Buying growth stocks can be profitable over the long run, but one should also focus on the starting valuation, as getting in at a good price can give the investors a great head start. Such may be the case with Air Products and Chemicals, Inc. (NYSE:APD), which at the current price of $263, trades close to its 52-week low of $251 and sits 17.7% below where it was just 12 months ago.

I last covered APD here back in April, highlighting its recent growth trends and opportunities in the hydrogen space. The stock has fallen by 8.3% since my last piece, due perhaps to higher interest rates and the recently leaked report on capped US tax credits for hydrogen production. In this article, I provide an update and discuss why growth and value investors alike may find APD appealing at present, so let’s get started!

APD Stock (Seeking Alpha)

Why APD?

Air Products & Chemicals is a leading industrial gas company that’s been around for 80+ years, serving the refining, chemicals, metals, electronics, manufacturing, and food sectors. Its focus on hydrogen has put it at the forefront of companies in the transition to low and zero-carbon energy in the heavy-duty and industrial sectors. APD also participates in the supply of liquefied natural gas process technology and equipment, as well as membrane systems and cryogenic containers globally.

As one can imagine, to become a leader in APD’s space requires plenty of capital and scale, which forms a moat against new entrants. This has enabled APD to establish strong profitability compared to peers in the Materials segment. This is reflected by APD’s A- grade for its EBITDA margin of 32%, sitting ahead of the 17% sector median, and A- grade for return on equity of 17%, sitting ahead of the 8% sector median.

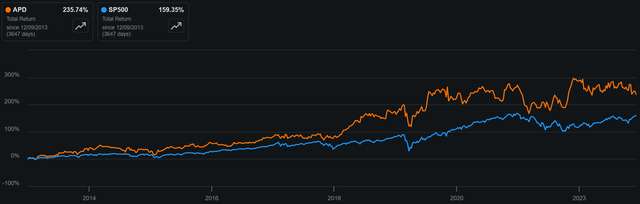

Higher margins combined with consistent growth in the industry have resulted in strong total returns for APD over the long run. As shown below, ADP has produced a 236% total return over the past 10 years, far surpassing the 159% total return for the S&P 500 (SPY).

APD vs. SPY Total Returns (Seeking Alpha)

Meanwhile, APD has continued to demonstrate respectable growth since my last piece, with adjusted EPS and EBITDA being up by 11% and 10% YoY, respectively during APD’s fiscal fourth quarter (ended September 30th). This was consistent with APD’s full fiscal year 2023 results with adjusted EPS and EBITDA being up by 12% and 11%, respectively. This was supported by higher volumes over the past 12 months on long-term take or pay contracts despite economic uncertainty across regions.

Encouragingly, APD is seeing increased profitability as its adjusted EBITDA margin grew by 390 basis points for the full year to 37.3%, driven in part by 740 bps adjusted EBITDA margin growth during fiscal Q4 to 39.5%. This was supported by pricing actions in the merchant business. Higher margins are important during an inflationary environment, as APD passes through higher expenses to its customers through price increases, while continuing to build upon its industry positioning in blue and green hydrogen.

This is supported by a number of hydrogen megaprojects in APD’s $19 billion pipeline, setting up APD for management’s guidance of multi-year double-digit annual EPS growth, which has been the goal for the company since 2014. Notable projects include the world’s largest green hydrogen-based ammonia production facility with JV Partners, ACWA Power, and NEOM, as well as the announcement to build, own, and operate a carbon capture and carbon dioxide treatment facility to produce blue hydrogen to serve Exxon Mobil Corporation’s (XOM) Rotterdam refinery in the Netherlands.

