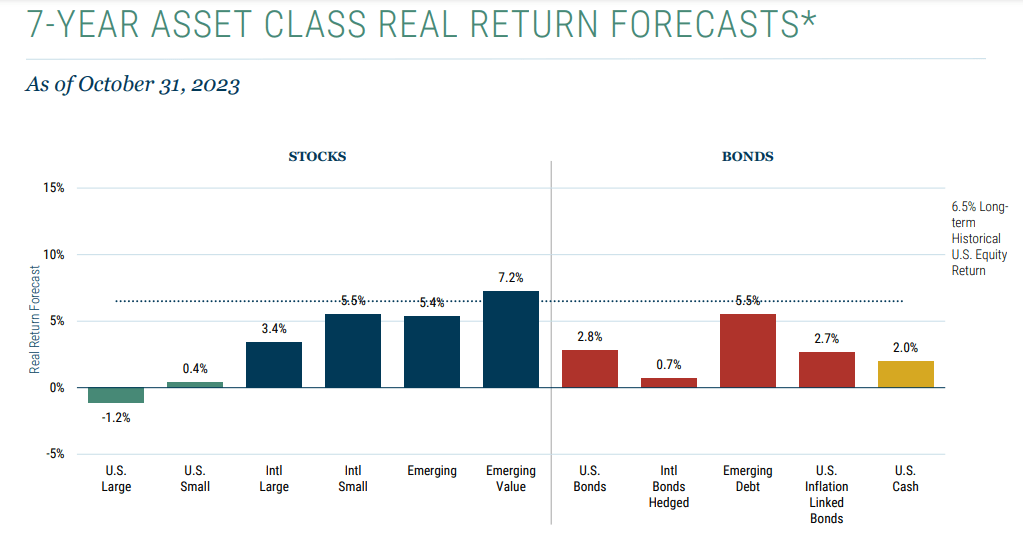

Although mega-cap growth stocks like Microsoft (MSFT) and Nvidia (NVDA) powered the U.S. markets to strong gains in 2023, I am not convinced they will continue to outperform in 2024. According to research from the well-respected institutional asset manager GMO, with mega-cap stocks trading at over 30x P/E, the forward returns for U.S. stocks is not favorable looking forward (Figure 1).

Figure 1 – Asset class forward returns (GMO)

Instead, international stocks and bonds have a more favorable forward returns outlook, as their valuations are much more reasonable.

The Pacer Global Cash Cows Dividend ETF (BATS:GCOW) is a solid value-focused fund that screens for international equities generating high free cash flow yields. Free cash flow is often a good measure of a business’ quality, as well as an important valuation metric. The GCOW ETF pays an attractive 5.3% distribution yield. I rate the GCOW ETF a buy.

Fund Overview

The Pacer Global Cash Cow Dividend ETF provide exposure to international companies with high free cash flows and high dividends. The GCOW ETF has $1.9 billion in assets with an operating expense ratio of 0.60%.

Strategy

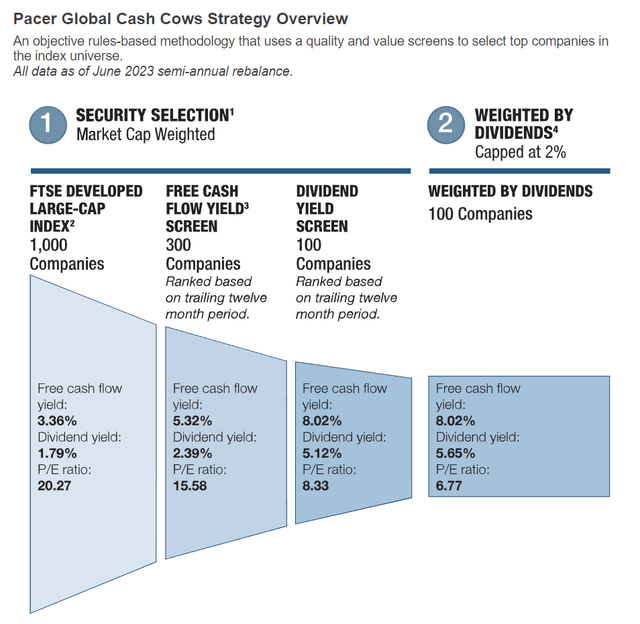

The GCOW ETF tracks the Pacer Global Cash Cows Dividend Index (the “Index”), an index that screens for companies with high free cash flow yields and dividends. The index first screens the FTSE Developed Large-Cap Index for companies with the highest projected free cash flow yield for the next 2 years. Financial companies and companies with negative free cash flow yields are dropped from the universe (Figure 2).

