Investment briefing

Investors running money in equities this year should consider the industrials sector as a starting point in top-down security selection in our firm opinion.

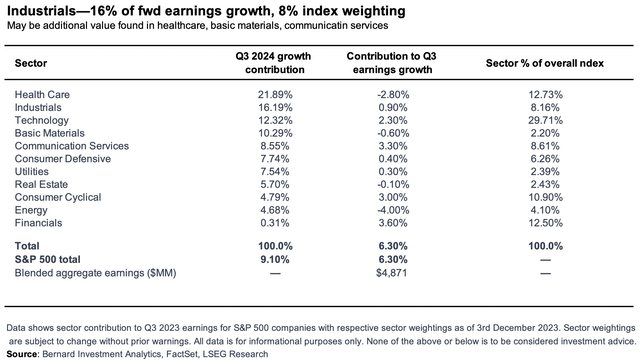

Our findings from Q3 2023 earnings illustrate the industrials sector held 8% notional value of the S&P 500 market capitalization weighted index towards the end of ’23 but was poised to deliver 16% of the projected 12-month earnings growth (Figure 1). This makes a composite of growth/value tremendously attractive for industrials in our estimation. Avid readers of mine will have seen the chart below ad nauseam as a starting point for capital allocation in ’24.

Figure 1.

Here at Bernard Investments, we have been avidly scouring the industrials sector for industry-specific bargains. The sector’s underperformance against high-beta counterparts in the last 5+ years provides ample opportunities to filter from.

Within the industrials sector lies the construction and engineering industry, heavily beaten down at 1.4x EBITDA and 6.5x cash flow (Figure 2) as the inflation/rates axis has taken its toll on the capital-intensive domain.

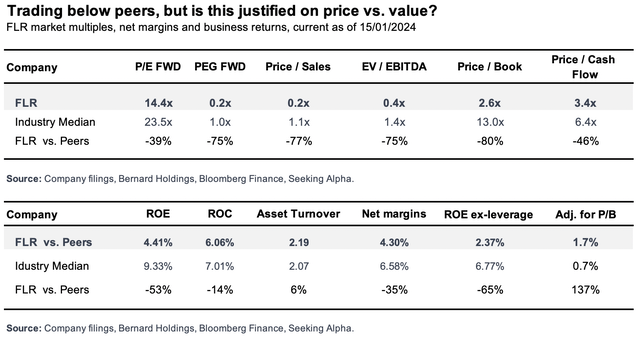

Our findings have led us to Fluor Corporation (NYSE:FLR), trading at a steep discount vs. industry peers at 14.4x forward earnings and 0.4x EBITDA, whilst commanding a market value of 2.6x the net assets employed to run the company.

Figure 2.

The company, founded in 1912 and headquartered in Irving, Texas, is recognized for its expertise in small modular reactor technology, having been a key innovator in the evolving energy sector. It has its footprint within several markets, including engineering, procurement, and construction services. It does business across four key segments, summarized in Table 1.

The debate on value at price is tremendously important here, because, even though FLR sells below peers, its business returns and ability to convert earnings into FCF are behind the industry. Question is, is the discount justified?

This report will unpack all of the moving parts of the FLR investment debate. Net-net, we rate FLR a buy with 12 months to 3 years investment horizon in mind. The lines are blurred looking beyond this period, given the industry’s sensitivity to economic cycles and cost of capital. We are eyeing initial objectives of $46/share, around 21-22% upside potential as I write.

