Dear readers/followers,

Consumer discretionary companies are fickle in a volatile macro, such as the one we have right now. My investment in Polaris (NYSE:PII) has performed alright, but still less than the overall market. Not entirely unexpected, and not something I view as a problem given my timeframe when I invest. This business was a bit of a favorite during COVID-19 because the demand for these products essentially skyrocketed. For a brief period, the company traded at almost 17x P/E, which might not sound like much initially, but is a whole lot when you consider that this company typically averages a 10-12x P/E, owing somewhat to its cyclicality, size, and relative yield.

I don’t invest in this sort of valuation – which was why I stayed out for most of the time until we saw valuations close to below 10x, which is when I bought my first stake in PII stock.

Let’s revisit PII and see what the company can “do” for you over the next few years.

Polaris – A lot of things to like, but not everything is clear

So, for a 50+ year company with a market-leading position, Polaris is actually still quite cheap and interesting. I’ll say that straight away going in. Going from 20 mph-snowmobiles to where it is today, the company has a lot of appeal going for it not just in products, but as an investment. You do need to buy the company at a good price though. If you’re one of the investors that bought PII at almost 18x P/E – and I know that there are some of you, because there were plenty of bullish articles when the company was trading above $120/share, even though some called the company “morbidly expensive” (which I view as correct) – then you’re still not in the clear, unless you were willing to sell off at a loss.

My M.O. if I held such a position at such a price, would be to hold on. The company will recover, and there is absolutely nothing wrong with Polaris fundamentally.

Polaris is a margin leader. In terms of returns on assets, equity, and other variables, the company comes out on top at the 88th-95th percentile in the sector, meaning its far, far better than average. What sector, you ask? The vehicle parts/discretionary sector, including such peers as THOR (THO), Harley Davidson (HOG), Brunswick (BC), BRP (DOOO), and Winnebago (WGO). In terms of market cap, the company is actually the leader in this segment, even if that cannot be said in revenue (THOR leads the charge here).

My point is, that it’s a very competitive segment, and Polaris is doing just fine.

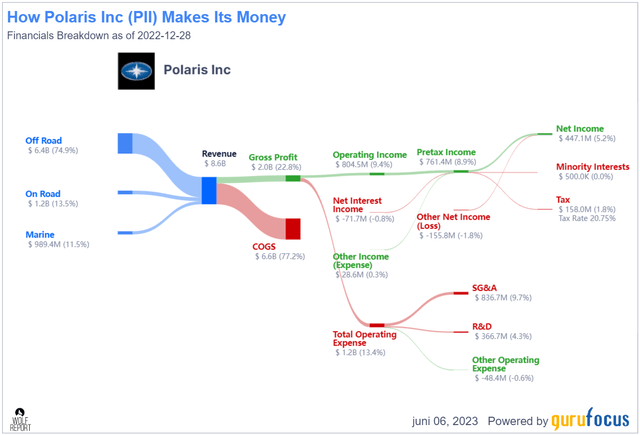

There are some fundamental considerations. Due to labor costs, inflation, and macro, PII is seeing some severe gross margin declines due to increased COGS. Operating margin, with OpEx, is also seeing some issues where the margins are down to single-digit level OM, 9.63% for the 2022 fiscal.

Debt to equity is at around 1.92x, which is high for the sector, despite an interest coverage of nearly 10x. Company COGS is up to 77.2%, with OpEx at around 13.4%. Combine these two, and take out tax and net out interest income/loss, and we see why making a good profit has become harder, and why PII is at a 5.2% net margin.

PII revenue/net (GuruFocus)

It’s not that there is anything wrong with the company per se. It is that the cost of making the products and the cost of the surrounding sales organization have grown much faster than the company, in the context of macro and customer preference and competition, has been able to grow its pricing to offset this. Neither strange nor unique in terms of being a problem.

