Co-authored by Treading Softly.

I’ve always enjoyed a good underdog story. Someone coming out of nowhere, with everything set against them, to eventually win and see success. Most underdog stories are very similar. One that I find to be very unique is the whole concept behind the idea of the movie, and also the book, Moneyball. The story behind Moneyball is simple. A man is set to manage a baseball team with a very restricted budget and has to figure out how to make a winning team without going through the usual path of finding an all-star or getting the best and biggest name players. He simply looks to build a team that can score for the requisite number of runs to be able to win a majority of games. Instead of looking for the flashiest (and most expensive) players, he looks to assemble a team of consistent and reliable players.

When it comes to the market, many people love to have their portfolio so laser-focused on a few all-stars that the market has fallen in love with thinking that these All-Stars will be able to carry their portfolio to the halls of success no matter what. Yet, for most of us, our portfolio doesn’t have enough money in it to make that a successful means of winning.

I focus on a portfolio that meets a goal of a different kind. I want my portfolio to earn a solid income for me. I need a portfolio of various holdings that get base hits, and doesn’t necessarily always have to be hitting Grand Slams every time. That steady, trickle of dividends into my account that grows with time and becomes a massive overflowing river and then a deluge of income pouring into my portfolio and into my account every single month and quarter is what I’m looking for. I’m willing to make up a team that connects for those base hits and doubles.

Today, I want to look at two players on my portfolio’s roster who consistently provide me with great income and do their job but are often overlooked by the market.

Let’s dive in!

Pick #1: CSWC – Yield 10.6%

Capital Southwest (CSWC) is a BDC (business development company) that lends to the “lower middle market” – small businesses that can’t access the public markets, but still have strong enough financials to justify using leverage for their business. BDCs have benefited greatly from high interest rates due to a business model of borrowing at fixed rates, and lending at floating rates. CSWC has provided yet another dividend raise, from $0.56 to $0.57/quarter, plus it is continuing to pay out a $0.06 supplemental dividend.

NAV continues to increase, up to $16.46 from $16.38, primarily thanks to CSWC’s net investment income exceeding the dividend. Even with consistent dividend growth, CSWC’s earnings keep exceeding the dividend!

CSWC has taken advantage of favorable macro conditions to grow the company quickly. With shares trading at a premium to NAV, CSWC has been able to issue new shares at a premium and make new investments with returns that “pay” the dividend for the new shares and have excess earnings to raise the dividend for everyone. This is a fantastic circle of virtue that Main Street Capital (MAIN) has been able to maintain for over a decade. In CSWC’s case, it also benefits from economies of scale. As it gets larger, expenses become a smaller portion of its portfolio.

CSWC is firing on all cylinders, and shareholders are being rewarded with consistently growing dividends!

Pick #2: EPR – Yield 7.2%

EPR Properties (EPR) reported a solid quarter in line with management’s guidance. Regal Cinemas has exited bankruptcy and is paying rent under the new agreement. EPR has already sold one of the 11 Regal theaters that it intends to sell, and we expect we’ll see more be sold over the next 2-3 quarters.

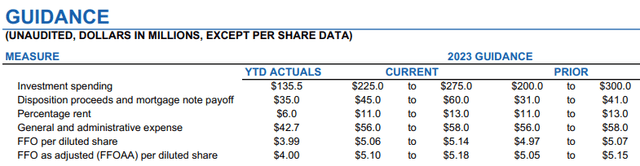

EPR raised guidance, with FFOAA (FFO as adjusted) now expected to come in at $5.10-$5.18. Source.

EPR Q3 Supplemental

However, when looking forward, we need to keep in mind that EPR had a particularly strong Q3 collecting deferred rent. During COVID, EPR deferred a lot of rent, and the tenants are currently paying current plus back rent. In Q3, a tenant was acquired, and as part of that acquisition, EPR received $11.6 million representing the remaining back rent. That is about $0.15/share benefit to FFO that is not recurring. So when FFOAA goes from $1.28 in Q2 to $1.47 in Q3, it looks like extremely strong growth. Backing out the one-time payment for consistency, FFOAA would have been $1.32. To have 3% growth in a single quarter is still very good.

Perhaps the most important line in the earnings release is this one:

“The Company will continue to be more selective in making investments, utilizing cash on hand, excess cash flow and borrowings under our line of credit, until such time as the Company’s cost of capital returns to acceptable levels.”

Like every other company, EPR is facing an environment where interest rates are high, and borrowing money is not particularly attractive. At the same time, share prices are low, so issuing equity is not very attractive either. We are pleased that EPR is not going to try to force growth for the sake of growth.

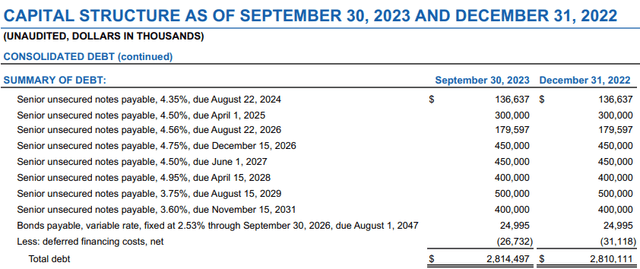

EPR has $173 million in cash on hand, and nothing borrowed on its $1 billion revolver. EPR’s balance sheet is strong, relying on fixed-rate debt and only one maturity in 2024 for $136.6 million. That’s an amount small enough to consider paying off entirely or in part, if refinancing cannot be achieved at attractive terms.

EPR Q3 Supplemental

Even in a “higher for longer” scenario, EPR only has $300 million maturing in 2025, representing only about 10% of its total debt. The current environment is preventing EPR from growing fast by issuing new equity and debt to go on a shopping spree, but EPR is growing at a steady pace and has ample cash flow after its dividend to continue investing.

Given that EPR is relying on cash flow to fund acquisitions, we expect that the dividend is not going to be raised in Q4. While they have the cash flow to support a raise in more normal times, we should prepare for EPR to also forgo a dividend raise next year as that would be a reasonable option to retain cash for investment. Instead, we can expect EPR to continue laying a path for the future, rebuild the portfolio, and grow FFO. Then when conditions for raising capital improve, it will be able to hike the dividend considerably and hit the ground running.

Conclusion

With CSWC and EPR, we have the advantage of two management teams not looking for fame or fortune but running their companies in an exemplary fashion regardless of what attention they’re given. Both of these companies are able to provide us with strong income because they are managing their portfolios or their companies’ operations exceptionally well. Neither one is likely to be a household name if you walk up and ask somebody who they were – they’re not going to be known as well as something like The Coca-Cola Company (KO) or Amazon (AMZN). Yet, unlike those other companies, these two companies are excellent players to have on the roster of your portfolio. They know what their job is, they do their job well, and they can richly reward you because of that.

We want a retirement that enriches us, helps us satisfy our goals, and lets us enjoy our interests and hobbies and spend time with the ones that we love or do what we love. We don’t need to take risks to find the next superstar, we need consistent and reliable income to replace our paycheck. I don’t need to worry about whether the stock I’m buying is going to become popular, or become a meme. I don’t need to rely on someone in the future being willing to pay me more money than a stock is worth. My return is going to come from dividends streaming into my account on a regular basis.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Read the full article here