A businessman is showered in money.

As a dividend growth investor, I own over 100 companies throughout just about every sector of the economy. One of my favorite sectors is REITs, which is evidenced by the fact that I own positions in 14 of them!

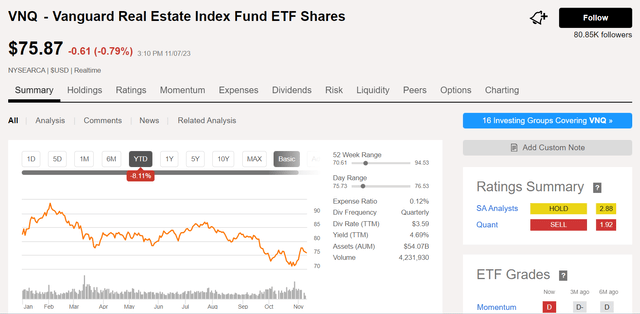

Seeking Alpha

We’re over a year and a half into interest rate hikes. Thus, it’s not a surprise that as measured by the Vanguard Real Estate ETF (VNQ), REITs are down 8% so far in 2023 and about 20% off their 52-week highs. This is because market sentiment toward REITs sours in periods of interest rate hikes as other investment vehicles are perceived to be more attractive options by conservative investors.

As beaten down as the stock prices of many REITs are, some have managed to thrive. Up 19% year-to-date, Iron Mountain (NYSE:IRM) stands out as one of my few big winner REITs in 2023. However, this rally seems to have swung shares from a discount to a premium.

For the first time since September, I will dig into Iron Mountain’s recent operating results and valuation to explain why I am maintaining my hold rating on the stock for now.

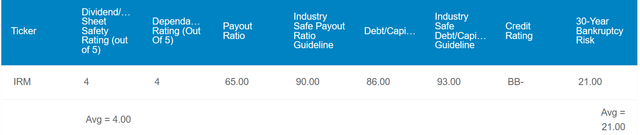

DK Zen Research Terminal

When stacked up against the current 4.6% yield of the 10-year U.S. treasury, Iron Mountain’s 4.3% dividend yield doesn’t really catch your attention. However, the dividend is well-covered for a REIT. The company’s 65% payout ratio is well below the 90% payout ratio that is considered safe for REITs in general. Considering Iron Mountain’s status of transforming into a data center REIT, this is also a payout ratio in line with what you like to see for that REIT sub-sector.

Shifting gears to the balance sheet, the company isn’t as financially sound as SWAN and ultra SWAN REITs. This is reflected by a debt-to-capital ratio of 0.86, which is just below the 0.93 that rating agencies like to see from REITs.

To be clear, Iron Mountain isn’t probably a REIT that highly conservative investors would want to own. After all, its debt is junk-rated at a BB- rating from S&P. But as I’ll elaborate on further, all indications point to a company heading in the right direction from a balance sheet perspective. That’s why Dividend Kings awards Iron Mountain a 4/5 dividend and balance sheet safety rating.

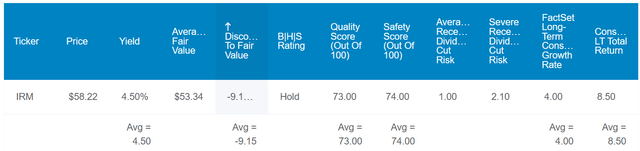

Fundamentally, I do like the REIT. However, the valuation just isn’t where I’d like to see it to justify a buy rating. For one, Iron Mountain’s $2.60 annualized dividend per share, a 10% discount rate, and my 5% annual dividend growth estimate suggest a fair value of $52 a share for the dividend discount model. This is a 14% premium to fair value relative to the current $59 share price (as of November 7, 2023).

