I just received two emails, which I copy below without identifying their authors. Both authors are keeping careful track, over time, of their projected Social Security benefits as reported on Social Security’s website. Both report projected benefits that are significantly lower than those projected earlier this year.

In the first email, 58-year-old Joe (made up name) reports that Social Security’s website is currently projecting his full retirement benefit at a value that’s 2.3 percent lower than it projected last February. As for his wife, the site is projecting her retirement benefit a whopping 17 percent lower.

Both the February and current projections are reported in today’s dollars. Hence, this is not due to the February apples being quoted in peaches and the current projection being quoted in oranges. Both are being quoted in apples. I.e. on an apples-to-apples basis Joe and his wife just learned that Social Security plans to pay them far less.

Social Security states, at this link: retirement/planner/AnypiaApplet.html, that “(Its) Online Calculator is updated periodically with new benefit increases and other benefit amounts. Therefore, it is likely that your benefit estimates in the future will differ from those calculated today.” It also says that the most recent update was in August 2023.

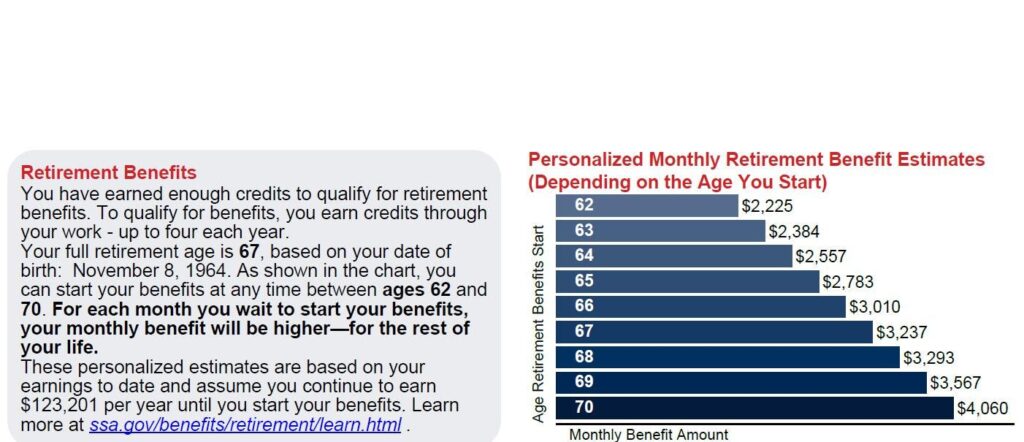

This statement references Social Security’s Online Calculator. But they have a number of calculators that make different assumptions. And it’s not clear what calculator they used to produce the graphic, see below, that projects your future retirement benefit conditional on working up to particular dates and then collecting immediately. Nor is Social Security making clear what changes they are making to their calculators through time.

What I’m quite sure is true is that the code underlying Social Security’s graphic projects your future earnings at their current nominal value. This is simply nuts. Imagine you are age 40 and will work till age 67 and take your benefits then. If inflation over the next 27 years is 27 percent, your real earnings are being projected to decline by 65 percent! This is completely unrealistic and makes the chart, if my understanding is correct, useless.

But over the to the second email, which comes from Sandy — another made-up name. Sandy previously checked her estimated benefit in July. Here’s what she writes:

On October 22, 2022, my age-70 monthly benefit amount was: $2865

On July 28, 2023, my age-70 monthly benefit amount was $3158

On October 17, 2023 (today), my age-70 monthly benefit amount is $2700.

Note, $2700 estimate is 15 percent lower than the July estimate!

What Could Possibly Be Going On?

The only thing that might, to my knowledge, reduce projected future future benefits over the course of the past four months is a reduction in Social Security’s projected future bend point values in its PIA (Primary Insurance Amount) formula. This could lead to lower projected future benefits for those pushed higher PIA brackets, which would mean reduced benefit brackets. This could also explain why the differences in projections vary by person.

But 17 percent and 15 percent reductions in future benefit estimates? These are massive real changes. And it makes no sense to be adjusting projected bend points dramatically. The 2023 and 2022 Trustees report make essentially the same inflation and nominal wage growth assumptions — the key factor underlying bend point projections. Hence, it’s hard to believe that the forecasted future bend points adjustment could have changed that much.

Yes, this is impossible to follow unless you are a fellow Social Security nerd. But the bottom line is this:

Millions of workers are being told, from essentially one day to the next, that their future real Social Security income will be dramatically lower. Furthermore, the assumption underlying this basic chart — that your nominal wages will never adjust for inflation — means that for Social Security’s future benefit estimate is ridiculous regardless of what it’s assuming under the hood about future bend points.

Getting the Right Benefit Projection

There is no reason for Social Security to present benefit estimates based on wacky assumptions — your nominal wage won’t adjust, ever, to inflation — or to make abrupt changes in bend point projections when the system’s Trustees aren’t abruptly changing their projections.

