Confirming our expectation, MPLX (NYSE:MPLX) warmed the hearts and pocketbooks of investors with its 10% distribution increase. In past articles such as, A Warm November Rain (Increased Distributions) Awaits MPLX Investors, we outlined the level of excess cash flow and management’s position for its use. Past history loudly spoke about both timing and amount. From the article, “[i]n our view, the November report will include a permanent increase between $0.10 and $0.15 per quarter. Yes, the investment temperature is nice and warm.” The actual increase equals slightly less than the lower limit estimated at $0.075 per quarter, still MPLX delivered a warmth with comforting results instead of usual Cold November Rains. Would you step inside for a moment and experience the comforting open arms for a look at what else is coming? We believe you will find the welcome, inviting.

Reviewing the Last Four Quarters

But first let’s review the 3rd quarter followed by the last three. For the 3rd, MPLX reported again stellar results including:

- Distributable Cash Flow of $1.4B.

- Adj. Free Cash Flow of $1B.

- Distribution Coverage of 1.6.

- Leverage Ratio at 3.4.

On a year over year basis, Logistics and Storage grew 10% while Gathering and Processing remained flat. This trend with gathering seems consistent with other transportation companies.

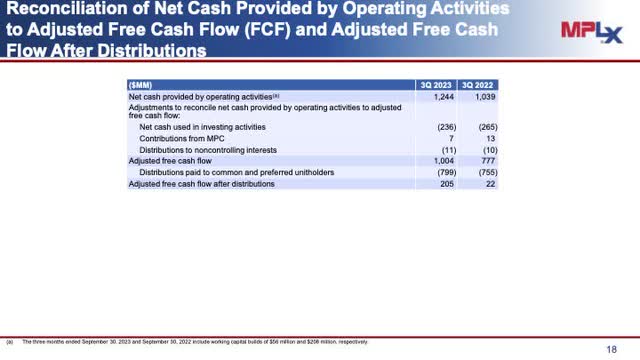

A slide provided in the quarterly presentation helps investors follow cash flows, for us, the most important result.

First, included is the 2023 3rd quarter’s cash balance.

MPLX 3rd Quarter

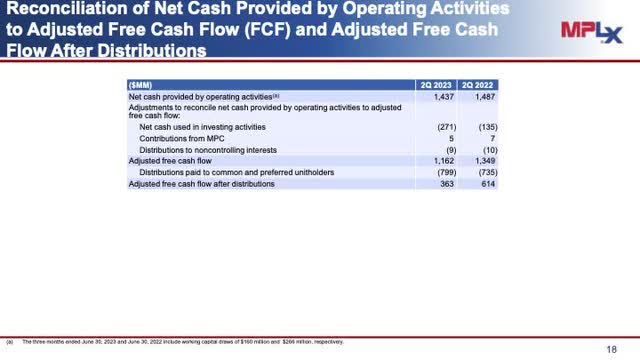

Next, the 2023 2nd quarter’s cash results follows.

MPLX 2nd Quarter

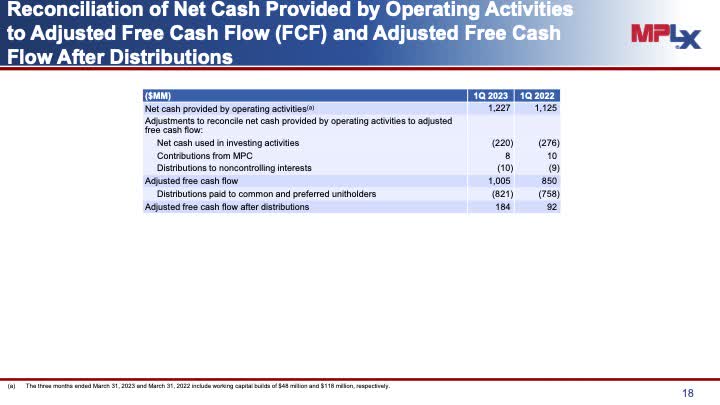

Continuing, we include the cash balance for the 1st quarter 2023.

