Ever since CEO of Palantir Technologies Inc. (NYSE:PLTR) made comments about the prospects for artificial intelligence-driven growth for the core software offers, investors have showered the company with praise and Palantir’s stock price has since risen from about $8 in May to about $20 today.

Though I am willing to acknowledge that Palantir Technologies has made some progress in terms of posting GAAP profits, positive investor sentiment seems to be off the charts right now.

Exaggerated optimism about AI adoption and the potential for AI-related sales growth have led to Palantir Technologies’ stock multiple to expand to 21x, which looks neither sensible nor sustainable.

Since Palantir’s GAAP profits relative to its accumulated deficit show a gap of monumental proportions, I think the AI bubble will soon be pricked.

My Rating History

Truth be told, I have been skeptical of Palantir Technologies ever since the stock made its public debut.

Palantir Technologies has racked up an obscene amount of losses since it was started more than two decades ago, a fact that too many investors are willing to overlook now that the company is reporting GAAP profits.

Slowing sales growth has been a concern for many investors and the valuation multiple is now so detached from fundamentals again, that a Sell rating is the only rating that makes sense, in my view.

My prior Sell call from February was, with the benefit of hindsight, wrong as the stock has soared from $8 to $21. With that being said, I think that the market continues to overvalue Palantir Technologies’ sales potential.

I cited a deteriorating sales position for Palantir Technologies (lower expected sales growth) specifically as a headwind for the stock. Investors should remember that not long ago, Palantir guided for 30% annual sales growth.

Despite the company posting GAAP profits, these profits are a nothing more than a drop in the bucket relative to Palantir Technologies’ accumulated losses. My key argument here is that investors overreact to PLTR’s reported GAAP profits.

Put GAAP Profits In Relation To Accumulated Losses

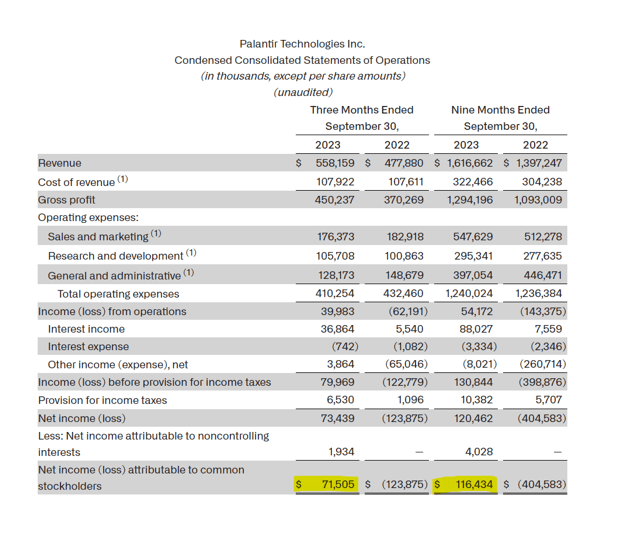

Palantir Technologies celebrated itself for producing a ‘fourth consecutive quarter of GAAP profitability’ in the third quarter which yielded a GAAP profit of $72 million. The first GAAP profit showed up on Palantir Technologies’ profit statement in the fourth quarter of 2022 when the company revealed positive $31 million net income.

Since Palantir Technologies has been celebrated for its third quarter earnings performance, it is important, in my view, to connect the 3Q-23 GAAP profit to the amount of accumulated losses PLTR also reported.

Net Income Losses (Palantir Technologies)

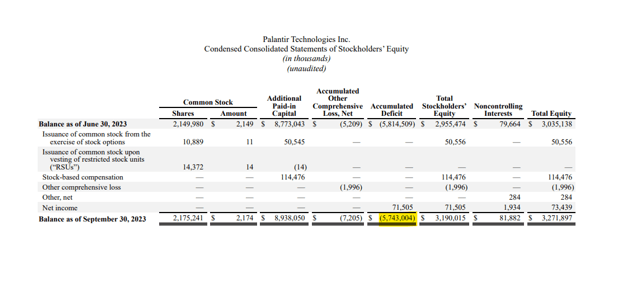

While the $72 million in 3Q GAAP profits looks like a big win (on first glance), it is rather a drop in the bucket considering that the company, at the beginning of 3Q-23, had an accumulated deficit of $5.81 billion.