Figure 2 – GCOW strategy overview (paceretfs.com)

Next, the 300 companies with the highest free cash flow yields are ranked by their dividend yield. The highest 100 dividend-yielding companies from this screen are then included in the Index, with their position sizes weighted by the aggregative dividends paid by each company in the trailing 12 months, with individual position sizes capped at 2%.

The Index is reconstituted and rebalanced semi-annually in June and December.

The key ideas behind GCOW’s strategy are that high-quality companies tend to have strong free cash flows, and a willingness to pay dividends indicate management’s confidence in the long-term viability of the business.

Portfolio Holdings

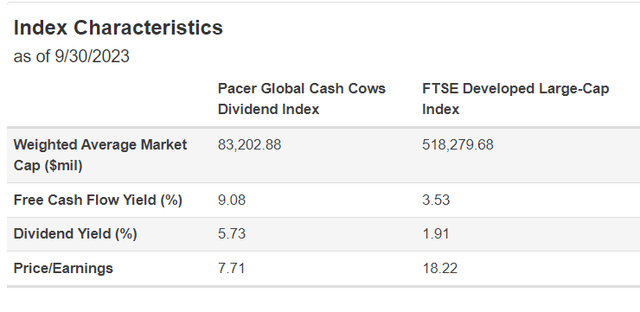

Overall, GCOW’s portfolio has a ‘value’ tilt, as the Index has a 9.1% free cash flow yield and trades at a 7.7x P/E (Figure 3).

Figure 3 – GCOW has a ‘value’ tilt (paceretfs.com)

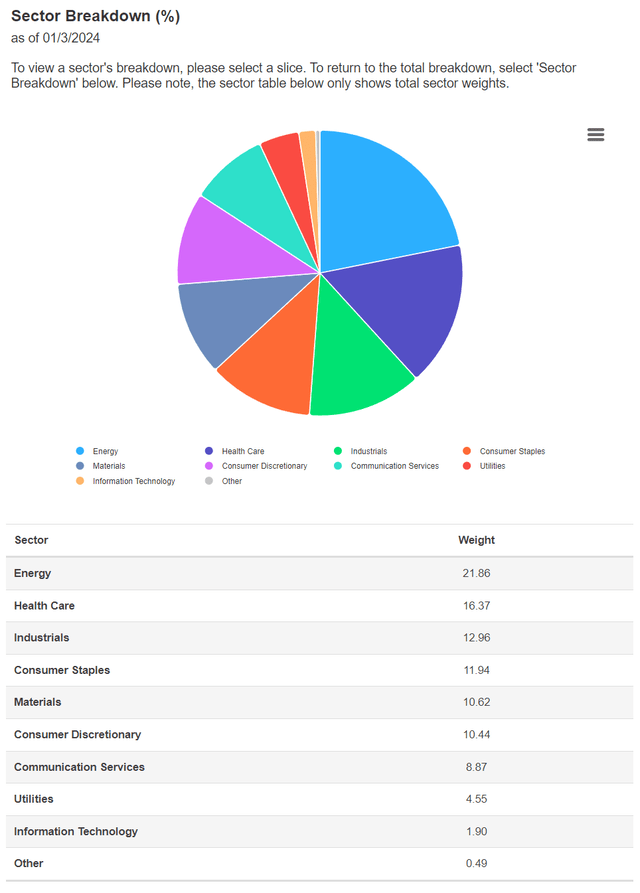

Figure 4 shows the GCOW ETF’s sector breakdown as of January 3, 2024. The Fund’s largest sector weights are Energy (21.9%), followed by Health Care (16.4%), Industrials (13.0%), Staples (11.9%) and Materials (10.6%).

