It is often challenging for companies that operate in highly competitive industries to generate attractive long-term returns for shareholders. However, there are exceptions to this rule for particularly well-run companies. Perhaps the best example of this is Southwest Airlines (LUV) which operates in the highly competitive airline industry. While LUV’s recent performance has not been great, it is the only major U.S. airline that has not gone through bankruptcy. LUV has generated strong returns for early investors. Another example is Nucor (NUE), a company that operates in the ultra-competitive steel industry yet has been able to reward long-term holders with very compelling returns.

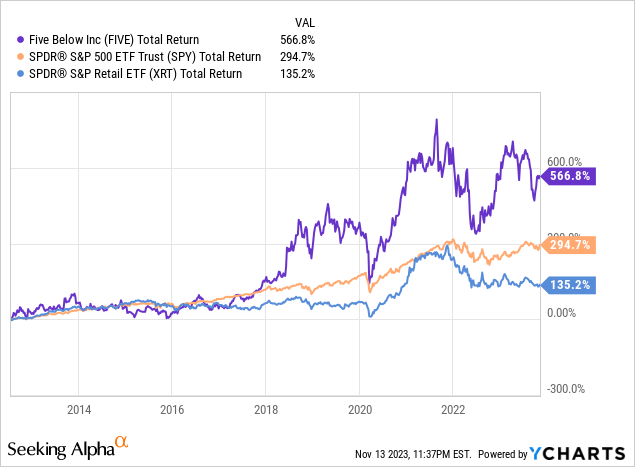

While less competitive than the airline business or steel business, the discount retail industry is highly competitive. Despite operating in this highly competitive industry, Five Below, Inc. (NASDAQ:FIVE) has generated a total return of 567% since going public in July 2012 compared to a 295% return for the S&P 500 and 135% return for the SPDR S&P Retail ETF (XRT) during the same period.

I believe the competitive dynamics of the industry and high valuation will make it hard for FIVE to continue outperforming the S&P 500 going forward.

Company Overview

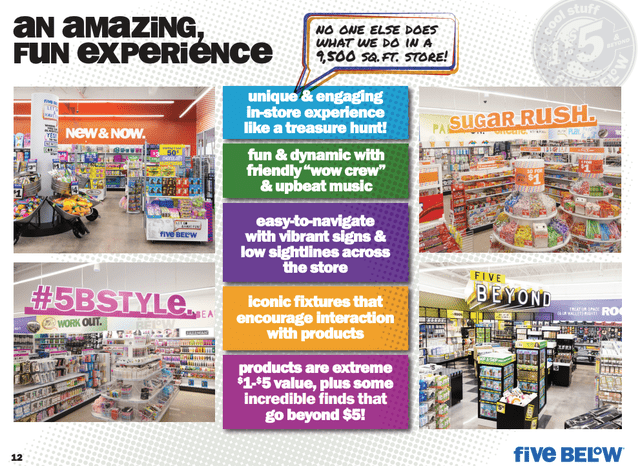

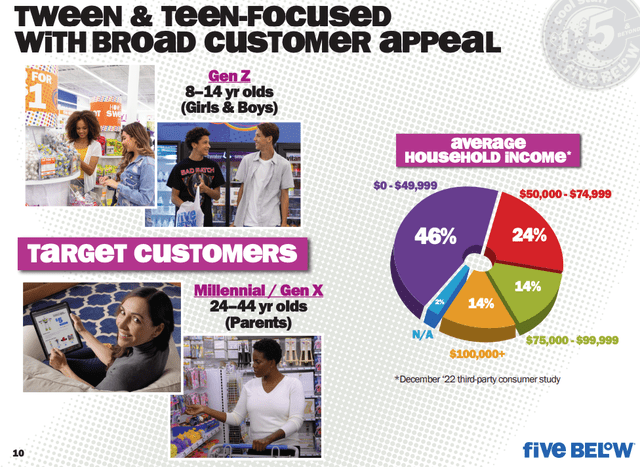

FIVE is a leading discount retailer offering trend-right, high-quality products to tweens, teens, and other consumers. The company offers customers a “let go & have fun” shopping experience filled with an assortment of products which are mostly priced at $5 and below.

The company currently operates ~1,400 stores across 43 states as well as an e-commerce website fivebelow.com. FIVE targets store sizes of ~9,500 square feet. FIVE is focused on the discount segment of the retail market with 46% of its customers having an average income of $0-$49,999.

