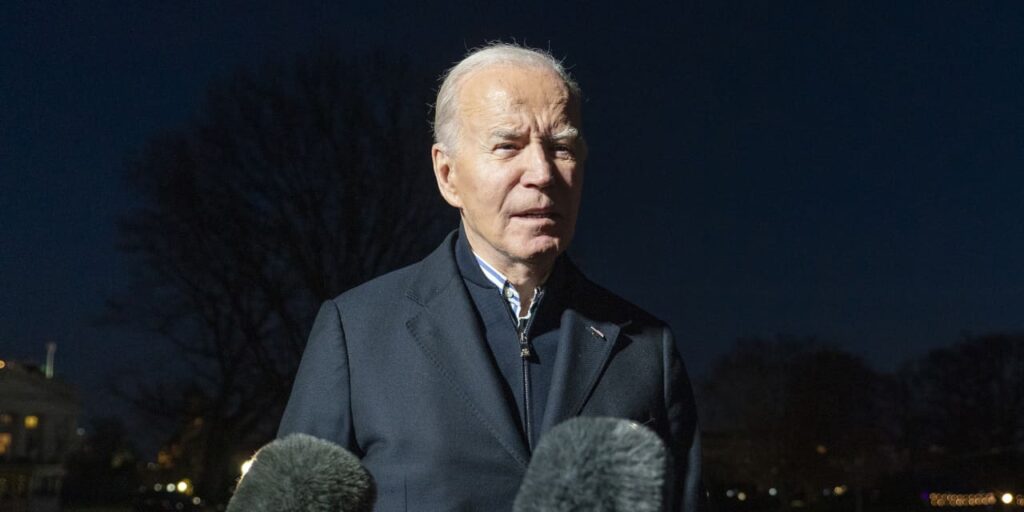

The U.S. economy has recovered from the COVID pandemic reasonably well, yet President Joe Biden is getting little credit and could even lose his job in 2024.

Third-quarter GDP growth scored at 4.9%; the Federal Reserve has enjoyed considerable success pulling down inflation. Jobs are plentiful, and the misery index — the sum of inflation and unemployment rates — is low by historical standards. Yet the University of Michigan Consumer Sentiment Index remains more depressed than past experience indicates it should be with conditions this favorable.

That’s bad news for Biden. According to recent polls tracked by Real Clear Politics, Americans disapproving of his handling of the economy outnumber those approving by about 22.5 percentage points. On inflation alone, the score is even worse — 32 points.

Since Biden took office, real incomes have fallen. Both the CPI and hourly wages are up 17% and 14%, respectively. That is not a big gap considering the body blow dealt by the COVID recession, but some prices have popped enough to cause real pain. Consumers don’t want inflation just to stop — they want prices rolled back significantly.

Giving them that wish would likely require the Fed to instigate another Great Depression. From 1930 to 1933, prices fell each year by an average of 7%. I doubt many of us would like to relive the biography of the Forgotten Man.

More broadly, the macroeconomic outlook is underwhelming. Economists are forecasting slower U.S. growth for 2024. Meanwhile, workers are in a struggle with their bosses over work-from-home and are generally more dissatisfied with their jobs.

As importantly, nominal wage gains and real wage losses are uneven. Prior to the UAW strike, the typical autoworker earned $37 an hour vs. $27 for manufacturing workers overall. Now autoworkers have won a 25%-plus inflation raise over four years. Maybe a server at a diner near a Ford factory will get bigger tips, but those gains won’t do the average worker outside the auto sector much good. Moreover, buyers now will face higher car prices.

Beyond the U.S. economy, so much else is going badly.

On foreign policy, the Hamas attack on Israel discredited Biden’s efforts to court Tehran and encourage normalized relations between Saudi Arabia and Israel, while tolerating Israeli Prime Minister Netanyahu’s resistance to a Palestinian State.

In Ukraine, relying on sanctions and limiting Kyiv’s access to weapons that might overly antagonize President Vladimir Putin have resulted in stalemate, perhaps worse, and the potential to endlessly tax both EU and U.S. budgets.

More Americans disapprove of Biden’s handling of foreign policy than approve by 25 points. On crime in U.S. cities, by 21 points and the flood of unauthorized immigrants by 30 points.

Things the president promised to fix — the high cost of college, home ownership and childcare — are not improving. Colleges are advertising less-aggressive tuition hikes but boosting dorm fees prodigiously.

Biden laid out a sweeping agenda in his Build Back Better program — ranging from free community college tuition and student loan relief to enhancements to Medicare, universal pre-K education and federally funded childcare. But he can point to only a handful of limited accomplishments — for example, regulating a limited number of prescription drug prices.

It’s hard to say that Biden has made enough people happy. His limited student loan forgiveness has left a plurality of Generation Z voters in swing states dissatisfied because he has done too little, while many older voters think he has done too much.

On the overall direction of the country, the sum is greater than its parts. Americans who say the country is heading the wrong way outnumber those who are pleased by about 43 points.

It’s easy to write off voter assessments of Biden by noting that most other U.S. presidents suffered low scores at this point in their tenure. However, as polled by Gallup, Biden’s approval ratings are lower than all former presidents going back to Ronald Reagan.

With the performance of the Biden administration getting bad grades nearly everywhere else, it’s not surprising Americans are so sour about an improving economy. Yet with inflation coming under control and the economy not sinking into a recession, that’s unfortunate — and a bit shortsighted. The job market may not be red hot but remains robust, and wages should broadly outpace inflation in 2024.

Peter Morici is an economist and emeritus business professor at the University of Maryland, and a national columnist.

Also read:

Health of U.S. labor market looms large on markets’ radar this coming week

‘My sunny outlook doesn’t come without some risks.’ What to expect after the Santa Claus rally

Read the full article here