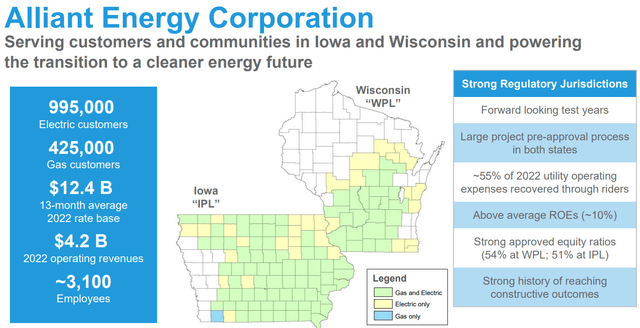

Alliant Energy (NASDAQ:LNT) is a public utility holding company based in Madison, Wisconsin, with power-provision operations across Wisconsin and Iowa. The company engages in the integrated production and distribution of electricity and gas in the latter geographies.

Alliant Investor Materials – AGA 2023

The firm engages with both gas and electric utilities across the majority of regions and maintains a hybrid energy mix, applying renewables where cost-effective and emissions-producing assets to ensure base-load capacity.

Introduction

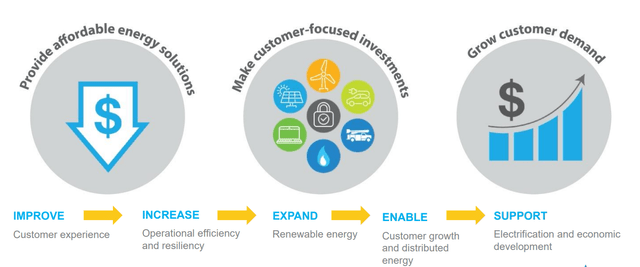

Alliant maintains a threefold growth strategy, enabling a macro virtuous scaling cycle. The utility is committed to providing affordable energy solutions, prioritizing cost-effective energy sources in doing so, making consumer-oriented investments, and, through the confluence of the latter two strategies, growing consumer demand for products.

Alliant Investor Materials – AGA 2023

By improving customer experiences, Alliant can support operational strength, use cash flows to invest in renewables- which are cheaper to operate, thus enabling low cost of energy and growing consumer scale, and ultimately feeding into a virtuous cycle of affordability and scale growth.

Combined with a general undervaluation, this operational strength and stability leads me to rate the company a ‘buy’.

Valuation & Financials

General Overview

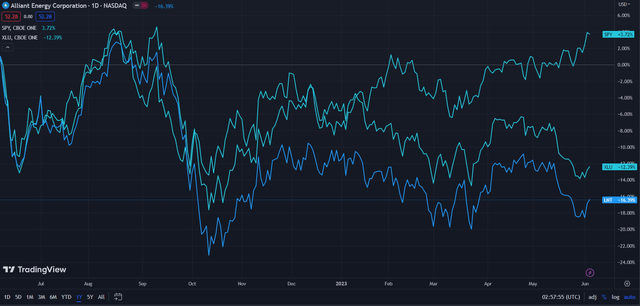

In the TTM period, Alliant- down 16.39%- has underperformed both the utilities index (XLU)- down 12.39%- and the broader market, represented by the S&P 500 (SPY)- up 3.72%.

Alliant (Dark Blue) vs Industry and Market (TradingView)

While the general drawdown in the utilities industry is a feature of increased input costs and compressed margins, Alliant faces additional pressures due to its high debt levels and consistent negative free cash flow levels.

That said, the double-digit revenue growth and the level of net income growth demonstrate Alliant’s ability to adequately cover interest and sufficiently generate additional cash flows through reinvestment.

Comparable Companies

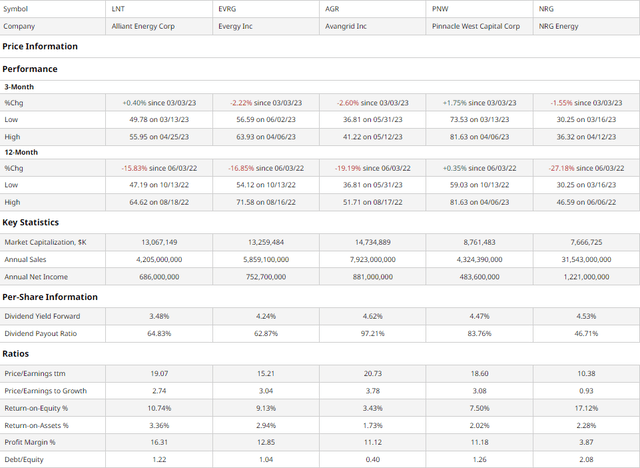

The inherently agglomerated nature of the utilities industry means that Alliant maintains no direct competition in the Wisconsin/Iowa markets of similar size. Therefore, I believe it is most justifiable to use utilities providers of similar size who operate in the US. This includes companies like Evergy (EVRG), with operations primarily across Kansas, Avangrid (AGR), with a major presence in New England, Pinnacle West (PNW), which runs Arizona-centric utilities, and NRG Energy (NRG), a nuclear energy provider in Texas.

