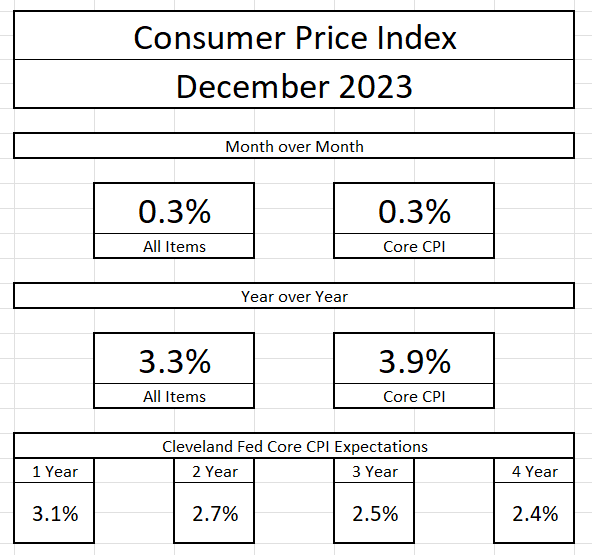

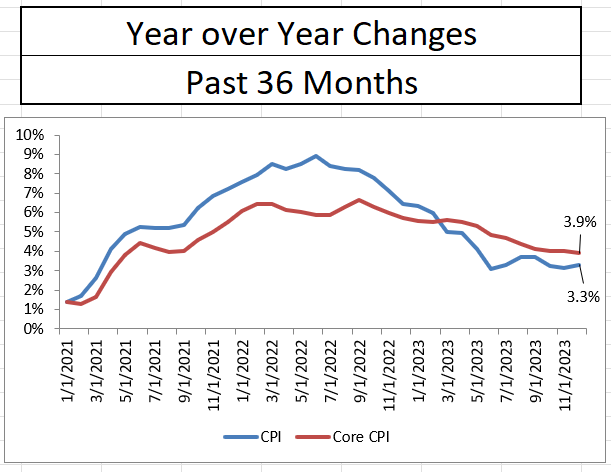

Earlier today, the Bureau of Labor Statistics released the Consumer Price Index for December. The report showed that overall inflation rose by 0.3% in the month of December. If you strip out the volatile food and energy components, core inflation also rose by 0.3%. On a year-over-year basis, core inflation notched down 0.1% to 3.9%, the lowest level since May 2021. Headline inflation actually rose 0.2% to 3.3%, driven by higher energy prices. While core continues to inch its way down, it remains at nearly two times the Federal Reserve’s long-range target and Fed officials should be seriously questioning their 2024 rate projections after these results.

Bureau of Labor Statistics

Bureau of Labor Statistics

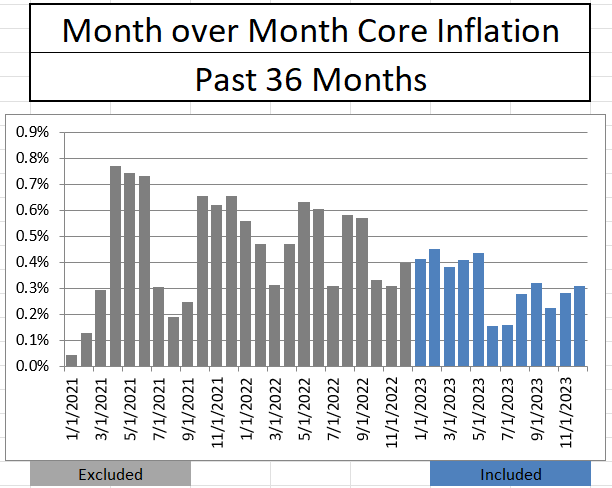

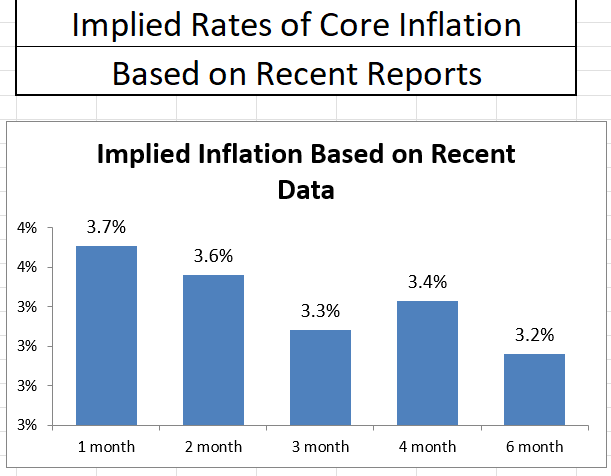

Over the last two months of the year, interest rates began to subside from the elevated levels experienced in October. That movement in rates from the markets appears to have subtly stoked inflation. While in the last six months of month-to-month inflation numbers have been lower, they’re still at 3.2% when annualized. Additionally, the last two months sit at 3.6% annualized, signaling that we are getting more resistance from lower interest rates in pricing. If this is the case, how is the Fed going to lower rates and expect disinflation to continue this year?

