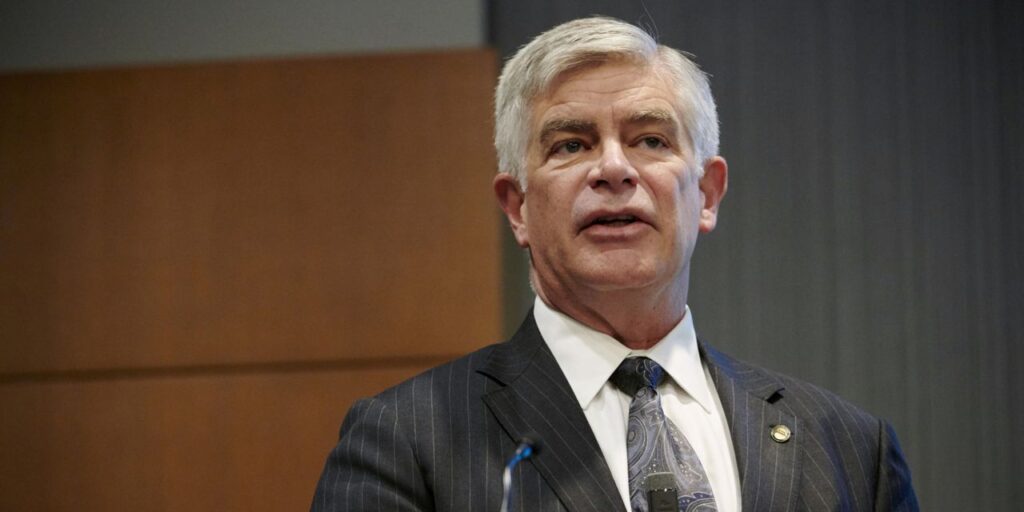

The Federal Reserve should take a break from raising interest rates, after moving them up at each of the last ten meetings, said Philadelphia Fed President Patrick Harker on Wednesday.

“I am in the camp increasingly coming into this meeting thinking that we really should skip, not pause, but skip an increase,” Harker said, during a discussion hosted by the OMFIF Economic and Monetary Policy Institute.

A pause would mean the Fed is going to hold its policy interest rate steady for a while. It is too soon to make that call, Harker said.

The Fed was getting close to the point where it could “sit for a little bit.” Harker said. But he added he didn’t know if we’re “exactly there yet.”

“I am not saying that we are not going to continue to tighten, but I think we can take a bit of a skip for a meeting,” he added.

Fed Gov. Philip Jefferson also appeared to suggest a pause is in order.

“A decision to hold our policy rate constant at a coming meeting should not be interpreted to mean that we have reached the peak rate for this cycle,” he said in a speech Wednesday.

“Indeed, skipping a rate hike at a coming meeting would allow the Committee to see more data before making decisions about the extent of additional policy firming,” Jefferson added.

Harker reiterated that the Fed is committed to bringing inflation down, but said he doesn’t think it needs to damage the economy in the process. It does not make sense to “slam on the brakes,” he said.

Harker said the May employment and consumer inflation reports, to be released before the June meeting, could change his mind.

The Fed will meet again on June 13-14. The Fed has pushed its key interest rate up to a range of 5%-5.25% at rapid pace since starting last March.

Harker said he is not forecasting a recession for the U.S. economy.

Inflation is moving in the right direction, but is “stubborn,” he said.

Fed officials are divided going into the June meeting. Some Fed officials have been advocating another rate hike in June, while others have endorsed a pause. Some others think the Fed has already tightened enough to bring inflation down.

Stocks

DJIA,

SPX,

were lower on Wednesday, while the yield on the 10-year Treasury note

TMUBMUSD10Y,

slipped to 3.65%.

Read the full article here