My company’s Maximize My Social Security tool adopts all of the Social Security Trustees’ latest assumptions. But it lets users specify that their wages will keep even with inflation or, indeed, grow slower or faster than inflation on a temporary or longer-term basis. I.e. it doesn’t insist that X will happen when X is surely the last thing that will happen. And it adjusts projected bend points annually based on the wage growth assumption in the latest Trustees Report. Hence, there are no abrupt changes in projected benefits as these emails are reporting.

Our Future Benefit Estimates Versus Social Security’s

Joe, currently age 59, believes his wages will stay fixed in today’s, not nominal, dollars, through age 67. That’s what he entered into our program. Under this assumption, Joe’s age 67 benefit is $3,727 — 18 percent higher than Social Security’s website is now projecting. But what if we adopt Social Security’s assumption that Joe’s wages will remain fixed for the rest of his career at their current dollar value? In this case, Joe’s full retirement benefit is just $3,576. That’s still 13 percent higher than Social Security’s latest chart projects!

This I don’t get. I know Social Security’s calculators can’t handle all manner of issues involving family benefits. Due to privacy rules, it can’t solicit or use information about your spouse’s past covered earnings, for example. But for single people, our tool and their more advanced calculator agree to the dollar for those currently age 60 with no future earnings. For this population the bend points have already been set in stone. Hence, I don’t get what bend point assumptions they are projecting now for those under age 60. But they can’t be consonant with Social Security’s Trustees assumptions.

My conclusion: Social Security has some bad code or is making, for purposes of its website’s estimated future benefit chart, assumptions at great odds with the latest Trustees economy-wide wage growth assumptions.

Social Security’s Response — No Response

I contacted Social Security to ask them to comment on the dramatically lower benefits they are now producing for Lord knows how many millions of American workers. No one returned my email or responded to my voice mail.

Not the First Time Social Security’s Software Has Thrown a Nutty

One possibility here is that a software engineer has made a big coding mistake. This happens. On February 23, 2022, I reported in Forbes that Social Security had transmitted, to unknown millions of workers, future retirement benefits statements that were terribly wrong. The statement emailed to me by a worker, which I copy in my column, specified essentially the same retirement benefit at age 62 as at full retirement age. It also specified a higher benefit for taking benefits several few months before full retirement.

Anyone familiar with Social Security benefit calculations would instantly conclude that there was either a major bug in the code or that that, heaven forbid, the system had been hacked. But if this wasn’t a hack, why would anyone have changed code that Social Security claimed, for years, was working correctly? Social Security made no public comment in response to my prior column. But it fixed its code as I suddenly stopped receiving crazy benefit statements.

The Only Way to Get Correct Information from Social Security Is Not to Ask them Anything and Not to Use their Calculators

This is harsh. But Social Security is making so many mistakes, making so many critical and undisclosed assumptions, and disseminating so much misinformation that anything the system says is more than likely to be miles off base. In dealing with Social Security, your rule should be:

Tell them, don’t ask them.

First Email

… I am concerned with the faulty Benefits Statements that the Social Security Administration currently shows on their My Social Security website. I am a few years away from retirement and filing for SSA benefits and am trying to do my due diligence as far as retirement planning goes. I religiously download and keep records of my benefits statements every year.

I checked today’s “updated” statement and it now shows a lower PIA than my previous statement from a few months ago. This is for both myself and my wife. Mine shows a 2.3% decrease, and my wife’s shows a 17% decrease in benefits (at PIA). Neither of us has had a decrease in wages, in fact both of us had a considerable increase in 2022 and 2023 wages.

I was able to call up the Social Security office (over 40 minutes on hold) and explain the situation to the representative, who was of no help at all. Her response was to wait a month or two and maybe it will correct itself on the SSA’s website.

I have done an internet search to see if any others had similar situations, but to no avail. I don’t know if this is something that you would like to write an article on, but if it is of interest, I would gladly give you my data. As stated in my comments, it is not just my benefits statement which shows a decrease, but also my wife’s, as well as that of a coworker of mine. My accountant agrees with me that there are errors here, as well as with the other amounts shown on the statement (i.e. from PIA, in my case age 67 on, there should be an increase of 8% per year in benefits up to age 70). That is also not the case. In my case it shows only a 1.7% increase (going from $3237/mo to $3293/mo, waiting from age 67 to 68 to file according to April statement, or 1.3% increase on the new statement).

There appears to be something wrong with the algorithm which SSA is using, and it would be a shame if many people are not getting what is due to them. Unfortunately, I know that most don’t compare or scrutinize their yearly statements as I do, so probably won’t catch these discrepancies.

So that you can see what I am talking about, I have included the two charts from the two statements in question.

Second Email

I’m a long time follower of your work. Thank you!

I’m 65 and still working… at the University of Maryland in College Park.

I’m planning on retiring from Social Security at 70.

Once a year or so, I check the SS website to see my monthly benefit amount.

Based on retiring at 70, my social security statements indicate:

On October 22, 2022 monthly amount was: $2865

On July 28, 2023 monthly amount was $3158

On October 17, 2023 (today) the amount is $2700

I have other statements where each year, the amount has consistently increased.

Today, my benefit amount is reduced by $458. How is this possible?

How can I find out why this is?

I called the social security office and after waiting more than 45 minutes online, the person hung up on me.

Read the full article here