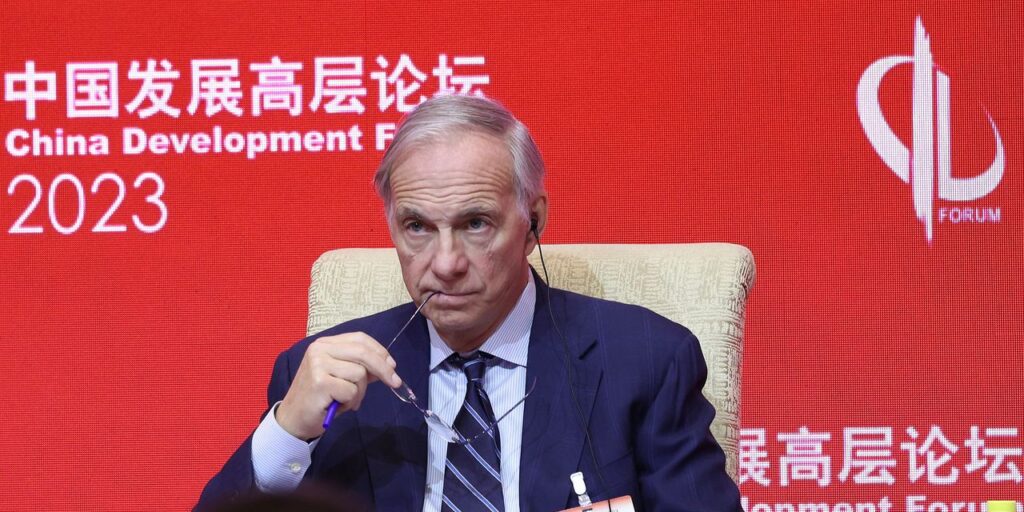

Hedge fund billionaire Ray Dalio says the West’s push to block China from accessing microchips is “very, very similar” to the policy the U.S. took towards Japan in the 1940s that is widely credited with escalating the Second World War.

Dalio, who started multi-billion dollar investment fund Bridgewater out of his Manhattan apartment in 1975, told the Money Maze podcast that the push to block China from importing the high-tech machines required to produce semiconductors mirror U.S. embargos on oil exports to Japan in the 1940s. The limits on Chinese exports have impacted companies including Nvidia

NVDA,

and ASML Holding

ASML,

The U.S. embargo on Japan, which was first brought into force on Aug. 1 1941, is widely understood to have heightened tensions between the two countries and acted as a prelude to the Japanese empire’s attack on Pearl Harbor in December that year.

Dalio argued the United States and Western powers are now seeking to contain China’s growth, in a similar manner to the way the U.S. sought to contain Japan, due to the growing threat the rising power poses to the dominant world order. Dalio argued the Western push to limit China’s access to semiconductor technology sits within the context of a wider fight for global hegemony. “The winner of a technology war is going to be the winner of this global world order war,” he said.

The hedge fund billionaire argued both sides are now preparing for war, as he pointed to internal strife in China and similar internal political conflict in the U.S. In making his point, Dalio pointed to China’s decision to remove defense minister Li Shangfu in October, following the removal of foreign minister Qin Gang in July.

Dalio suggested the internal political struggles in both countries are aimed at ensuring those in government fall in line in preparation for the outbreak of war.

“In periods of war, there is a great risk of internal conflict. So everybody’s got to line up, and it’s almost dictatorial. Even in the United States of World War II, you were not allowed to be anti-war,” Dalio said.

The investor, however, said that both the U.S. and China are currently fearful of war due to the extent to which their economies are intertwined. “If you cut this, it’s enormously impactful,” Dalio said. “22% of American manufactured goods imports come from China.”

Dalio noted he made his first trip to China in 1984 during an era of sweeping economic reforms introduced by Chairman Deng Xioaping, that saw China away from Maoism to become “much more capitalist.”

He explained that Deng held the view that: “It doesn’t matter if it’s a white cat or a black cat, just as long as it catches mice.”

Dalio has built connections with the country’s top politicians, including close ties with China’s former vice president Wang Qishan, according to the New York Times.

In interviews, Dalio has repeatedly described China’s leadership as “very capable,” in comments that have seen him labeled a “China booster.” This is despite Bridgewater’s own use of offshore financial instruments to bet against Chinese assets in a way the Chinese government is unable to track, the report said.

Read the full article here