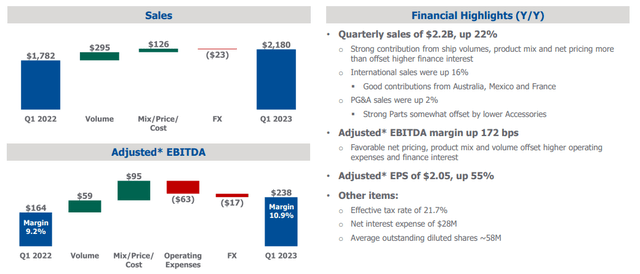

The latest set of results we have for PII is the 1Q23 results, which come in at a relatively positive tone. Sales are up 22%, the adjusted gross profit margin (a lot of adjustments here, keep that in mind) is up 170 bps, the adjusted EBITDA margin is up 172 BPS, and a 55% increase in adjusted EPS. Typically such results would be grounds for joy – not really the case here, even if things have moved in the right direction.

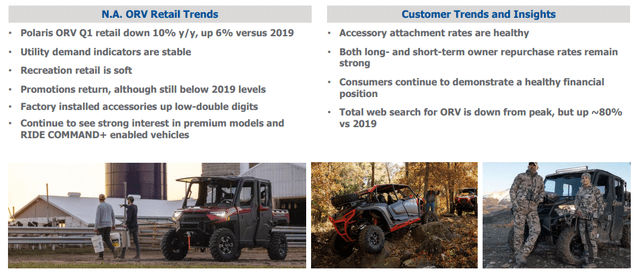

The backdrop to these results is a mixed-demand story, with NA retail down 5% YoY, but at least up compared to the pre-pandemic period. Segment-wise, Utility vehicles are the most stable, with Snow vehicles strong.

Recreational is the black sheep, which makes total sense given decreases in consumer spending and inflationary trends. The company also has its Indian motorcycle segment, which is stable and is showing strong market share gains – a positive.

However, adjustments can’t take away from the fact that the main issue is production inefficiencies, both ones the company can control, and others the company cannot. Interest costs are up, and overall input costs are still rising.

Demand indicators, as I said – are mixed.

Polaris IR (Polaris IR)

Inventories at dealer levels are once again rising, though this is to the 2021-2022 period when much of the products were sold out. The company considers inventories nearing optimal levels, with a sort of normalized retail seasonality returning.

As for the margins, I will carefully say that the top line is looking pretty excellent, but the company is still unable to offset much of the actual headwinds in margins – meaning operating expenses. But it’s a slow recovery. Recoveries are almost always much slower than people/investors want them to be, but they do come.

Polaris IR (Polaris IR)

It would not be wrong, as I see it, to call this a good start to the year – it could have been a lot worse, that’s for sure. I certainly wasn’t expecting anything better out of the company than what it ended up delivering here. Company guidance remains relatively positive, with 0-5% top-line growth, but a very volatile EPS guidance of negative 3% to up 3% for the year, up to around $10.75 on the high end, with margins… well, essentially flat. Slight improvements on an adjusted basis that are uncertain to move over into GAAP.

PII IR (PII IR)

The uncertainty arises from mixed underlying demand signals from the market – and I do not believe that the market trends we’ve seen point to this easing or growing less volatile. Still, PII continues to generate GAAP-positive results and good cash flows. Even with interest rate and FX headwinds continuing, in the end, I have no doubt that Polaris will end up outperforming what peers there are in the industry, and remain a good company and investment.

However, it’s definitely not an investment where you want to be paying a massive premium – or actually, any premium at all.

Let’s clarify the June 2023 valuation for Polaris

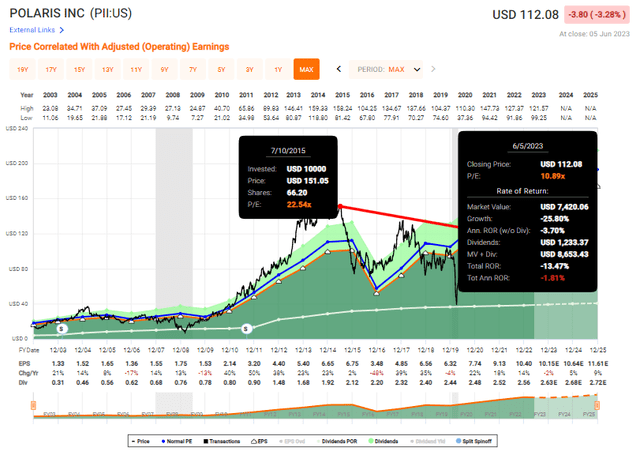

Polaris, as I said, should be viewed as a volatile cyclical company, despite relative stability in its sales over the past 10 or so years. In fact, with the exception of the 2016 earnings decline, Polaris has managed surprising stability and lack of cyclicality in its earnings and has generated impressive earnings.