barchart.com

As illustrated above, while Alliant has not experienced the worst price action- second best, actually- in the past quarter and year, the company nonetheless remains somewhat undervalued, particularly when examining the company’s growth and shareholder returns.

For instance, on a PEG basis, Alliant’s PEG ratio of 2.74 is the second-best value among peers. In conjunction with the company’s ability to generate cash flows via organic investment- with the second-highest and highest respective ROE and ROA- and ability to sustain the highest profitability among peers, this manifests Alliant’s operational capabilities.

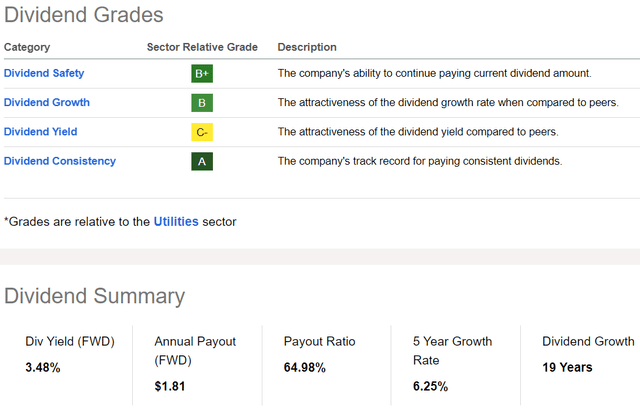

Seeking Alpha

This culminates in superior and stable investor returns, with a Seeking Alpha provided dividend report card emphasizing Alliant’s dividend consistency, safety, and growth.

Valuation

According to my discounted cash flow valuation, the fair value of Alliant, at its base case, is $60.26, meaning the company is undervalued by 13% at its current price of $52.49.

My model, calculated over 5-years without built-in perpetual growth, assumes a conservative discount rate of 10%, in line with Alliant’s high debt-levels and higher-cost cap structure. Additionally, I calculate revenue growth at ~6% and declining, much lower than the firm’s 2021-22 growth of 14.61%.

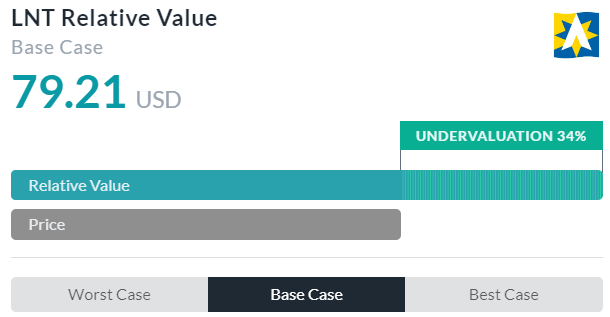

Alpha Spread

Alpha Spread’s multiples-based relative valuation tool supports my positive view of Alliant and its undervaluation, calculating a base case undervaluation of 34%, with fair price projected to be $79.21.

Therefore, taking an average of my DCF calculation and Alpha Spread’s estimates, the fair value of the company should be $69.74, meaning the stock is currently undervalued by 23.5%.

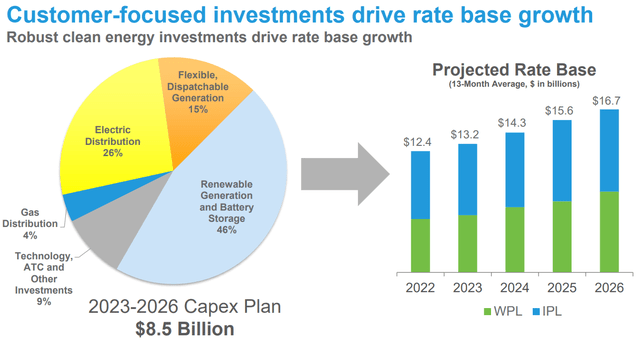

Scale-Driven Growth Supports Dual Consumer/Shareholder Orientation

Alliant, as previously discussed, takes a consumer oriented strategy, underpinning general scale growth. This consumer direction is at the core of Alliant’s capital investment strategy; among the $8.5bn Alliant has allocated towards capex in the coming three years, the company maintains a general focus on enhancing consumer services, supporting renewable energy- a proposition supported by consumers and enabling reduced opex- and electric generation and distribution flexibility. This is expected to drive rate base growth from $12.4bn today to $16.7bn in 2026.