Table 1. Description of FLR core business divisions

| Segment | Description |

|---|---|

| Energy Solutions | Provides services for energy transition markets, focusing on asset decarbonization, renewable fuels, hydrogen, and more. |

| Urban Solutions | Offers EPC and project management services to infrastructure, advanced technologies, life sciences, and mining. |

| Mission Solutions | Specializes in technical solutions for U.S. and other governments, with a focus on nuclear security and waste management. |

| Other | Engaged in researching, developing, licensing, and commercializing small modular reactor technology. |

Source: FLR 2022 10-K

Critical investment findings

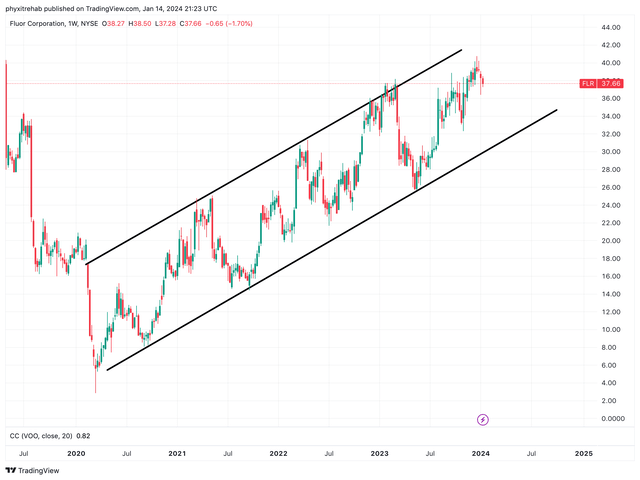

FLR has rallied off its Covid-19 lows in ’20 and continued within an ascending channel to date as traders continue to define clear support and resistance zones (Figure 3). With the move extending into the new year, we need evidence on what can extend the move. The case for buying FLR at different investment horizons is outlined in the arguments below.

Figure 3.

Source: TradingView

-

Investment returns coming 12 months

Investors must recognize that returns on corporate securities in the initial 12 months after purchase are heavily dictated by starting multiples. Overpaying can substantially reduce investment returns in the first year.

FLR trades at 14x forward earnings which adjusts to 0.24x earnings when factoring in growth estimates. Contrast to the sector’s 19x P/E and 1.75x respectively, and the industry’s figures observed in Figure 2 earlier.

In our estimation, there is asymmetrical reward potential in buying FLR at 14x earnings for the next 12 months. The ratio of upside to downside is heavily skewed to the former—precisely the advantage of value investing in the first place. Buying high-quality securities at statistical discounts provides statistical advantages as it relates to percentage returns.

Moreover, at 14x earnings, the following dislocations are noted when factoring in both asset factors and earnings power:

- The market values its net assets at 2.6x, illustrating FLR’s ROE is higher than its cost of equity. Growth would create shareholder value if this continues.

- Paying 2.6x book value equals an ROE of 1.7%, around 1.4x the industry median when adjusted by P/Book ratio.

- Adjusted for growth expectations, you are paying 0.24x earnings—less than $1 for a $1 of future growth.

Analysis by Deloitte also projects high single-digit growth in the construction industry this year, adding structural tailwind to the company’s re-rating prospects:

[L]ooking ahead to 2024, there could be a boost to construction associated with manufacturing, transportation infrastructure, and clean energy infrastructure, as funds from three key pieces of legislation passed in 2021 and 2022—the Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA), and the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act—are expected to flow into the industry”.

— Deloitte 2024 engineering and construction industry outlook

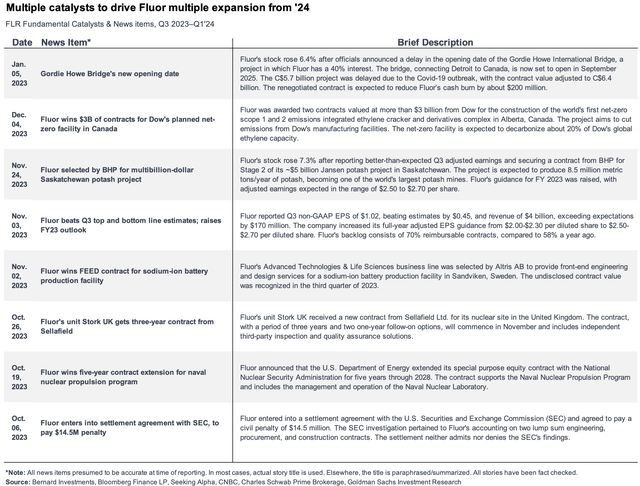

In addition to these points, I would also highlight the string of news catalysts that position FLR well for the coming 12 months. These are summarized in Figure 4. Critically, each of the updates is idiosyncratic to the company and are therefore uncorrelated to the broad market’s return.