Bureau of Labor Statistics

Bureau of Labor Statistics

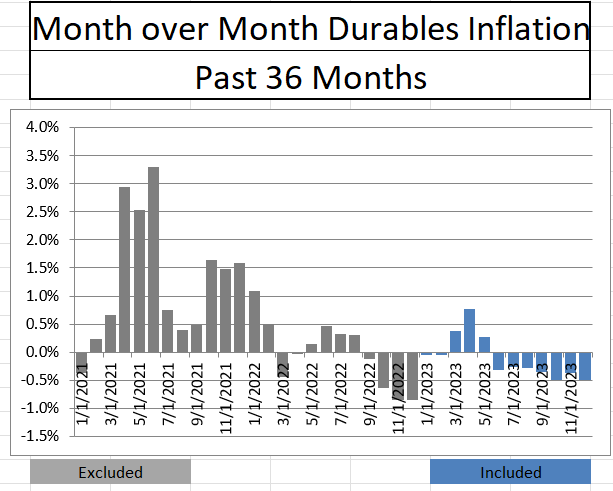

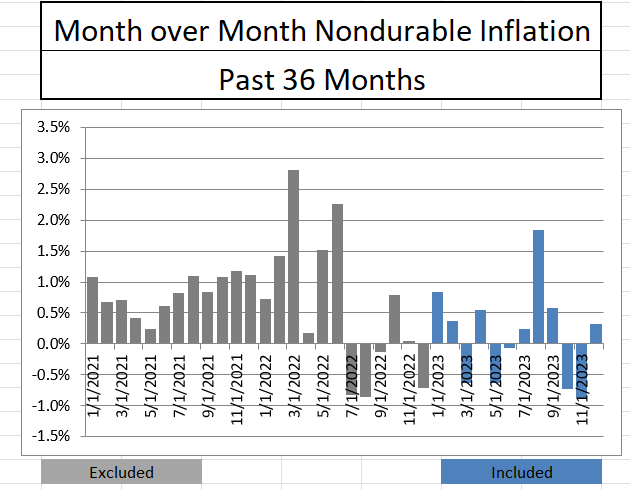

There are some components in the inflation report that continue to help stabilize pricing. Durable goods inflation remained negative for the seventh consecutive month and is at -1.2% year over year. Additionally, nondurable goods posted a positive inflation number for the month of December but posted a year-over-year inflation number of under 2%, albeit a tick higher than from November. In the macro picture, goods pricing is going to need to remain under pressure for the CPI to even get close to 2%. On the micro side, investors should take note of the pricing pressure and expect profit pressures from the relevant companies in the goods sector.

Bureau of Labor Statistics

Bureau of Labor Statistics

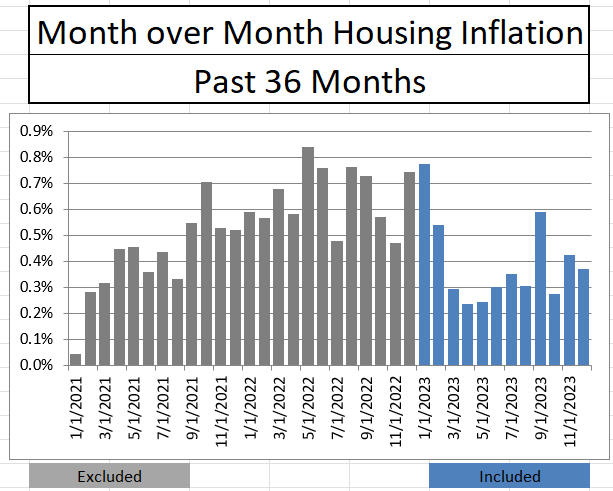

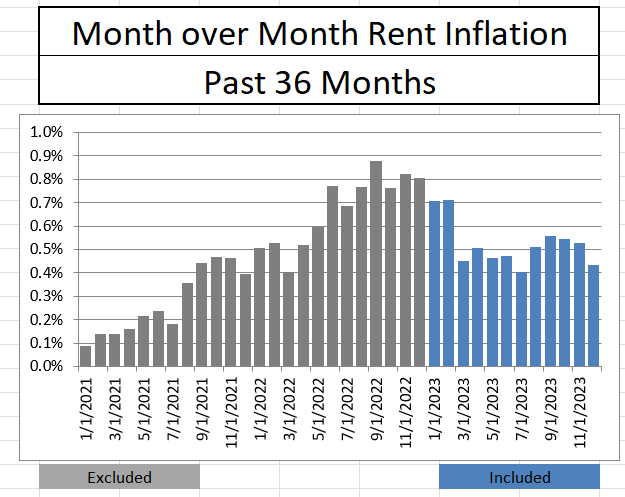

The typical contributors to higher than targeted inflation continued to be problematic toward price stability in the month of December. Housing inflation continued to decline to 4.8% year-over-year and appears to be showing promise over the next two months as fairly large price jumps in January and February come off of the annual calculations, but price increases in three of the last four months remain rather elevated. Rent rates show some promise, but year-over-year price inflation remains above 6%, with the bottom appearing relevant at 5%.

