Investment Thesis

I wanted to take a look at Disney’s (NYSE:DIS) current situation and why it has not gone anywhere for quite a while now and may continue its downward spiral further. The company’s financials have deteriorated dramatically over the last 5 years, which explains the drop in share price, and even according to my generous improvements in the assumptions on margins, the company is still too expensive.

Outlook

Disney+

While I was preparing my financial model, I noticed a lot of red flags. The company seems to have been going downhill for at least 5 years now. Disney+ has been bleeding money every year since it was launched, with a slight slowdown in the latest quarter, however, the margins are still negative in this segment, which is the company’s second-largest revenue generator under the DMED business segment (Disney Media and Entertainment Distribution). Streaming competition is a tough one these days, with so many different offerings. Companies like DIS need to spend a lot of money on original scripting, which eats away at all of the profits. It is hard to tell if it’ll ever be profitable for the company, but I would assume that Iger will take some steps to improve the company’s profitability and efficiency.

The last time I had a subscription was when I was watching the first seasons of Loki and the Mandalorian. I don’t even remember what year that was, but I am not missing it one bit. I’m not a fan of waiting around for a week to see another episode of the show I like. I might get the subscription someday, but to be honest there wasn’t anything worth watching recently. I don’t know how long they can milk the Marvel Universe. I haven’t seen anything new since the last Avengers movie, although I hear good things about Guardians 3. The same thing goes for the Star Wars franchise.

Restructuring and Cost-Cutting Measures

Looking at the financials of the company, which I will go into more in-depth below, the company under Chapek was not going anywhere fun, although even under Iger the company was experiencing a downtrend in margins, efficiency, and profitability, so it is not all his fault. However, now that Chapek is out, Iger comes to right the ship once again, by announcing $5B worth of cost-cutting measures and 7,000 job cuts to bring back Disney to its former glory. $3B will be cut from content.

Iger is already making moves in the DTC segment by taking an impairment charge of $1.5B to pull content from streaming. A lot more content will be cut in the near future, and who knows maybe that will translate to positive margins, but I won’t be holding my breath.

Politics- I’ll Avoid

One massive thing that may keep the share price depressed is the war between Iger and DeSantis of Florida. The company, according to many, is too woke these days and is alienating a large group of people, something like Bud Light (BUD) has done with its marketing, which made it lose a lot of sales. That’s all I’m going to say on this issue. I like to look at companies and their management’s efforts of increasing profitability in the long run, which will reward its shareholders. And so far, from what I’ve seen in the financials, the company’s share price deterioration can be explained without all the politics.

Financials

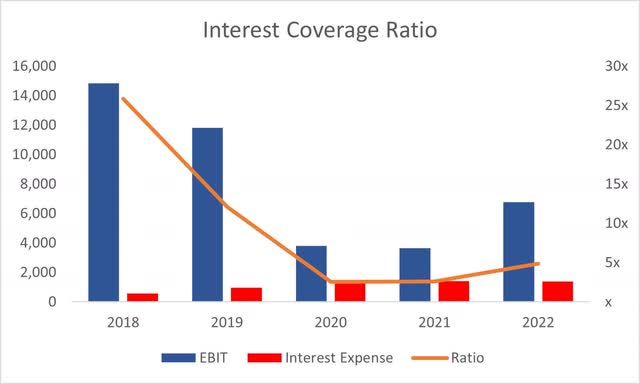

In the latest quarter, DIS had $10.4B in cash and $45B in long-term debt. This alone can deter a bunch of investors who particularly don’t like a company that has so much leverage, but that does not necessarily mean leverage is bad or unsustainable. The Interest coverage ratio of DIS at the end of FY22 has improved from the year before and is around 5x, meaning that EBIT can cover interest expense almost 5 times over, which is more than sustainable.

Coverage Ratio (Own Calculations)

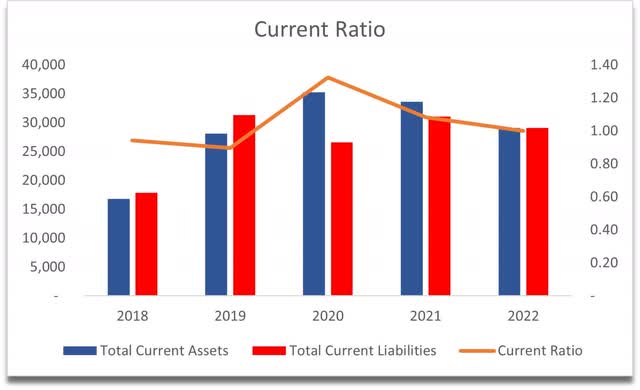

The current ratio of the company is sitting right at the minimum I’d like to see. It doesn’t look like the company would have any liquidity issues.