These are all bullish points for the coming 12 months in our view.

Figure 4.

-

Investment returns 1-3 years

FLR presents with exceptional investment characteristics for the investor considering a 1-3 year horizon. Any corporation’s market value over 1-3 years is heavily dictated by fundamentals, epitomized through sales and earnings growth.

Historically, FLR has grown its top line at 0.14% on average for the last 3 years, producing CAGR operating earnings growth of 97% in the same time—clear evidence of the operating leverage it possesses (keep in mind this works on the way down, too).

Consensus has the firm to grow earnings 218% in FY’23—likely well captured in the company’s market value already—with 8-10% bottom line growth in the subsequent 2 years. Sales are also tipped at 8-14% at this time, ahead of the construction and engineering market’s projected growth outlined earlier. In that vein, FLR is tipped to steal market share from competitors, should it grow faster than the market.

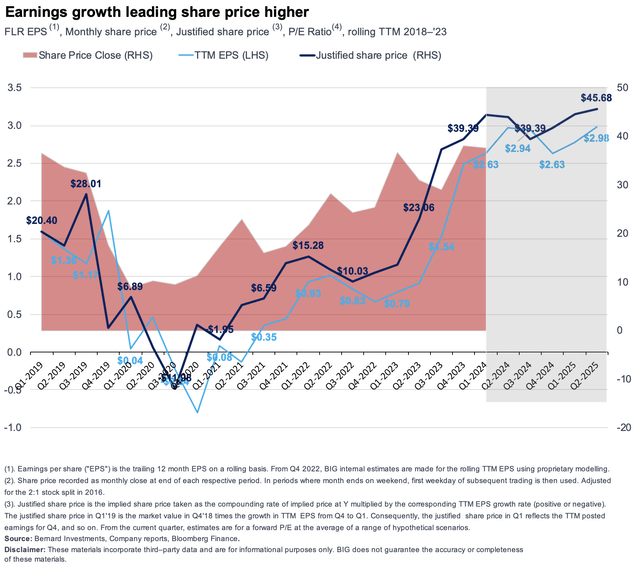

This earnings growth is a critical point to highlight. The market is a conduit between investors and their companies. It capitalizes earnings into an asset value, which changes investors’ net worth over time. It is strikingly accurate in pricing corporate securities based on fundamentals, like earnings growth and return on capital. As seen in Figure 5, the market has done a fair job at pricing FLR based on the trajectory of its earnings power, pricing in changes to growth to the firm’s market value accordingly.

Under this convention, our earnings growth assumptions on FLR estimate its stock price to command a fair value of $45-$46.00. This is constructive for the coming 1-3 years.

Figure 5.

-

Investment returns 3 years+

The case for owning FLR beyond a 3-year investment horizon is substantially weaker than the mid-term outlook in our opinion.

As a quick reminder, we judge a company’s long-term (3+ years) investment value by its ability to reinvest surplus cash that is generated from conducting business.

We want corporations that produce incremental earnings growth above what is achievable with similar risk. Companies that have the capacity and opportunity (i.e., the free cash flow and market growth) to invest into additional high-return projects over many years are deemed the most investible in our mandate.

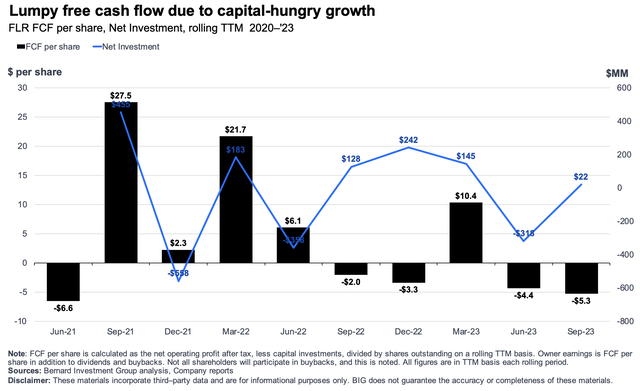

Alas, here is our struggle with FLR. Despite the fact that it is both (i) cheap, and (ii) poised for profitable growth, the propensity to methodically turn this into FCF and reinvest for additional, high-reward projects may be clamped in our opinion.