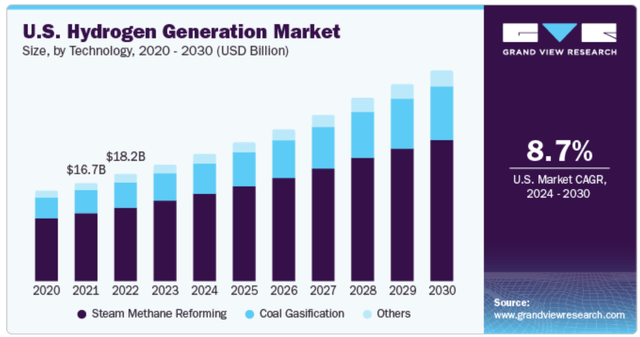

The hydrogen market is expected to grow in the high single digits between now and the end of the decade in the U.S. alone, as shown below, as this alternative fuel is expected to make its way to different parts of the economy including transportation.

Grandview Research

Beyond hydrogen, APD also has promising growth avenues in other alternative fuels including nitrogen. This is reflected by APD’s leadership position in purification membranes, as there are now 2,000 seagoing vessels worldwide utilizing membrane-based nitrogen generation systems from APD.

Risks to APD include the potential for a slowdown in the global economy due to high interest rates and inflation, which may lessen demand for energy products including hydrogen. In addition, there is currently a debate on how much tax credits hydrogen producers may get, as it depends on the emissions generated in making hydrogen.

The leaked draft of the U.S. Treasury Department shows that requirements sought by some environmentalists would limit the tax credit to $3 per kilogram based on no emissions in producing hydrogen with a phase-out based on emissions levels. To get the full $3/kg credit, companies would have to rely only on wind, solar, or other clean energy projects built within the past 3 years. While APD’s hydrogen projects are expected to be profitable with or without tax credits, it remains to be seen what the full impact of a final ruling will be for the hydrogen industry as a whole.

Meanwhile, APD’s dividend has stood the test of time, as it has raised its dividend for the 41st consecutive year. At present, APD yields 2.7% and the dividend is well-covered by a 60% payout ratio. It also comes with a 5-year dividend CAGR of 10%, which closely tracks EPS growth in recent years.

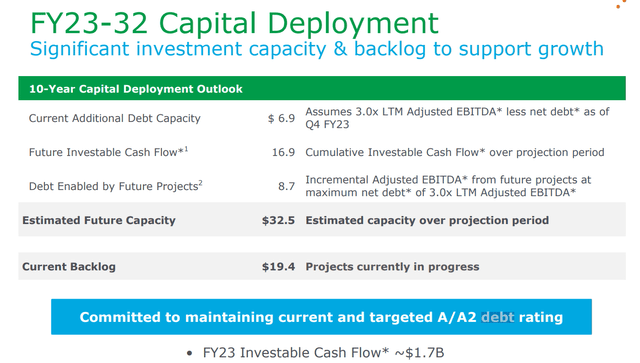

APD also carries a strong A credit rating from S&P and is reasonably levered at a net debt to EBITDA ratio of 3.0x, considering the infrastructure nature of its asset base and growth pipeline. Management estimates $32.5 billion in funding capacity from different sources to fund its $19.4 billion backlog, as shown below.

APD Funding Sources (Investor Presentation)

Lastly, I see value at the current price of $263 after the recent drop in price from the near-$300 level in early November. While APD is not necessarily cheap at a forward P/E of 20.3, sitting close to its normal PE of 19.8, I believe the valuation is justified considering its solid underlying execution and prospects for growth in the burgeoning alternative energy industry. Moreover, sell-side analysts who follow the company estimate 10% to 21% annual EPS growth between 2024 and 2027. Considering the catalysts in place, I believe APD is a current ‘Buy’ at this price.

Investor Takeaway

In summary, APD remains a strong player in the industrial gas industry with consistent growth and high margins. Its leadership position in blue and green hydrogen, as well as other alternative energy markets, provides promising opportunities for future expansion in its top and bottom lines. Despite potential risks related to economic slowdown and tax credit regulations, APD’s solid financials, dividend history, and infrastructure capabilities make it a worthy investment for long-term growth. As such, growth investors seeking to buy on dips may want to consider APD at its current price and valuation for potentially strong total returns down the line.

Read the full article here