Current Ratio (Own Calculations)

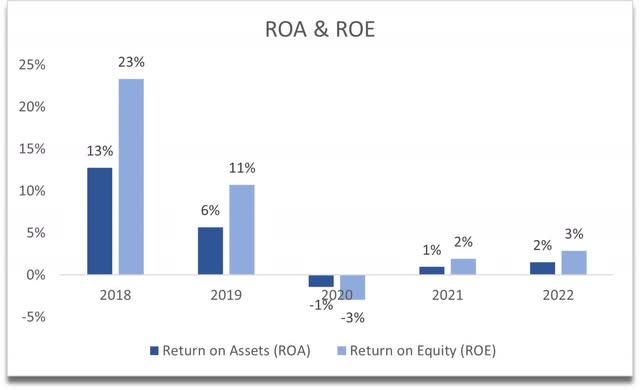

These next metrics are where the company shows that it has lost it completely in the last 5 years and why the company’s share price has not recovered anywhere close to where it was. ROE and ROA have been trending down ever since ’18 and are nowhere near recovering efficiency and profitability. The management proved that it was not able to utilize the company’s assets efficiently and did not create any value for its shareholders.

ROA and ROE (Own Calculations)

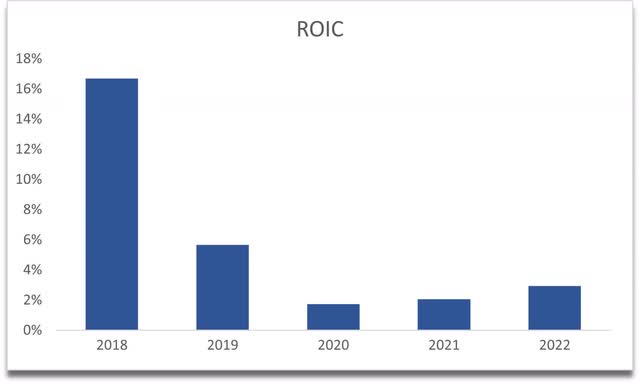

The same story is seen in return on invested capital. The company fell from grace right around the time it entered the streaming wars and has not seen any real progress ever since. It had a decent competitive advantage and a strong moat in ’18, then went and squandered it.

ROIC (Own Calculations)

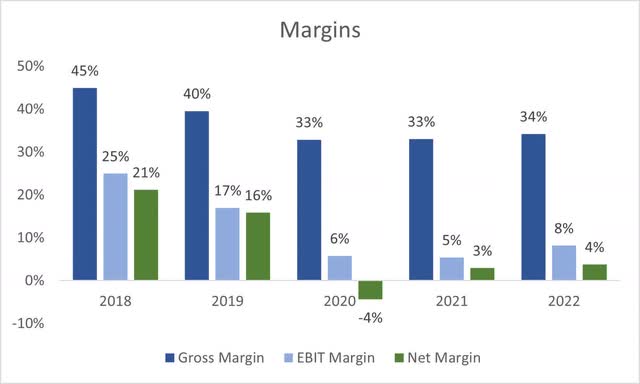

In terms of margins, it is no better. 2018 was the last year the company was attractive to invest in, but then it all went downhill and has not recovered very meaningfully yet.

Margins (Own Calculations)

Numbers don’t lie. The company was not managed very well, got involved in the streaming wars, and once the covid pandemic went away the stock price fell also just as people started to lose interest. Iger will have to work really hard to return to better numbers here. I’m not surprised the stock price went nowhere in the last 5 years. This was happening well before the whole supposed “woke” thing.

Valuation

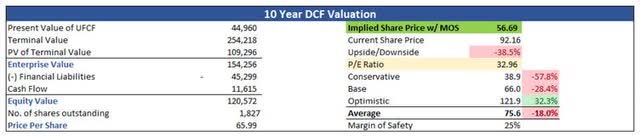

I’d like to look at some valuations that will consider Iger’s ability to right the ship, although, I’ll keep it conservative due to the negative sentiment for the company and because I like to be on the conservative side.

For the revenue growth, I went with a 5% CAGR over the next decade for the base case. For the optimistic case, I went with 9%, while for the conservative case, I went with 3.2%. All scenarios seem to be reasonable in my opinion.

On the margins side, I assumed Iger will be quite aggressive in cutting costs, and no doubt he will look at the numbers the company was putting up in ’18 when gross margins were at 45% and net margins at around 21%. I would if I were in his place. What I decided to do for the base case here is improve gross and operating margins by 500bps, or 5%, and 400bps, respectively, over the next decade. So, by ’32 the company will achieve 40% gross and 14% net margins, which is still well under ’18’s margins because I want to keep it on the conservative side.

For the optimistic case, margins end up slightly better, and for the conservative case, slightly worse compared to the base case.

I will also add a 30% margin of safety to the calculations. I usually add a minimum of 25%, but the books of the company are not immaculate.

With that said, the company’s intrinsic value is $56.69, implying a 38.5% downside from the current valuation.

Intrinsic Value (Own Calculations)

Closing Comments

The management did not run the company very efficiently and saw its share price tumble in the last 5 years. I don’t think it was all because of their political stance. The numbers looked very bad and so the stock price went down. Simple. Can Iger right the ship? We’ll have to wait a little while longer to see his cost-cutting measures. I wouldn’t sell right now, but would add on further weakness, when, for example, the stock price reaches $80 as that seems to be a recent floor.

I’m sure Iger will introduce further efficiencies that will lead to the company being more profitable and creating shareholder value in the future, however, I wouldn’t jump in right now if I’m a new investor. Too much negative sentiment surrounding the company and overall macroeconomy can and will bring volatility.

Read the full article here