Some commercial real estate lenders are currently in a state of flux as previously safe and stable property asset classes like offices and urban hotels get disrupted by the now entrenched post-pandemic working-from-home trend. Hence, TPG RE Finance Trust, Inc. (NYSE:TRTX) has experienced a significant level of earnings volatility despite a broadly diversified portfolio of loans to a range of property types including multifamily properties, industrial facilities, offices, and hotels. The lender last declared a quarterly cash dividend of $0.24 per share, unchanged sequentially for a 15% annualized forward dividend yield. The yield sits far above its comparable mortgage REIT peers with TRTX also currently trading at a 46% discount to its recent third-quarter book value of $12.04 per share.

TPG RE Finance Trust Fiscal 2023 Third Quarter Presentation

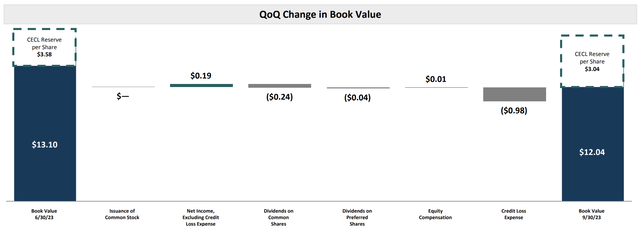

A fat double-digit yield for 54 cents on the dollar is seemingly a compelling buy but TRTX has seen quite significant book value deterioration and has a history of dividend cuts. The closing of this discount represents a source of potential upside for common shareholders, but forms the core reason why the dividend yield is at its current level. TRTX trading at book value would mean a dividend yield of 8%, around 700 basis points lower than the current yield. Critically, the continued dip in book value represents a fundamental barrier to building a position in the commons with book value dipping from $14.28 per share a year ago in the third quarter of 2022 and $16.15 per share in the third quarter of 2021.

Book Value And Current Expected Credit Losses

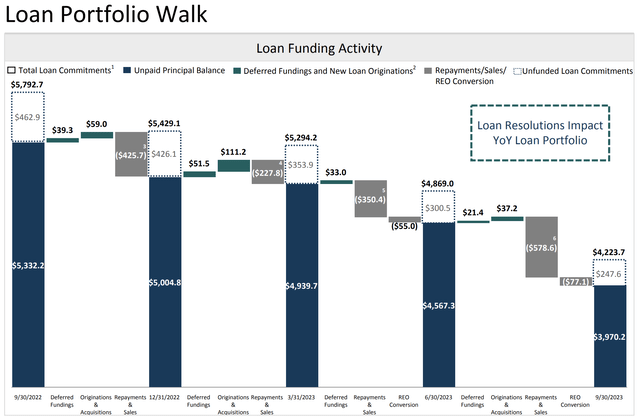

TRTX’s loan portfolio was valued at $4.2 billion at the end of the third quarter with the unpaid principal balance component of this at $3.97 billion. The portfolio had 59 loans with an average loan size of $71.6 million, a 9.28% weighted average all-in yield, and was 100% invested in floating-rate loans. The portfolio has been declining on the back of repayments in excess of new originations with TRTX seeing repayments and sales of $578.6 million during the third quarter versus $37.2 million in originations.

TPG RE Finance Trust Fiscal 2023 Third Quarter Supplemental

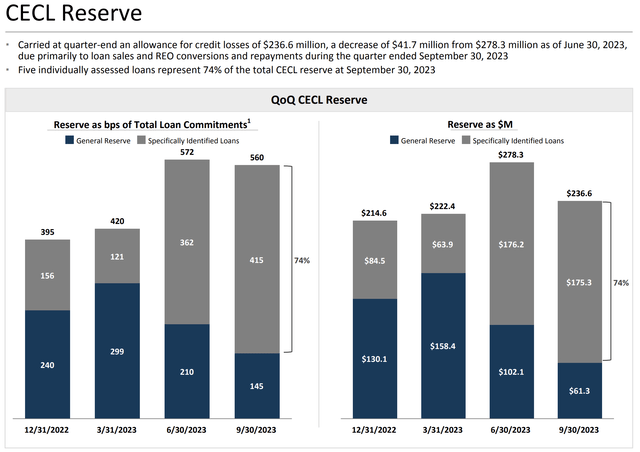

TRTX’s allowance for credit losses was $236.6 million at the end of the third quarter, a sequential dip of $41.7 million. On a per share basis, CECL reserve was $3.04 per share, down from $3.58 per share in the second quarter. It was also 5.6% of TRTX’s total loan portfolio, a decline of around 12 basis points sequentially.

