Shares of Hims & Hers (NYSE:HIMS) have lagged the market and are down following my initial write-up on the stock in April. At the time, I thought the stock looked cheap and that the company had a number of opportunities in front of it. However, I was also worried that the business model could come under scrutiny.

Company Profile

As a quick reminder, HIMS is a telemedicine platform focused of prescribing medication for Men’s health issues, such as erectile dysfunction, STDs, and PE. It’s also moved into Women’s health with prescribing pills for birth control, libido enhancers, and STDs, as well other areas such a dermatology and mental health.

Most of the company’s prescriptions are sold through subscriptions that are delivered by mail order pharmacies. The subscription can be every month or less frequent. The company does employ the doctors directly on its platform, but the medical groups that service the company were established for the sole purpose of providing services to HIMS.

Post Earnings Sell-Off

Despite reporting strong Q1 earnings and raising its full-year guidance, HIMS saw its stock retreat -11.5% the session following its report. The stock has steadily trended lower, and is now down over 20% since the report.

Despite the weakness in the stock, the quarterly results were actually quite impressive. One area in my initial write-up that I noted HIMS was doing a good job with was in acquiring new customers. That continued into Q1, with the company seeing its subscriber count grow 87% year over year to 1.209 million. On a sequential basis, subscribers grew over 16% from 1.040 million at the end of 2022.

The company launched an omnichannel marketing campaign with actress Kristen Bell during the quarter as well as started to lean more into brand campaigns, which helped subscription growth. Of course going hand in hand with subscriber growth is doing it cost effectively. On that front, the company did say that as it diversifies its marketing channels into brand advertising and adding ambassadors that the payback will be longer as these marketing investments are longer term in nature. However, it still expects its collective marketing efforts to lead a one-year payback period. It also noted that that thus far in 2023 it was seeing a favorable customer acquisition environment that it expects to continue throughout the year.

The investments in building its brand and brand aware make sense in the long term, even if the initial payback isn’t as good as some other channels such as performance marketing. There are a number of online pharmacies that sell the same or similar product as HIMS, so if the company can build its brand, it should be able to capture more business over time and not solely compete on price and performance ad placement.

With the company moving into other categories such as mental health and dermatology, brand awareness can become even more important, as HIMS will want to be perceived as a brand consumers can trust. It takes a while to build a brand, but once established brand equity becomes a powerful marketing tool itself.

Growing its Women’s Health business was another area I talked about in my initial write-up. Unfortunately, HIMS didn’t break down how that category was doing or really give much of commentary about it. I find that a bit disappointing and think more metrics on new categories could help the stock (if they are performing well). There is only some much market share in selling medicine for ED and hair loss, so growing these other categories is very important over the long term.

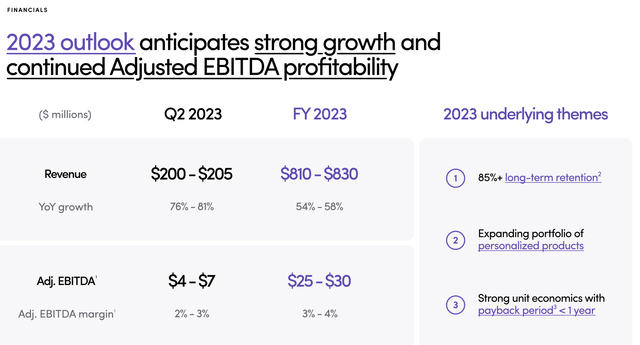

Overall, there didn’t seem to be much to complain about with HIMS quarterly results and guidance for the information if did provide. It beat on the top-line by $11.7 million, with revenue growth of 88% to $190.8 million. Meanwhile, it upped its full-year revenue guidance to $810-830 million from a prior outlook of $735-755 million. It took its full-year adjusted EBITDA guidance from $20-30 million to $25-30 million.

Company Presentation

Sometime next-quarter guidance can hurt a stock, but on that front HIMS forecast was strong as well. It guided for Q2 sales of between $200-205 million, which was easily ahead of the $183.3 million consensus. It’s also looking for positive EBITDA of $4-7 million.

It’s not often you see a company raise revenue guidance by ~10% and see the stock struggle. The lack of transparency with newer categories and the high-end of EBITDA guidance not being move up could be behind the weakness, but it doesn’t seem like a good explanation. There clearly remains some investor skepticism when it comes to the stock.

Valuation

HIMS currently trades around 60x the 2023 consensus EBITDA of $28.9 million and about 27x the FY2024 consensus of $64.4 million.

It trades at a forward PE of over 70x the 2023 consensus of 13 cents and nearly 34x the 2024 consensus of 27 cents.

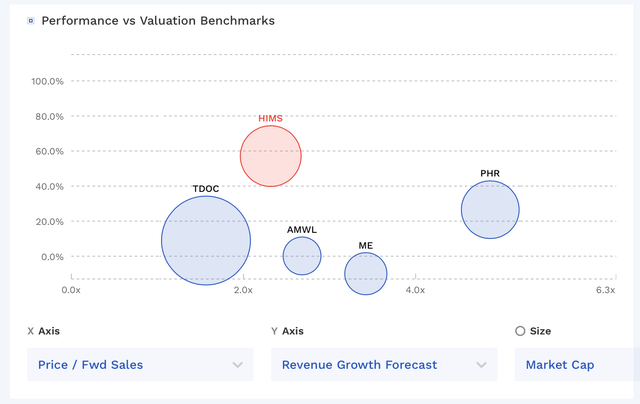

With mid-70s margins, HIMS can also be looked at on a P/S multiple. On that front, it trades a 2.3x and 2023 revenue estimates of $827.4 million and under 1.9x 2024 revenues of $1.033 billion.

Revenue growth is expected to be 57% this year, and then grow around 25% in 2024.

From a P/S ratio, the company trades towards the lower end of the pack versus its peer group, despite higher growth rate.

HIMS Valuation Vs Peers (FinBox)

Conclusion

When I stuck a neutral rating on HIMS stock, it was despite the fact I thought the company could continue to put up solid results in the near to medium term. Meanwhile, I thought the valuation looked attractive, and now it has only gotten more attractive following the stock pullback and raised guidance.

However, questions still persist about its business model and if it will be able to successfully move into other categories. More transparency into the growth of categories outside of Men’s Health could go a long way into making investors more comfortable with the name. I for one would like more insights into this area before becoming more constructive on the stock.

For now, I remain neutral on the name.

Read the full article here