Figure 4 – GCOW sector weights (paceretfs.com)

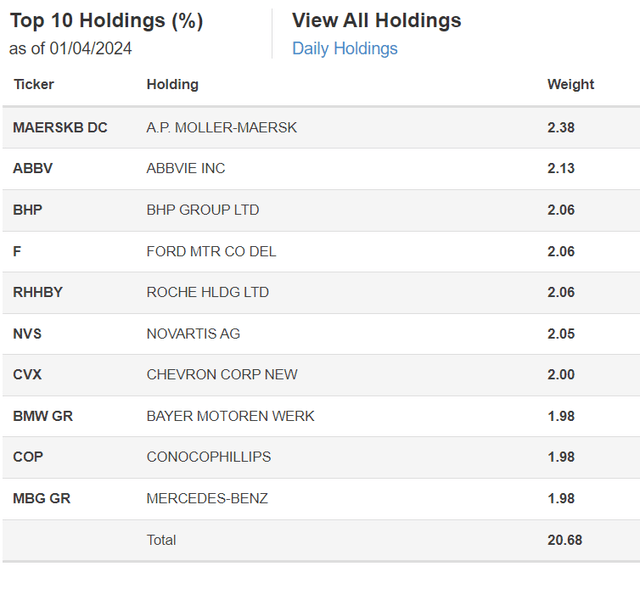

Figure 5 shows the top 10 holdings of the GCOW ETF as of January 3, 2023. Since the GCOW ETF caps individual positions at 2%, the fund is not overly concentrated with the top 10 holdings only accounting for 20.7% of the portfolio.

Figure 5 – GCOW top 10 holdings only account for 20.7% of the fund (paceretfs.com)

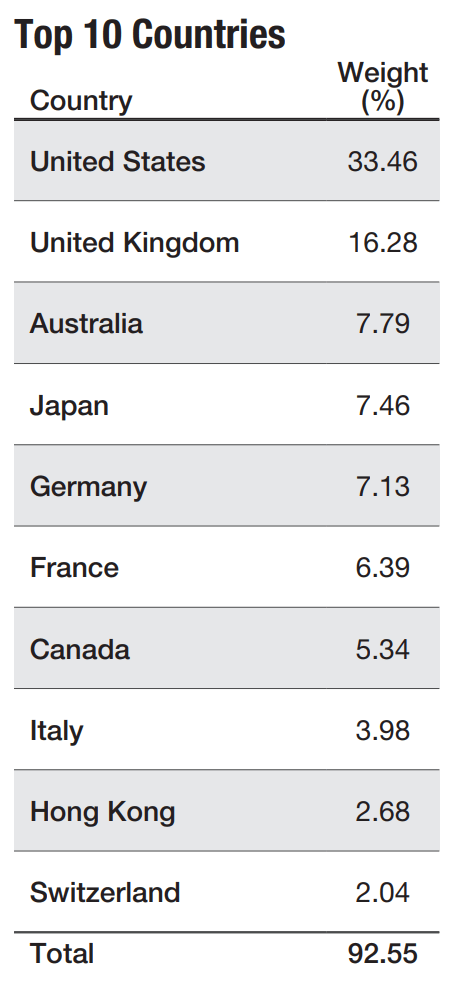

For U.S.-based investors, the GCOW ETF provides international diversification, as its portfolio only has a 33.5% allocation to U.S. stocks as of September 30, 2023 (Figure 6).

Figure 6 – GCOW geographical allocation (GCOW factsheet)

Distribution & Yield

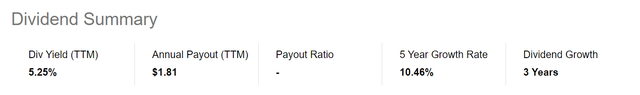

With its underlying portfolio paying an attractive 5.7% dividend yield, the GCOW ETF can afford to pay an attractive distribution to investors. Currently, the fund pays a quarterly distribution with a trailing 12 month yield of 5.3% (Figure 7).

