Two years of living under high inflation has many Americans feeling stuck when it comes to making financial progress, according to a recent BMO Financial Group survey.

Overall, 46% of Americans said they have not made any financial advances since inflation hit a historical high two years ago, according to the survey. Of those not making progress, 36% said they had fallen behind on savings or goals and 66% had no written financial plan.

U.S. inflation increased to 3.7% in August and has moderated since hitting a 40-year high of 9.1% in June 2022. But Americans are still paying more for most things and are significantly impacted by soaring interest rates as the Federal Reserve battles to reduce inflation to its 2% target rate.

“U.S. consumer confidence fell more than expected in August amid still-elevated food and gas prices, softening labor market conditions and economic uncertainty,” Michael Gregory, the deputy chief economist and head of U.S. economics at BMO said. “Despite this and after several Fed rate hikes, the economy is still growing – 2 percent in the most recent quarter – and consumer price inflation has come down nicely from last summer’s 40-year high of 9.1 percent to just above 3 percent. Looking forward, the Federal Reserve has made it clear that a 2 percent inflation rate target is still the goal, but that we have a long way to go.”

If you are struggling amid high inflation, you could consider taking out a personal loan to help pay down debt at a lower interest rate, lowering your monthly expenses. Visit Credible to compare multiple lenders and choose the one with the best interest rate for you.

MANY STUDENT LOAN BORROWERS STILL CLUELESS ABOUT REPAYMENT OPTIONS: SURVEY

Americans worry about housing costs

With no relief in sight, 80% of Americans said that concerns over their deteriorating financial situation triggered anxiety, according to the survey. The top stressors keeping respondents up at night were:

- Fear of unknown expenses (83%)

- Family-related expenses (68%)

- Housing costs (67%)

- Medical expenses (62%)

- Credit card debt (51%)

Mortgage rates topped 7% in September as home prices regained momentum. The combination put housing affordability out of reach for many Americans, particularly first-time buyers.

Beyond housing costs, Americans also deal with record levels of personal debt. Credit card balances increased to $1.03 trillion in the second quarter of 2023, according to the latest report by the Federal Reserve Bank of New York. In addition, total household debt hit $17.06 trillion in the second quarter of 2023, up by $16 billion from the previous quarter.

This elevated cost environment is why 80% of respondents sought advice on how to grow and manage their money to achieve financial security, the survey said.

“Given the current economic climate, it’s clear people want to take action to become more financially secure – even going so far as to think about additional sources of income,” BMO Head of Consumer Strategy Paul Dilda said. “With increasing costs proving challenging for many, it’s important that Americans know there are free resources available to help make financial progress – even in uncertain periods – such as meeting with your banker to create a budget and help build a personalized plan to make the most of their money that also address the various sources of income a person may have.”

If high-interest debt is taking up a sizable amount of your budget, you could consider paying it down with a personal loan, which could reduce your monthly payments. Visit Credible to compare debt consolidation options to find the best personal loan rates for you based on your credit score and credit history.

GEN ZERS CREDIT CARD BALANCES GROW THE FASTEST: TRANSUNION

Higher costs push some to drop car insurance

Another area of household spending that has felt the sting of inflation is the cost of car ownership. Drivers are dealing with higher car prices, rising gas costs and record-high insurance.

Car insurance costs have soared faster than the inflation rate, surging by roughly 8% in 2022 and up another 5.9% in the first six months of 2023, according to a J.D. Power report.

Higher insurance costs have pushed some Americans to drop their policies. The report said that the number of American households with at least one vehicle who say they do not have auto insurance increased to 5.7% in the first half of 2023 from 5.3% in the second half of 2022.

“Drivers who remain insured should consider reviewing their uninsured/underinsured motorists coverage with an insurance professional,” J.D. Power said. “With more uninsured motorists on the road, ensuring proper coverage can offset some of the risks of being involved in a collision with someone who is not currently or adequately insured.”

If you are looking to save money on your car costs, you could consider changing your auto insurance provider to get a lower monthly rate. Visit Credible to shop around and find your personalized premium without affecting your credit score.

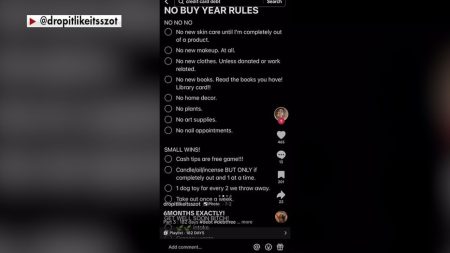

SHOPPING ON AN IMPULSE IS DERAILING AMERICAN BUDGETS – HERE’S HOW TO TAKE CONTROL

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at [email protected] and your question might be answered by Credible in our Money Expert column.

Read the full article here