FIVE Investor Presentation

FIVE Investor Presentation

Highly Competitive Industry Resulting in a Thin Moat

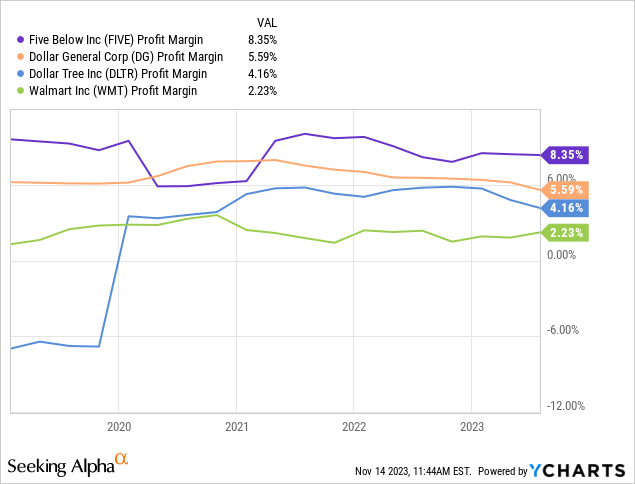

The discount retail business is highly competitive. Some of FIVE’s direct competitors include dollar store operations such as Dollar General (DG), Dollar Tree (DLTR), 99 Cents Only Stores, and other smaller operators. The company also competes with value retailers such as Walmart (WMT), grocers such as Kroger (KR), and convenience stores such as CVS (CVS) and Walgreens Boots Alliance (WBA). Additionally, FIVE competes with online retailers such as Amazon (AMZN), Temu, and Shein.

Given the pricing sensitivity of consumers with low household incomes, price is a very important competitive factor for discount retailers. Customers tend to have low levels of loyalty to any specific retailer and will often shop where they find the best value.

The high degree of competition and limited product differentiation has generally resulted in low-profit margins for discount retailers. As shown by the chart below, discount players tend to have profit margins in the mid-single digits. FIVE stands out as a best-in-class operator with margins which have historically been in the high single digits.

Strong Historical Performance and Strong Balance Sheet

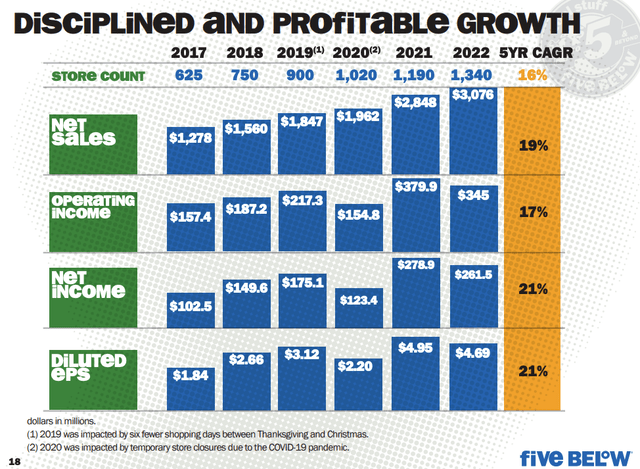

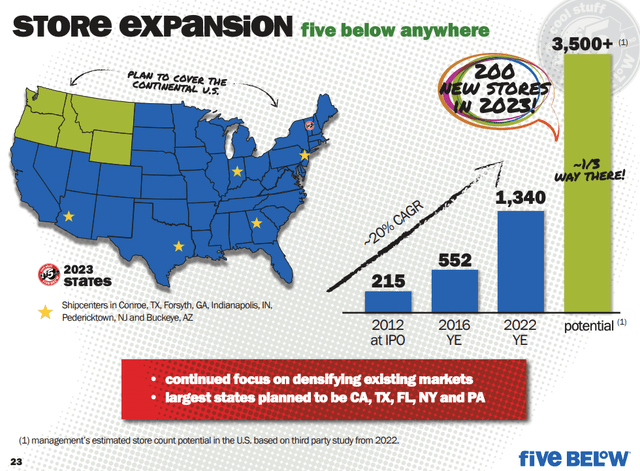

FIVE has posted very strong financial performance since going public. FIVE has grown EPS at 21% CAGR over the past 5 years and revenue at a 19% CAGR over the past 5 years. The growth in sales and earnings has been driven by new store openings as the company has grown its store count at a 20% CAGR since going public in 2012.