Figure 7 – GCOW has a 5.3% distribution yield (Seeking Alpha)

Returns

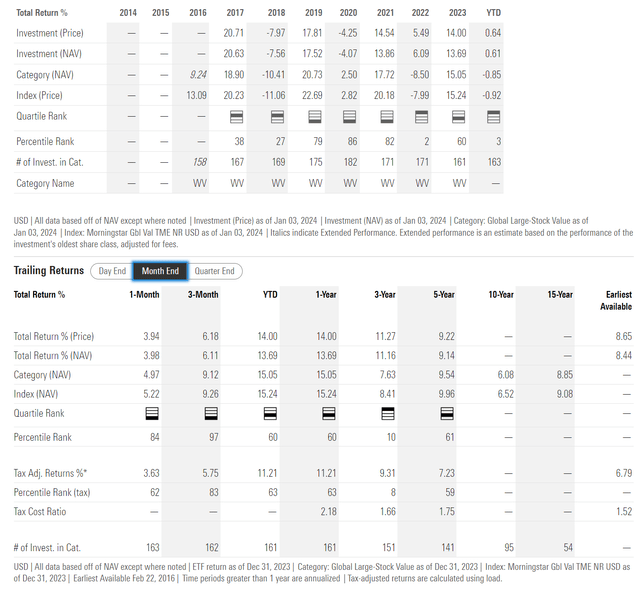

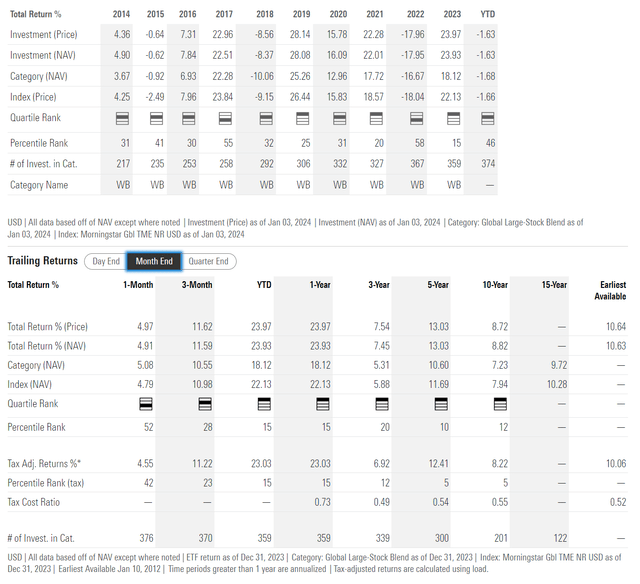

While a high distribution yield is nice to have, as a total return-focused investor, I am much more interested in GCOW’s historical returns performance, especially compared to passive market indices. Figure 8 shows GCOW’s historical returns. On a trailing 3 and 5 year basis, the GCOW ETF has returned 11.2% and 9.1%, respectively, to December 31, 2023 (Figure 8).

Figure 8 – GCOW historical returns (morningstar.com)

Figure 9 shows the historical performance of the iShares MSCI World ETF (URTH) for comparison. Relative to URTH, GCOW underperformed in 2023, outperformed over the trailing 3 years, and underperformed over the trailing 5 years.

Figure 9 – URTH historical returns (morningstar.com)

Given the volatile relative performance of the GCOW ETF, how should investors think about its suitability in a portfolio?

GCOW Outperforms When Value Is In Vogue

I believe the key deciding factor on the GCOW ETF’s relative performance is whether “growth” or “value” investing is in vogue. Looking at the ratio between the iShares Russell 1000 Value ETF (IWD) and the iShares Russell 1000 Growth ETF (IWF) as a guide, we can see that when the value factor underperforms growth, GCOW also underperformed the iShares MSCI World ETF (URTH) (years 2017 to 2021, 2023) (Figure 9).

Figure 10 – IWD/IWF ratio (Author created with price chart from stockcharts.com)

However, when value outperformed in 2022, the GCOW ETF outperformed the URTH ETF, returning 6.1% compared to -18.0%. So, the decision to buy the GCOW ETF should depend on one’s view of whether “value” stocks or “growth” stocks will outperform.