The share price, however, has always been volatile, swinging wildly from 4.4x P/E in the GFC, despite growth in EPS, to almost 23x P/E back in 2013-2014. It’s been a wild ride, and if you didn’t sell at 2014 /2015 highs, you’re actually still in the negative inclusive of dividends, at a 3.7% negative RoR.

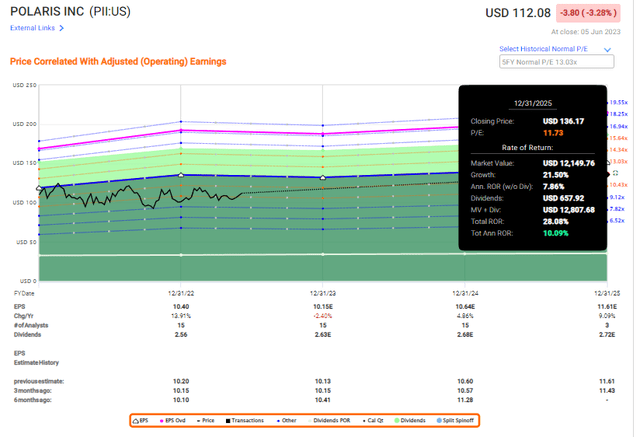

PII RoR (F.A.S.T. Graphs)

Valuation, valuation, valuation. It more than matters – it’s the core of my investment style, and it’s seen me beat the market over multiple years. What the valuation currently dictates, as I see it, is being somewhat careful. PII trades at a double-digit 10.9x P/E, but it’s set to generate a relatively negative EPS this year, with a likely decline to 2022 results. I do not believe the company will be able to outperform OpEx and COGS cost increases, and I guide for the lower end of the range and expect the company to manage double-digit EPS, but only barely. This comes to a 2-4% EPS decline on an adjusted basis.

At the same time, the company isn’t expensive for what it is. If we forecast and expect the company to recover its momentum in the next few years, normalizing to between an 11-13x P/E, then we can see an upside at least in the double-digits until 2025E.

F.A.S.T. Graphs PII Upside (F.A.S.T. Graphs)

And what you see above is the very least conservative thesis I consider likely at this time. So investing in PII here is per definition not a bad idea – because I consider it likely that you’ll actually outperform the market.

This can go all the way up to a 13x P/E, which would imply a 14-15% annualized RoR, or over 40% total RoR until 2025E, with an implied share price of $150+.

I would consider this likely as well. Any decline in share price at this point is, as I see it, not justified by the longer-term trends, even if shorter-term trends are not necessarily positive. So PII has become a company you need to be okay “waiting” for if you want a good upside.

As long as you are willing to do so, there is, as I see it, no problem here.

And other analysts tend to agree with me here. The current analyst corp from S&P Global has 13 analysts between $82/share on the low side and $175/share on the high side (man, I would love to see those calculations and assumptions), with an average of $118/share. This leads to 5 out of 13 at a “BUY” or equivalent, but with the majority of analysts at a “HOLD”, essentially wanting to wait and see what sort of OpEx and other input challenges the 2Q and 3Q periods bring.

They’re not wrong. But neither is it wrong, as I see it, to go “in” at this time and start adding to your Polaris position.

Polaris isn’t the most undervalued or “best” company at this time. But if we sat down and discussed valuation, and your stance was that you’re buying more Polaris because the company is undervalued, my answer to that would be relatively simple.

I would say that “I agree” – but then also give you some alternatives.

For this though, Polaris is a “BUY” at this time, and here is my thesis on the company.

Thesis

- Polaris is a world-leading play on ATVs, snowmobiles, and interesting, necessary alternative modes of transportation. It’s a cyclical stock that’s seen share price pressure for years going into COVID-19 and these recessionary trends we’re currently facing.

- The near term does not make things easier, and we do see increased Operating expenses, financing costs and other input pressures.

- While the company is attractively priced and I give it a conservative price target of $115, I consider it a better choice to consider some of the options for investing here.

- Still, Polaris is a “BUY” here, with my current PT as of June of 2023.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I won’t call it cheap any longer, but I will consider it with a good enough upside at this particular time.

Read the full article here