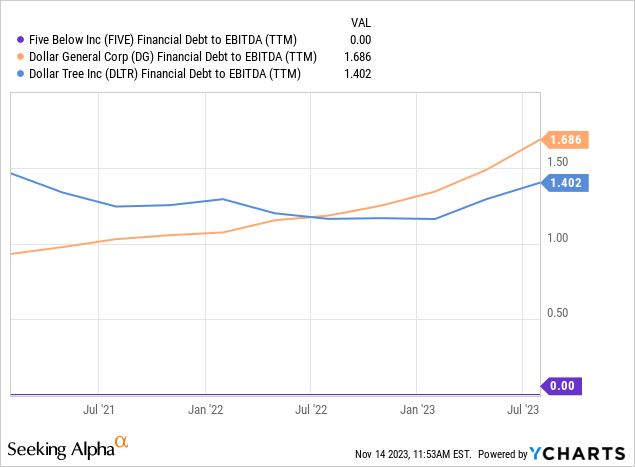

In addition to having a very strong operating track record, FIVE has maintained a very strong balance sheet with no long-term debt. Comparably, Dollar General and Dollar Tree are operating with significantly more debt.

FIVE’s strong balance sheet is an important positive as the company is not significantly exposed to potential increases in interest costs due to rising rates.

FIVE Investor Presentation

Growth Potential

FIVE believes it can grow its store count to 3,500 by 2030. This would imply a 7-year store count CAGR of ~14%. This compares to a historical CAGR of closer to 20%. While 14% store growth is a lofty goal, it should be noted that FIVE currently has significantly less market penetration compared to other more mature discount players such as Dollar General and Dollar Tree which have ~19,500 and ~16,000 stores, respectively. That said, FIVE is somewhat more of a niche given that the company is focused on a fun shopping experience and not just offering goods at the lowest possible price.

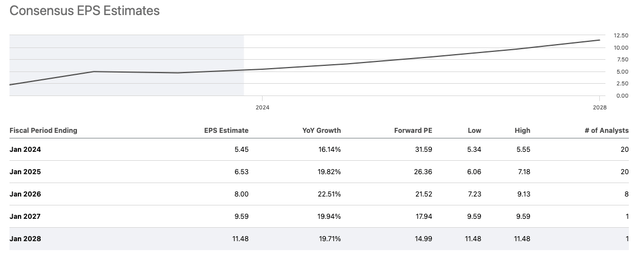

Current consensus estimates call for FIVE to grow EPS by ~20% each year for the next four years. I view this estimate as overly aggressive given the company has grown EPS at a CAGR of 21% over the past 5 years. FIVE is now more mature and I believe it will be somewhat harder to grow going forward than has been the case historically.

FIVE Investor Presentation

Seeking Alpha

Relative Valuation Analysis

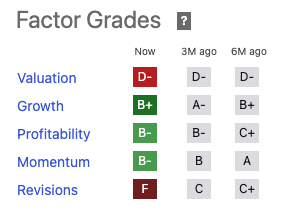

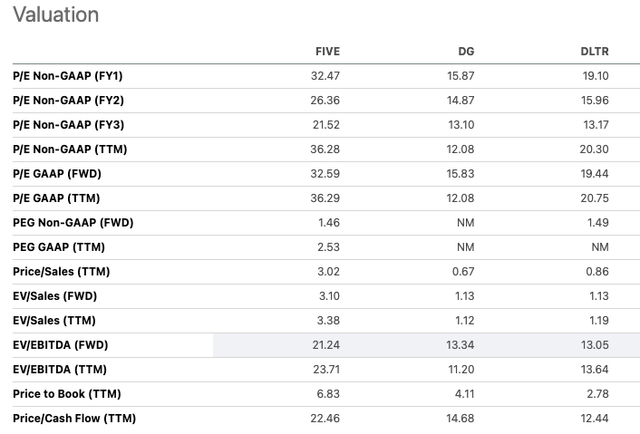

As shown by the table below, FIVE receives a D- valuation grade from Seeking Alpha quant rating. I am included to agree.

