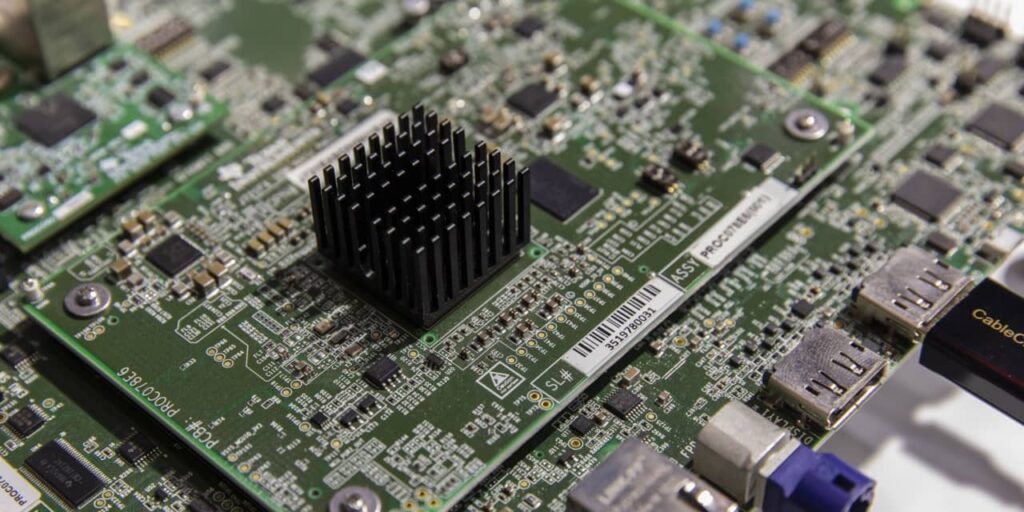

Texas Instruments

earnings topped estimates but its stock was dropping after the chip maker provided a revenue forecast for the December quarter below expectations.

For the September quarter, the semiconductor company reported earnings per share of $1.85, compared with Wall Street’s consensus estimate of $1.82, according to FactSet. Revenue came in at $4.53 billion, which was below analysts’ expectations of $4.6 billion.

Guidance was also weak. Texas Instruments (ticker: TXN) gave a revenue forecast range for the current quarter of $3.93 billion to $4.27 billion—which was below consensus of $4.5 billion.

“During the quarter, automotive growth continued and industrial weakness broadened,” CEO Haviv Ilan said.

Texas Instruments shares fell by 6% to $138.10 in premarket trading Wednesday, the morning after the report.

The chip maker sells the basic building-block chips that go into products in nearly every sector of the economy from autos and industrials to consumer electronics.

Texas Instruments stock is down 11% this year, compared with the 32% rise for the

iShares Semiconductor ETF

(SOXX). The ETF tracks the performance of the ICE Semiconductor Index.

Write to Tae Kim at [email protected]

Read the full article here