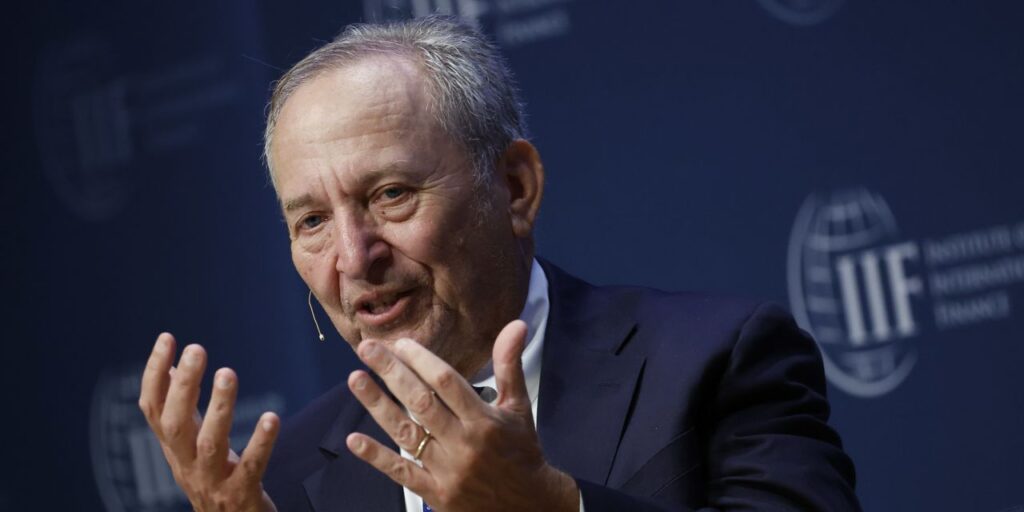

Former Treasury Secretary Larry Summers believes that the current federal budget deficit poses a greater challenge for the economy than it has before in U.S. history.

Summers said Tuesday during an event staged by the Center for American Progress, a Democratic Party-aligned think tank, that the U.S. budget deficit, which came in at $1.7 trillion in 2023, “is probably a more serious problem than it ever has before.”

Summers discussed the issue of IRS enforcement of tax laws, an issue that he said was of increasing importance when the fiscal deficit remains so high.

Read more: Here’s how House Republicans’ Israel-aid bill could add $30 billion to the deficit

The budget deficit is large not only in absolute terms, but also relative to the size of the U.S. economy. The 2023 shortfall came in at 5.3% of GDP, well above the average 3.8% seen over the past 40 years, according to data from the Office of Management and Budget.

Summers compared the current situation unfavorably to what former President Clinton dealt with in the early 1990s, when Summers served as Treasury Secretary and the administration pushed through a deal to trim the deficit with tax increases and spending cuts and during President Obama’s first term, when he attempted to reduce the deficit through a combination of tax increases and reforms to Social Security, Medicare and Medicaid.

“Seems to me that before we get to painful spending cuts, before we get to raise taxes on anybody under the law, we ought to be collecting the taxes that are owed,” Summers said. “I see a kind of overwhelming evidence that by strengthening the work the IRS does, we can raise more tax revenue.”

Summers supported the passage of the Inflation Reduction Act last year, which reduced the budget deficit and paid for new investments in clean energy in part with increases to the IRS enforcement budget.

The Inflation Reduction Act of 2022 provided $80 billion in new IRS funding over ten years, which the Congressional Budget Office estimated would increase revenues by roughly $200 billion over that same time.

Summers statements come in the wake of a House Republican proposal that called on cutting $14.3 billion in IRS funding and using that money to pay for military aid to Israel.

Marc Goldwein, senior policy director at the nonpartisan fiscal watchdog group Committee for a Responsible Federal Budget, said that the plan would add roughly $30 billion to federal deficit because the cuts to the IRS would impair its ability collect taxes.

Read the full article here