Soft Landing Should Benefit International Value Stocks

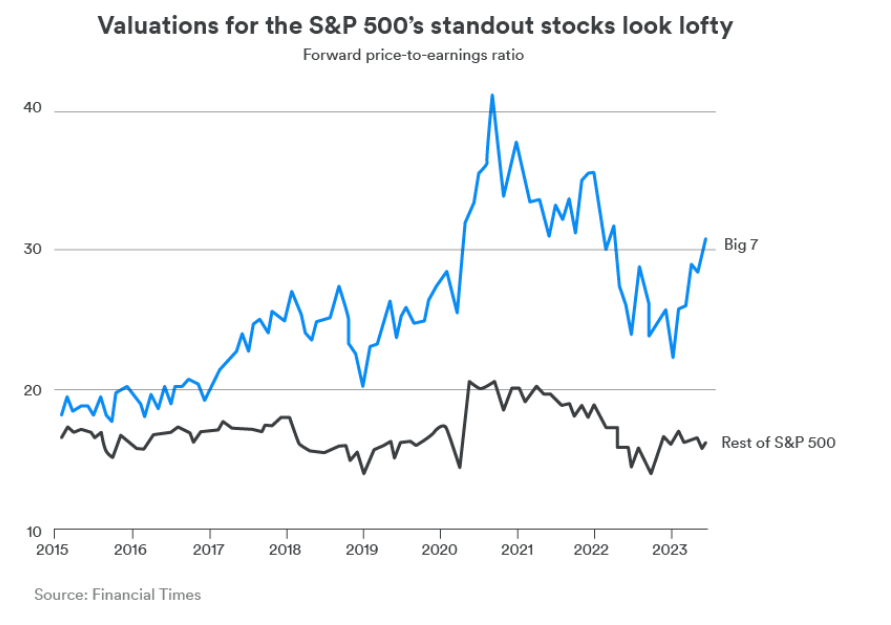

One of my main investment themes for 2024 is that in a “soft landing” scenario, whereby inflation moderates while economic growth remains robust, institutional investors will likely rotate out of the expensive mega-cap ‘Magnificent 7’ stocks and into the rest of the markets, as the valuation disparity is reaching extremes. While the “Magnificent 7” trades at over 30x Fwd P/E, the rest of U.S. large caps are trading at a much more reasonable ~16x (Figure 11).

Figure 11 – Magnificent 7 are richly valued (Financial Times)

Since the “Magnificent 7” (Apple, Microsoft, Amazon, Alphabet, Nvidia, Meta, and Tesla) are commonly associated with “growth” investing, if they were to underperform, then it should be safe to reason that value stocks should outperform.

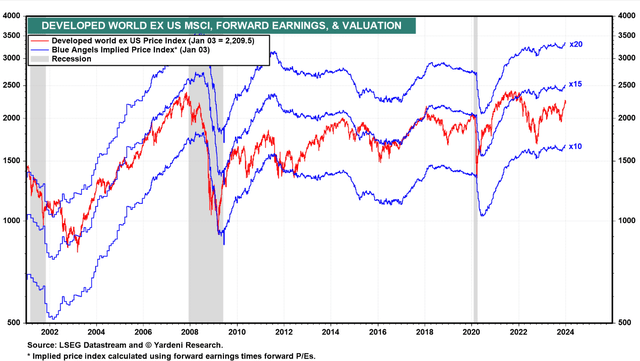

Furthermore, there is also a wide gap in valuations between the U.S. and international markets, with the U.S. markets trading at over 20x Fwd P/E while the Developed World, excluding the U.S., is only trading at 13x. Assuming the global economy holds up, I expect international stocks should outperform the U.S. as investors hunt for bargains (Figure 12).

Figure 12 – Developed World ex. US trading at reasonable 13x Fwd P/E (yardeni.com)

Putting these two ideas together, I believe 2024 could see international value stocks gain relevance and outperform U.S. growth stocks, benefiting the GCOW ETF.

Risks To GCOW

While I have a favorable view of the GCOW ETF, there are a couple of risks that should be mentioned. First, as projected free cash flow yields are only estimates, actual free cash flows may disappoint and lead to stock drawdowns, particularly if the global economy slows down.

Another risk to the GCOW ETF is if equity markets continue to favor growth stocks in the coming year, then the GCOW ETF may underperform. However, with U.S. mega-gap growth stocks overvalued and over-owned, I believe the risk-reward is simply better in other asset classes like international equities.

Conclusion

The Pacer Global Cash Cow Dividend ETF gives investors exposure to international companies with high free cash flows and dividend yields. I believe the GCOW ETF should outperform in the coming year, as U.S. mega-cap growth stocks have become overvalued and over-owned. I rate GCOW a buy.

Read the full article here