Counting the $72 million in profits against the accumulated deficit leaves us with a 3Q ending accumulated deficit balance of $5.74 billion.

In a nutshell, Palantir Technologies had a total net profit in 3Q equal to just 1.2% of its total historical losses which, in my view, is not something that investors should bring the champagne bottles out for.

Accumulated Deficit (Palantir Technologies)

Palantir Technologies would have to see much higher GAAP profits in order to justify its valuation, in my view, and the valuation multiple presently seems to be detached from the underlying fundamentals. It would take years of improving GAAP profitability for Palantir Technologies to grow into its present valuation, but if the commercial business, for instance, keeps performing well, a case could be made for a richer sales multiple.

Moving forward, Palantir Technologies clearly has an opportunity to grow its AI-related services which could be instrumental in boosting the company’s operating income margins as well as GAAP profits.

The scaling of Palantir AI could be a source of incremental growth, in both the commercial and government realm, but it is difficult to quantify. With that being said, though, Palantir Technologies won’t be the only company that offers AI-related services, so I am still skeptical about the ‘uniqueness’ aspect for Palantir Technologies’ AI offer.

Palantir Technologies also will still have to show that it can successfully translate demand for AI into stronger sales growth since Palantir’s total sales growth is slowing down. So far, this is not yet the case, really.

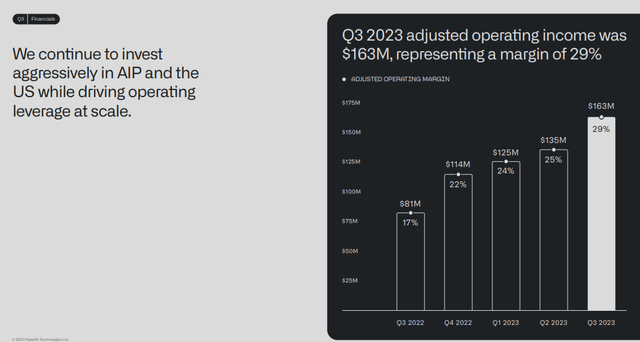

Adjusted Operating Income (Palantir Technologies)

Palantir Technologies’ sales rose 17% YoY in the third quarter to $558 million, but U.S. commercial sales were up 33%. Government sales were up 12% YoY, so the non-government business is growing much faster right now. Total commercial sales were up 23% YoY in 3Q-23 compared to 16% YoY in the first three quarters of 2023, so Palantir Technologies is seeing some momentum here. While the 17% may sound good, it doesn’t justify the high sales multiple and it is way below the initially stated 30% annual sales growth prediction.

The commercial segment continues to outperform government which is good for Palantir Technologies as it reduces the company’s reliance on government clients which in the past have been crucial in driving Palantir Technologies’ sales growth.

With that being said, though, I don’t think this invalidates my core criticism about Palantir Technologies which is that the rate of sales growth doesn’t justify the company’s excessively high sales multiple.

Moving forward, Palantir Technologies clearly has an opportunity to add to its commercial client roster. The company’s customers grew 34% YoY in 3Q-23 and more companies are signing on for partnerships for Palantir Technologies’ Artificial Intelligence Platform. The combination of AI and commercial customers could potentially be beneficial for Palantir Technologies, but the potential nonetheless appears to be presently over-hyped.

I do expect this momentum in the commercial segment to continue. The commercial segment appears set to not only drive Palantir Technologies’ sales growth, but to also account for a higher sales share in the future.

Commercial sales accounted for 44% of all sales in the first nine months of the year and this percentage may very well rise above 50% moving forward.

I don’t see Palantir Technologies, however, to return to its earlier stated goal of achieving 30% annual sales growth as competition for AI services is only going to increase and the company’s sales growth overall has slowed quite drastically. Thus, I expect Palantir Technologies to keep growing its sales well below 30% in the near future.

AI Adoption, Sales Outlook And Palantir’s Unsustainable Valuation Multiple

Alexander Karp said a few months back that the company was going in big on AI. He said in Palantir Technologies’ latest shareholder letter that demand for its AI products was growing.

