Manhattan, the heart of New York City, is a focal point of global real estate interest, and its dynamic market reflects various economic, social, and geopolitical factors. Given its relative importance, here are five critical areas or factors poised to influence the Manhattan real estate market in the upcoming months. Through a combination of data-driven insights and market trends, this piece attempts to provide some indications of the potential directions the Manhattan market might take in the months ahead.

No. 1: Interest and Mortgage Rates

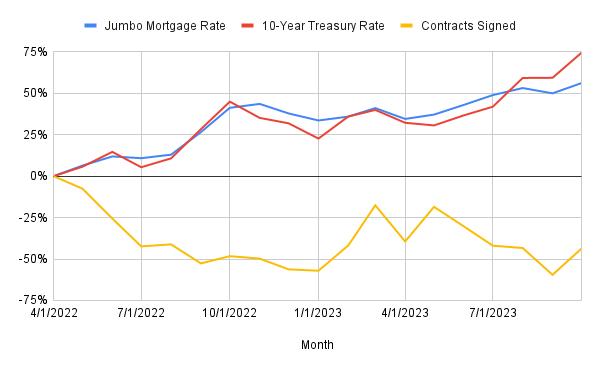

With the interplay between the Federal Reserve’s target rate, the 10-year Treasury yield, and mortgage rates, significant shifts in these rates can impact the Manhattan real estate market. Notice the sizable positive move in rates compared with the downward move in contracts signed. While the correlation between mortgage rates and demand is negligible, the historically significant rate movement has certainly forced buyers to reexamine affordability questions.

What we’re watching: If the Fed Funds futures, as they stand today, are correct, and the Fed starts to cut rates in May or June next year, we may start to see a decrease in mortgage rates. Such a scenario can potentially boost demand, especially in a market that is not oversupplied, as present expectations about future costs become more manageable.

No. 2: The Strength of the General Economy

The S&P 500, often seen as a barometer for the general economy, provides insights into the health and direction of the broader market. If interest rates stabilize or decline, the stock market might experience another leg up, potentially driving more demand in the real estate market. A buoyant stock market often signals increased consumer confidence, which usually translates to more activity in the real estate sector. Despite rising rates and recessionary threats, the S&P 500 has shown remarkable adaptability since January 2022, suggesting a resilience that underscores the US economy.

What we’re watching: If the economy manages to avoid a much-predicted recession and consumers remain strong, the wealth effect may come back into play and drive Manhattan sales once again, especially in the luxury sector.

No. 3: The 2024 Presidential Election

Historical data reveals a noticeable trend in the Manhattan real estate market around election periods. There’s a tendency for both supply and demand to dip. While this may be due to uncertainties associated with elections, it is likely more of a seasonal effect as the Manhattan market usually begins slowing down for the holidays around the same time. Either way, buyers and sellers tend to adopt a cautious approach to the market, leading to reduced activity. Post-election clarity sets in around the same time as the busy spring season begins. Manhattan usually sees a burst of activity in March/April, which is more likely due to seasonal patterns versus waning uncertainties.

What we’re watching: If the 2024 election becomes another diametric choice on policy, buyers may pause to wait it out, forcing must-sellers to cut prices to drive demand.

No. 4: Geopolitical Uncertainties

Global events, especially in regions like the Middle East and Ukraine, can cast ripples across global markets, including real estate. While the direct correlations can be intricate, such geopolitical tensions sometimes lead investors to seek safety.

What we’re watching: If events begin to cast a more global shadow, we could see increased demand for safer, US-dollar-denominated assets, which could translate into a bid for Manhattan condos from foreign investors.

No. 5: Return-to-Office Dynamics

The evolving landscape of work, especially the hybrid model, has brought about significant changes in Manhattan. According to a white paper by foot traffic analytics firm Placer.ai, the percentage of Manhattan workers back in the office recovered to more than 80% of its January 2020 level in June. Although this number has seemingly stalled at these levels, it does suggest that the previous work-from-home mentality in 2021 and early 2022 did not significantly deter transactions and that further gains could help revive the economic health of local businesses, building a foundation for buyer demand.

What we’re watching: If Manhattan workers continue their return to the office, Manhattan’s real estate could see increased demand from current commuters or those looking to remain in vibrant, urban neighborhoods.

Looking Ahead at 2024

As the last few weeks of the fall season fade away, the Manhattan real estate market stands at a crossroads, with various macro and micro factors vying for influence. From interest rates and economic indicators to global events and local work patterns, the market’s trajectory is shaped by many elements. While challenges persist, we are watching the resilience and dynamism of Manhattan real estate, which remains one of its defining features.

Read the full article here