of high-yield savings accounts, your money will take a couple of days to be available to transfer and then will take an additional couple of days to transfer. That being said, this can be flipped into a positive because not having as easy access to your savings can help you to save more long term.

When researching high-yield savings accounts, things to look out for are minimum balance requirements, the interest rate offered and the maximum amount of transactions that you can make per month.

3 THINGS TO CONSIDER WHEN SEARCHING FOR A HIGH-YIELD SAVINGS ACCOUNT

Certificate of deposit (CD) accounts are another popular option for growing savings. In a CD account, you typically need to put in a minimum balance, usually $500 or $1,000, and then you agree to keep your money in that account for a certain period of time. In return, you’ll be rewarded with a higher interest rate. Be cautious with CD accounts because if you do take the money out before your term is up, you’ll have to pay a fee. Again, this can be good if you have difficulty saving money because the money you save will essentially be locked away for a period of time.

5. Pay off debt as fast as you can

Paying off debt and trying to save at the same time can be a major challenge. People use a lot of different methods when it comes to paying off debts. An important first step is to list out all the debt you have. This could include college loans, credit card debt, car payments, etc. Once you have your debts written out, write down the interest rates for each of these loans and how much total money you owe on each of these debts.

There are a few primary methods that are used to pay off large amounts of debt. One method is to pay off your debts from the one with the highest amount owed to the lowest. Now, there are minimum payments associated with debt, but if you just pay the minimum payment and no more, you’re probably going to be paying off your debt for a lot longer than you wanted. If you want to pay off your debt faster so that you can have more freedom with your money, paying extra on the highest owed and then moving down from there is one favored way to do it.

Another method for paying down debt is paying it off in terms of interest rates rather than amount owed. With this method, start paying off the debt with the highest interest aggressively, and then move down to the next highest, then the next, and so forth until all your debts are paid.

A third method is to start with the smallest debt first. This can create a quicker sense of accomplishment and allow you to knock out one debt fast.

Having debt is normal, but paying it off as quickly as possible can provide you with greater financial freedom so that you can allocate your money toward other things.

6. Start putting money toward an emergency fund

An emergency fund is extremely important to have in the event that any surprise expenses come up – which they will. An unexpected car bill, medical bill, loss of income or an emergency home repair could end up being a huge stress without an emergency fund.

IS IT BETTER TO PAY OFF DEBT OF SAVE?

In general, an emergency fund should be enough to cover three to six months of your living expenses. Figure out what this amount is for you and start to save. The great thing about saving for an emergency fund is once you have reached your target amount, you can let it sit and stop funding the account. It may be a wise option to put extra money toward an emergency fund to get to your target amount quickly so that you can then put your money elsewhere.

An emergency fund is one account that is a good one to start in a high-yield savings account.

7. Track your money, know what is coming in and out

When it comes to budgeting, there are so many different methods, and it may take a process of trial and error to figure out which one works for you. For some, creating a detailed budget each month works best for them. For others, a simpler approach of aggregating the amount of money that is coming in and being spent is enough and thus a detailed description of where money is going is not necessarily needed.

At a minimum, know how much income you are bringing in, how much is going to savings and how much you need to pay your bills each month.

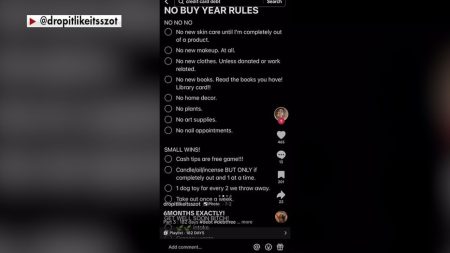

8. Allow yourself to spend responsibly

Don’t feel guilty for spending. Overspending can become an issue, but putting money aside for the things you enjoy is completely OK. If you like to go out to dinner with friends, make sure you have money put aside for that. If you like to go shopping, put money aside for that activity. Putting money aside for the things you enjoy will allow you to spend guilt-free.

9. Pay off that credit card bill as soon as possible

Having a high credit card bill can not only be detrimental to your credit score, but your high bill can accumulate interest quickly. The exact interest rates on credit cards differ depending on the card you have, but many have rates right around 20%. This extremely high rate means that you will end up paying lots of extra money the longer you don’t pay off your bill.

Every time you swipe your card, make sure that you have enough to pay that bill. A good rule of thumb to get into a good habit is to pay your balance as soon as you can.

10. Check in and readjust when necessary

Once you have money automatically funding your savings, your investments, and you are in the routine of paying extra on your debts, you’ll still want to occasionally check in on your accounts. There may be times when you need more money for spending, or you may want to adjust the amount you are allocating to certain accounts. Check in with your savings and budget when necessary to make any adjustments you may need.

Read the full article here