FIVE trades at 26x forward earnings compared to ~18x for the S&P 500. On a PEG basis, using a 12% earnings growth, the S&P 500 trades at a PEG of 1.5x. FIVE trades at a PEG of 1.3x assuming a 20% earnings growth rate. While FIVE appears cheaper based on the PEG ratio, I would note that the 20% growth rate for FIVE is fairly aggressive and I believe there is a significant risk that the company will grow at a somewhat lower rate going forward. Moreover, I see longer-term risk to FIVE’s earnings potential given the highly intense degree of competition it faces in the discount retail industry.

FIVE is trading a significant premium to its closest discount retail peers, Dollar General and Dollar Tree. However, it should be noted that FIVE has more growth potential and is expected to grow earnings more rapidly than Dollar General or Dollar Tree. Dollar General is expected to grow earnings at ~6.3% for FY 2024 and 13.5% for FY 2025. Dollar Tree is expected to grow earnings at 17.8% for FY 2024 and 21.1% for FY 2025. Thus, in my view, FIVE is trading at a reasonable valuation relative to its peers.

Seeking Alpha

Seeking Alpha

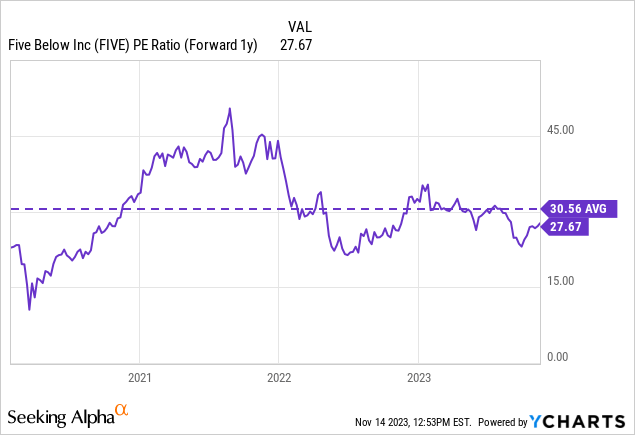

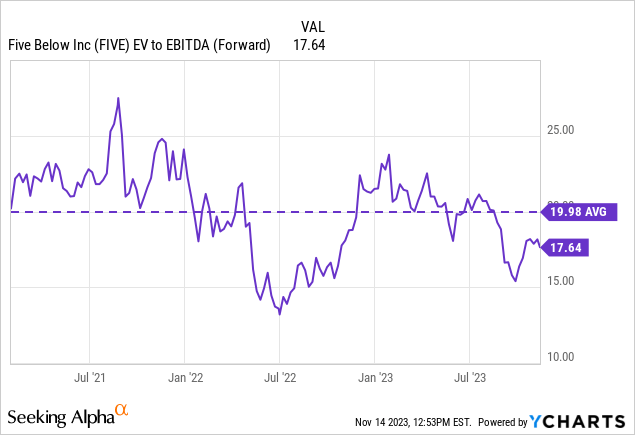

Historical Valuation Analysis

FIVE is trading close to its historical valuation averages on both a forward P/E basis and a forward EV/ EBITDA basis. This suggests to me that FIVE is neither significantly over nor undervalued at the moment.

Q3 2023 Earnings Preview

FIVE is expected to report Q3 2023 earnings on December 1, 2023. Consensus analyst estimates call for FIVE to report EPS of $0.23 per share which represents a ~25% decline on a year-over-year basis. The company is expected to report revenue of $727.6 million which represents a ~13% increase on a year-over-year basis. During its Q2 2023 earnings release, FIVE cut its Q3 2023 earnings outlook due to a 150bps operating margin hit related to increased shrink levels. Given current valuations, I believe the upside and downside heading into the report is largely symmetrical.

Conclusion

FIVE has delivered impressive results for shareholders and has significantly outperformed the S&P 500 and retail sector since its IPO in 2012. The company has been able to grow its earnings at a very impressive CAGR of 21% over the past 5 years and consensus estimates expect that level of growth to continue going forward. The company’s financial performance is especially impressive given the competitive nature of the discount retail business.

I believe high levels of competition make it challenging to build a wide moat business in the discount retail industry over the long term. Currently, FIVE trades at average levels relative to its historical valuation range and at a premium valuation relative to the S&P 500 as well as larger more mature peers such as Dollar General and Dollar Tree. However, FIVE has above-market growth prospects over the near term. For these reasons, I rate FIVE a hold at current levels and will continue to evaluate the investment opportunity in the future. I would consider upgrading the stock if the valuation picture were to improve.

Read the full article here