TPG RE Finance Trust Fiscal 2023 Third Quarter Supplemental

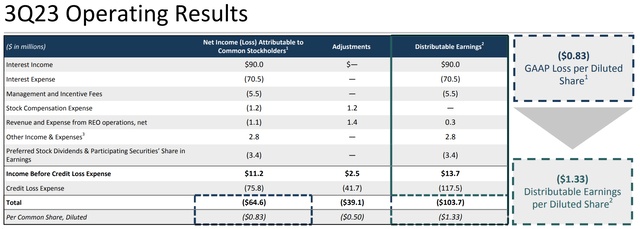

The mREIT realized a GAAP net loss of $64.6 million, around $0.83 per share on the back of quite a substantial credit loss expense of $75.8 million during the third quarter. The loss was driven by the sale of two loans at substantial discounts to their unpaid principal balance. There was an office loan sold for $79 million with an unpaid principal balance of $152.4 million that drove a loss on sale of roughly $74.4 million. TRTX also sold a mixed-use loan for $95 million, generating a loss on sale of $35 million against an unpaid principal balance of $129.2 million.

Dividend Outlook And The Preferreds

TPG RE Finance Trust Fiscal 2023 Third Quarter Supplemental

Third quarter distributable earnings was a loss of $103.7 million, around $1.33 per share but would have been $13.7 million or $0.18 per share without realized credit losses. The more positive figure was down 7 cents from $0.25 per share in the second quarter. It means the mREIT is only able to cover its $0.24 per share dividend by 75%, a roughly 133% payout ratio. This is problematic as whilst TRTX ended the third quarter with $302.3 million in cash and equivalents, these funds are earmarked for investment with $15.6 million of this required to satisfy liquidity covenants under the mREIT’s secured financing agreement. The Series C preferreds, TPG RE Finance Trust, Inc. 6.25% RED PFD C (NYSE:TRTX.PR.C) offer an alternative and safer option and are currently trading at a 41% discount to their $25 per share par value and with a roughly 10.7% yield on cost.

TPG RE Finance Trust November 2023 Investor Presentation

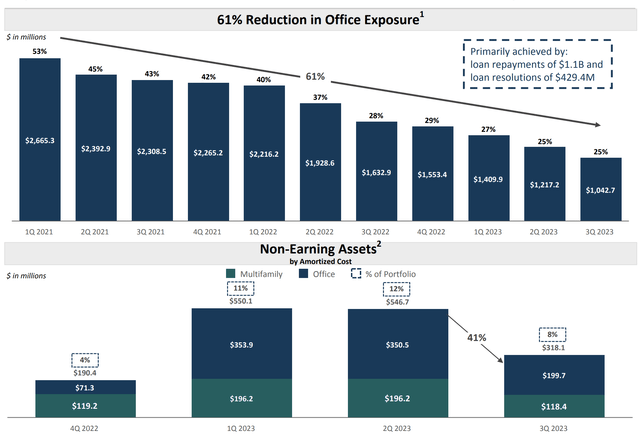

Further, whilst the mREIT is making progress in derisking its loan portfolio’s previously high office exposure, this reduction has come at a high cost of losses with office loan repayments of $1.1 billion being responsible for just 72% of the total reduction since the start of 2021 and the remainder being driven by loan resolutions. TRTX is in a state of extreme flux with an uncertain outlook for a declining loan portfolio now set against a dividend that’s not covered by distributable earnings. The mREIT has cut its dividend before during the pandemic when the previous $0.43 per share distribution was cut by 54%. There could be another cut coming with the commons making a tough purchase against the continued NAV decline and the poor outlook for the dividend.

Read the full article here