Bureau of Labor Statistics

Bureau of Labor Statistics

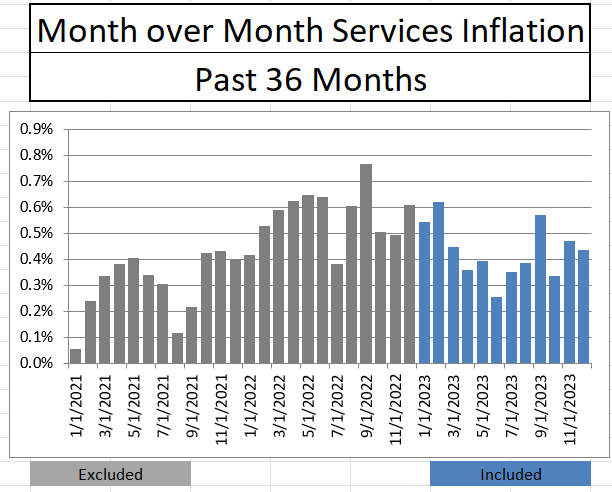

Service side inflation, which plays such a large role in the overall calculation, continues to show a gradual decline with year-over-year inflation at 5.3% in December. But, as in the case with housing, recent monthly data appears to indicate a near term floor of 4.5%. If service sector inflation remains above 4% on a year-over-year basis, all other major indicators in pricing would need to be at or below zero to have any shot at the Fed’s 2% price target.

Bureau of Labor Statistics

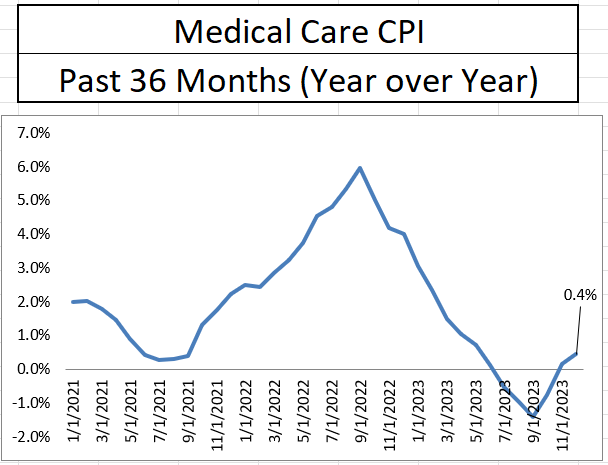

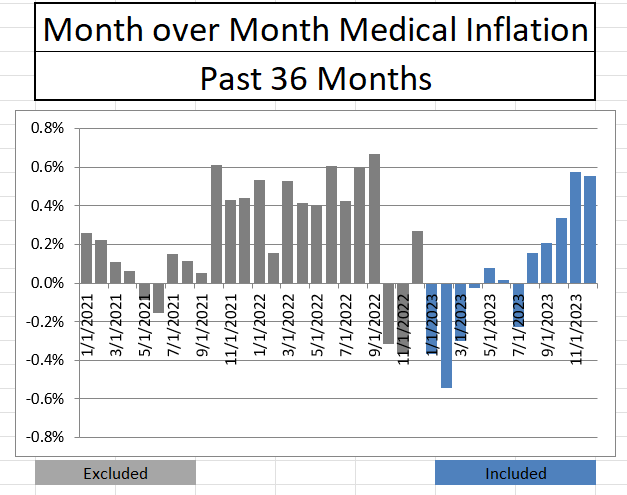

Over the last several months, medical care has been an unexpected helper toward price stability. Unfortunately, inflation in this sector has had a pronounced increase over the last five months. With three large deflationary numbers rolling off in the next three months, medical care could resume its previous track record as being a buoy of core inflation.

Bureau of Labor Statistics

Bureau of Labor Statistics

The December Consumer Price Index report combined with the recent trends in inflation lead me to believe that major resistance is coming to the disinflation movement. Combine this with the fact that lower market rates over the last couple of months have flared up the month to month price fluctuations and one could easily be concerned with Fed rate cuts leading to a refueling of inflation. As for now, I believe any talk of rate cuts in 2024 remains premature.

Read the full article here