MPLX 1st Quarter

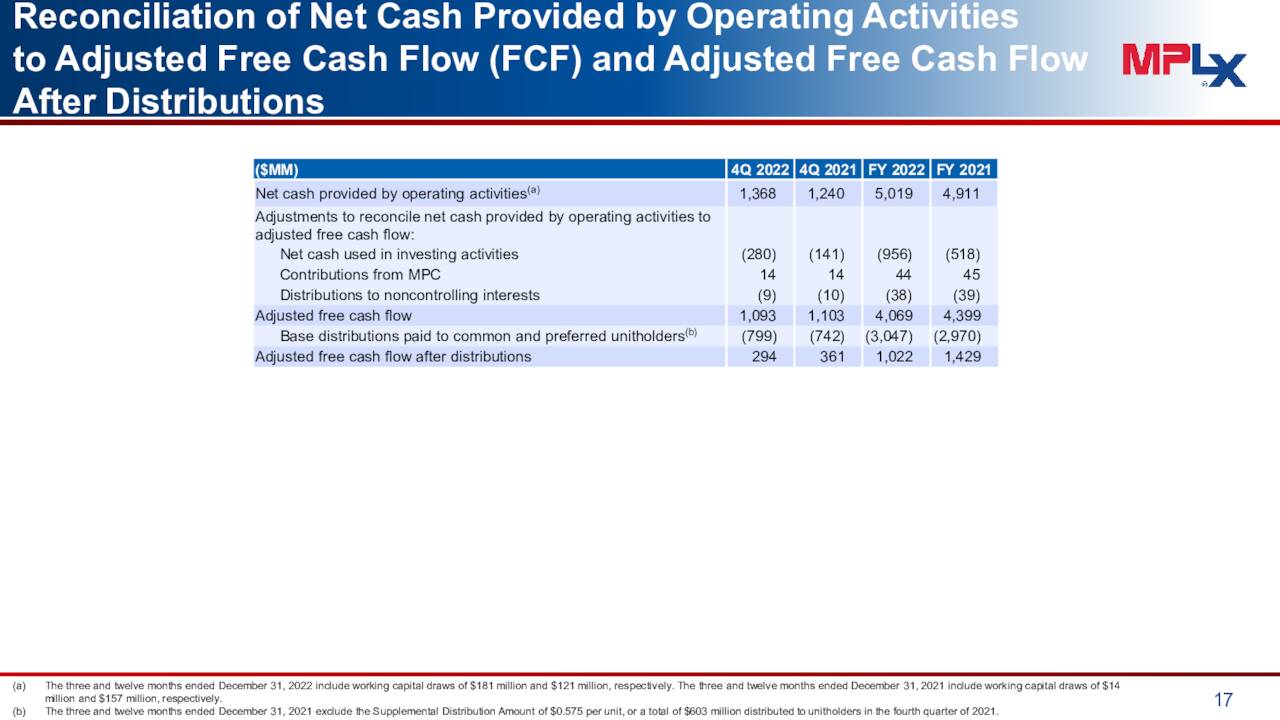

And finally, we add the 4th quarter cash balance for 2022.

MPLX 4th Quarter

Taken from the slides, a summary of the excess cash balance is displayed in the next table.

| MPLX | 3rd 23 | 2nd 23 | 1st 23 | 4th 22 | Total |

| Cash *(Millions) | $205 | $365 | $185 | $295 | $1050 |

* Rounded to the nearest $5 million.

The distribution increase announced with the company’s billion units, consumes approximately 30% of the excess cash leaving a significant level available for future increases without significant growth in the future.

Future Growth

Even though growth might not be essential, management expects it.

“We remain confident in our ability to grow the partnership and our focus on executing the strategic priorities of strict capital discipline, fostering a low-cost culture and optimizing our asset portfolio, all of which are foundational to the continued growth of MPLX’s cash flows.”

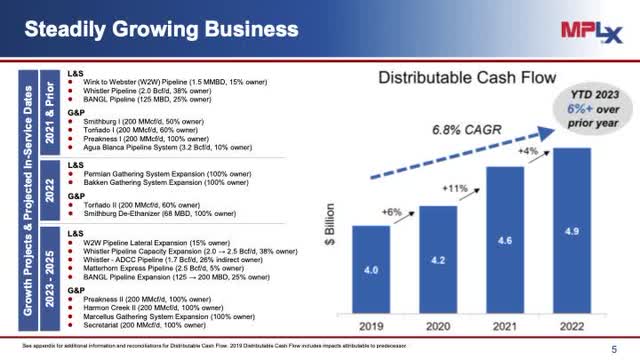

Management included an interesting slide in the 3rd quarter presentation laying out the history of growth and the respective projects driving it.

MPLX Investment Summary

The critical parameter found in the slide is the average growth rate at 6%, which strangely includes, in general, the awful year of 2020.

Beginning with capital, MPLX spent or will spend $800 million for growth in 2023.

Projects highlighted for the L&S segment includes:

- “[J]oint venture natural gas, crude and NGL pipeline projects in the Permian. . ..”

- Whistler’s expansion completed in the 3rd quarter with strong demand.

- Construction of Agua Dulce Corpus Christi lateral. Startup of this pipeline is expected next year, 3rd quarter.

- Wink to Webster crude pipeline ramping during the next two years.

-

BANGL pipeline expansion. “[E]xpected to be completed in the first half of 2025.”

Projects highlighted for the G&S segment includes:

- Preakness II coming on-line in early 2024.

- Secretariat, a seventh gas processing plant, coming on-line in the last half of 2025.

- Harmon Creek II gas processing plant coming on-line in the first half of 2024.

Actual increases in returns aren’t fully known, but it is clear management expects growth. At another 6%, if that occurs, the growth will equate to significantly higher surpluses.

Distribution Position

With respect to management’s distribution position, the following statement makes it clear,

“We’re committed to returning capital to unitholders and expect our distribution to be the primary return of capital tool supplemented with opportunistic repurchases . . ..”

It is important for investors to remember that each ten cents per year consumes $100 million.

Risks

Now for the risky subject, risks. Obviously, there are some, but we must start with what isn’t since this subject always appears in comments. From management’s prepared remarks,

“Our position on MPLX and its structure is unchanged. MPLX is a strategic investment for MPC, which now expects to receive $2.2 billion in annual cash flows via the distribution. MPC believes that its current capital allocation priorities are optimal for its shareholders and MPC does not plan to roll up MPLX.”

It couldn’t be made clearer.

Usage risks always exist with all companies during periods of weaker economies. MPLX isn’t immune totally, but it is a transportation company with fixed rates not generally subject to marketplace price highs and lows. Lower volumes may occur, but these tend to be subdue. It likely generates sufficiently high levels of cash to pay bills and investors. We strongly believe future increases in distributions are in the works, likely similar to this last one. The yield with prices in the $36 region equals 9.5%, higher than others we follow, i.e. Plains All American Pipeline (PAA). We rate MPLX a buy in the $36 range, a strong buy under $35. For investors seeking lower price entry points, most often prices drop lower in the period following the distribution payday. Warm and open arms appear ready for those interested in coming inside.

Read the full article here