Alliant Investor Materials – AGA 2023

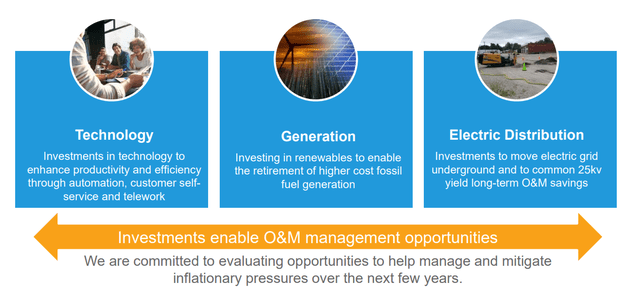

Adjacent to the direct benefits of consumer-orientation, Alliant presents a tripartite cost-savings investment initiative; superior technology products support enhanced productivity and consumer interaction, with renewables supporting increased efficiency, and innovative electric distribution yield long term savings and potential for new market verticals (i.e. smart grids).

Alliant Investor Materials – AGA 2023

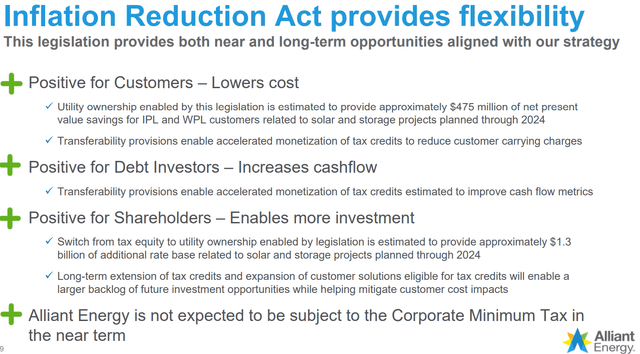

In investing in forward-looking technologies, Alliant seeks not only to become regulation proof, but actually leverage regulatory and government policy to support material organic growth and position itself to capture megatrend growth. Case in point, the Inflation Reduction Act supports Alliant’s consumer oriented affordability proposition, while reduced tax, greater capex support, and tax credits enable shareholders and bondholders.

Alliant Investor Materials – AGA 2023

Wall Street Consensus

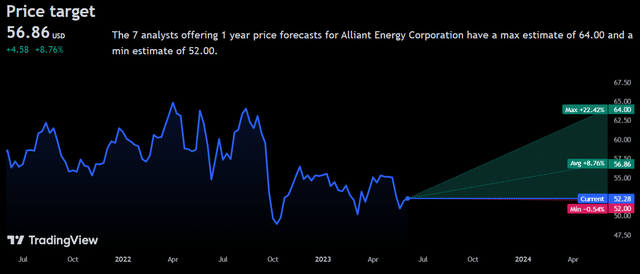

Analysts largely support my positive view on Alliant, estimating an average 1Y price increase of 8.76%, to a price of $56.86.

TradingView

Even at a minimum projected price decline of -0.54%, to a price of $52.00, investors will be net positive for the year, when incorporating dividend returns.

Such projections only enhance Alliant’s position as a stable, safe haven asset.

Risks & Challenges

Continued Interest Rate Increases May Increase Operating Expenses

Although Alliant’s higher debt levels are not out of the ordinary for utility providers, and the company has demonstrated its ability to leverage debt for growth, increased interest rates may reduce the company’s ability to execute on its capex plans and inhibit future rate base growth prospects, all the while dampening cash flow generation and profitability.

Regulatory Pressures May Reduce Profitability & Expansion Capabilities

The inherent nature of utility companies leads to greater municipal, state-level, and federal regulatory pressures, often oriented towards environmental sustainability and affordability. While Alliant remains a cost-oriented and ESG positive company, these pressures nonetheless may lead to reductions in the firm’s ability to operate flexibly and generate maximal profits.

Commodity Prices Guide Net Income Potential

As Alliant moves away from gas utility and coal-fired power plants, it becomes less dependent on volatile input prices. That said, with the company aiming for high-levels of capex and renewables- particularly solar panels- are priced with the inputs of rare-Earth minerals and metals and still impact Alliant’s bottom-line.

Conclusion

In the short term, I expect continued scale growth and stability for investors.

In the long term, I project that Alliant’s consumer orientation will support gradual cash flow positivity and enable the company to capture megatrend growth.

Read the full article here