With that being said, this demand is not really translating into tangible sales growth (at least not so far), suggesting that investors that are bidding up Palantir’s stock price primarily on hopes. And this is where I think investors are going to get a brutal reality check moving forward.

Let’s just look at the company’s sales guidance for 2023 to see what I mean.

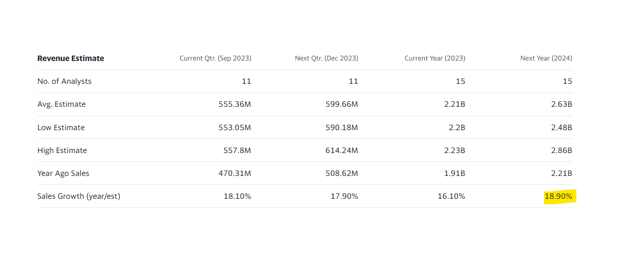

Investors have clearly bought into the hype about AI products as can be seen in the huge inflation in PLTR’s stock multiple, but Palantir Technologies’ outlook for 2023 only calls for $2.216 – $2.220 billion in sales this year.

The guidance was raised QoQ from $2.212 billion in 2Q-23, but the revised guidance implies a rather paltry YoY growth rate of only 16%. Not exactly what I would expect from a company that is active in the booming market for alternative intelligence.

Nvidia Corporation (NVDA), for instance, is expected to see 104% sales growth this year and 51% next year, and those are growth rates that would be deserving of a high sales multiple.

Now, 16% is not nothing and the market presently models 19% sales growth next year, but it is hardly a rate that I would want to describe as impressive, and most certainly Palantir’s sales growth isn’t skyrocketing to the extent that one would expect when reading about growing AI adoption.

Palantir Technologies’ stock valuation, I would submit, is fully and utterly unsustainable again and investors are way, way too celebratory about the company’s 3Q GAAP profit. This year, the market models $2.21 billion in sales which translates into a 19.4x sales multiple (based on this year’s sales) which is not only excessive, but not sustainable, in my view.

If I was really generous, I could agree on paying 5x 2023E sales (4x 2024E sales) for Palantir Technologies’ growth potential, particularly as it relates to the AI realm, but this would be conditional upon the company scaling aggressively, improving profitability and, preferably, cutting back on its share-based compensation scheme (which is another issue in and of itself).

With a 4x 2024E sales multiple, Palantir would have a market value of $11 billion which would be equal to a stock value of $5. I previously considered a 2-3x 2024E sales reasonable, but in acknowledgement of commercial growth and potential with AIP, I think a higher sales multiple might be justified than the one I laid out the last time.

Revenue Estimate (Yahoo Finance)

Why Palantir Technologies Might See A Higher Valuation Multiple

If Palantir Technologies were, against my expectations and judgment, to see a translation of its AI adoption into actual sales growth, there is a not insignificant chance that investors will continue to inflate the company’s stock multiple. Irrationality can clearly persist for very long periods of time, and so can exuberance.

Should Palantir Technologies manage to grow and scale its AI products to such an extent that its sales growth rate accelerates, then PLTR might deserve a rich valuation.

Since the stock multiple is already more than rich right now, I tend to think Palantir Technologies’ valuation is in bubble territory and the stock has a deeply, deeply unattractive risk/reward.

My Conclusion

Investors often fall into the same trap: They wholeheartedly jump on press releases, containing acronyms like ‘AI’, ‘AI demand’ or ‘AI adoption’ which causes them to fail to evaluate the underlying performance of the business that purports to deliver such benefits to its customers.

Palantir Technologies may be GAAP profitable now, but Palantir’s business has put investors back a cumulative $5.74 billion since its inception which in and of itself is a cause for concern.

Furthermore, Palantir Technologies’ sales growth and extraordinary AI potential that so many analysts seem to see, is not really reflected in the company’s sales outlook for 2023 nor in the market estimates for next year (19% growth).

Paying 19.4x sales for a software business with a TTM GAAP profit of $147 million and a $5.74 billion accumulated deficit seems more than just excessive and I think investors are set for a painful reality check in the near future.

Read the full article here