Additionally, Dividend Kings’ fair value based on historical dividend yield and P/AFFO shows the stock to be worth $53 a share. If Iron Mountain were to grow as expected and revert to fair value, here is what total returns for the next 10 years could look like:

- 4.3% yield + 4% FactSet Research annual growth consensus – 1.2% annual valuation multiple contraction = 7.1% annual total return potential or a 99% cumulative total return versus the 10% annual total potential of the S&P 500 (SP500) or a cumulative 160% total return

A Solid Quarter For The REIT

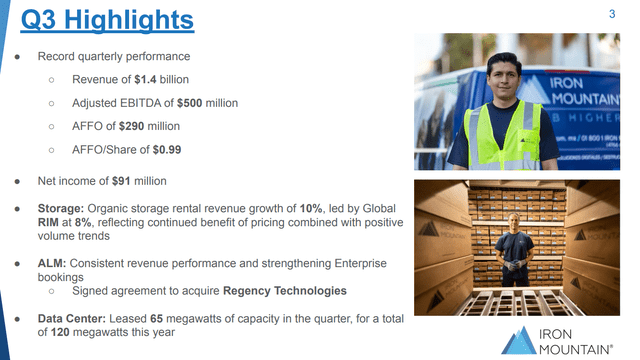

Iron Mountain Q3 2023 Earnings Presentation

Iron Mountain shared strong operating results for the third quarter ended September 30, 2023. The company logged $1.4 billion in revenue during the quarter, which was a new quarterly record and up 7.9% over the year-ago period.

This was largely driven by organic storage rental revenue growth of 10% in the third quarter. Aside from price hikes, CFO Barry Hytinen pointed to positive volume trends and data center commencements as responsible for this growth in his opening remarks during Iron Mountain’s Q3 2023 earnings call. That is how storage rental revenue surged higher by 13% year-over-year to $859 million for the quarter. Iron Mountain’s service revenue increased by 0.6% over the year-ago period to $530 million during the quarter.

The company’s AFFO per share edged 1% higher year-over-year to $0.99 in the third quarter. This is why Iron Mountain’s management team reiterated $3.955 ($3.91 to $4) in AFFO per share for 2023, which would be about 4% growth at its midpoint over 2022. As the company brings more data centers into service moving forward, this is also why FactSet Research believes such growth can continue.

The REIT’s quarter-end leverage ratio of 5.1 is at its lowest level in a decade, which suggests its financials are improving. The company also maintains nearly $2 billion in available liquidity. Best of all, only about $250 million in debt is coming due in 2024 and $920 million is coming due in 2025. The other $9.4 billion of Iron Mountain’s debt matures after that point, when interest rates should hopefully be lower than they are currently (unless otherwise linked, details sourced from Iron Mountain Q3 2023 earnings press release and Iron Mountain Q3 2023 Earnings Presentation and Iron Mountain 10-K filing).

Dividend Growth Has Returned

In August, Iron Mountain boosted its quarterly dividend per share by 5.1%. It also looks like the REIT can deliver similar dividend growth in the future.

This is because with midpoint AFFO per share set to be $3.955 in 2023 and the dividend per share obligation at $2.5055, the payout ratio will be just 63.4%. That is comfortably within Iron Mountain’s targeted payout ratio in the low- to mid-60% range.

Risks To Consider

Iron Mountain is proving itself to be a decent business. However, all businesses face risk. This REIT is certainly no exception to the rule.

I would reiterate my risks from my previous article about a temporary downturn in results from a recession and the potential for data center supply to exceed demand.

Also, Iron Mountain is a possibly lucrative target for hackers because of all the sensitive information regarding employees and customers. If the company were to be successfully hacked, its operations could be disrupted, and significant legal liabilities could also result. Were it to happen, that could be enough to shatter the investment thesis for Iron Mountain.

Summary: Iron Mountain Could Be A Good Buy At The Right Valuation

DK Zen Research Terminal

Iron Mountain is a business that some investors will certainly find to be worth owning. Though not amazing, the company’s growth prospects are respectable. The balance sheet is trending in the right direction as well.

But the current valuation doesn’t offer any margin of safety. Iron Mountain’s double-digit premium to fair value simply can’t be justified. Its annual total return potential is around 7% for the next 10 years, which is well below the 10% annual total return prospects for the S&P 500. Until a meaningful correction occurs, this is why I must maintain my buy rating on the stock for the time being.

Read the full article here