Figure 6.

Consider the following:

- FCF per share has been lumpy and generally lower in the last 3 years, due to the capital-hungry nature of the business/industry (Figure 6).

- These have been compounded by asset inflation, meaning asset replacement costs and maintenance CapEx requirements are indefinitely higher for the company.

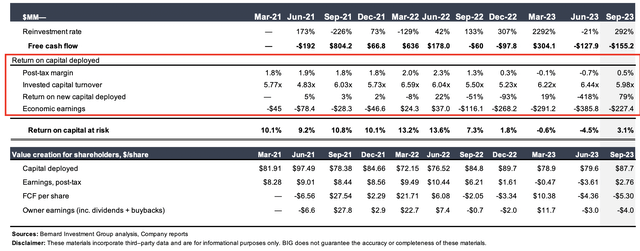

- Like most in the industry, FLR is a low-margin, low return business. Cost of revenues is tremendously high—the COGS margin rests above 96% for the company. Operating margins are equally thin, 100–200bps on average.

- FLR is, however, a high-capital turnover business. Each $1 of invested capital produces $6–$7.00 in sales for the company, potentially attractive for the company’s planned CapEx moving forward. If the company is to expand its asset base moving forward, this may result in additional sales growth at the ratio of $1 investment: $5–$6 revenue.

Point (3) is tremendously constructive in the investment debate in our view.

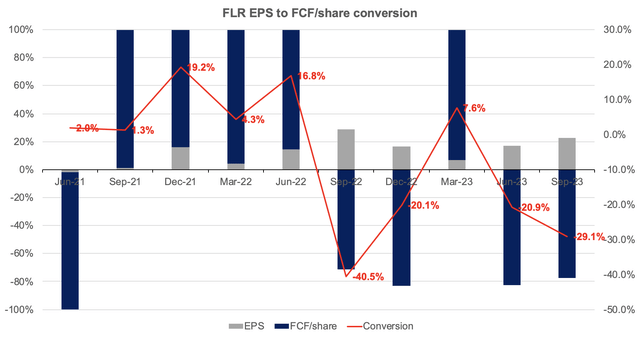

But we immediately circle back to point (1) — that FLR does not produce a high rate of earnings on capital employed in the business. It therefore does not spin off high amounts of FCF to reinvest in the first place. Further, it does not methodically rotate earnings into FCF (Figure 8). There is profit, but little cash, as basically all profit must be reinvested to stay competitive—classic economics within the construction industry.

Cash has to come from somewhere, and for FLR, it is not from its operations based on our analysis.

Figure 7.

Figure 8.

Source: BIG Investments, Company Reports

Valuation and conclusion

Our investment thesis on FLR looks to the coming 12 months to 3 years as a holding period, as mentioned. Beyond that horizon, we need further clarifications. Subsequently, as seen in Figure 5, our assumptions imply the company is worth $45-$46.00 based on projected earnings growth out to 2025. In our estimation, investment returns and growth are to be driven by:

- Dislocations in market value to implied value,

- Related to the above, absolute multiples are thin, providing statistical advantage to the upside,

- Construction and engineering market growth estimates,

- FLR forward growth estimates for the next 1-3 years, ahead of market forecasts.

An implied value of $45-$46.00 corresponds to 16–17x forward earnings, substantial value gap of 21.5% from where the market’s priced FLR today.

Table 2.

| Market multiple | Implied |

| 14x P/E forward | 17x P/E forward |

| Value gap: | 21.5% |

Source: Bernard Investments estimates, Bloomberg Finance LP

Consequently, there is robust evidence that supports buying FLR for a 1-3 year investment horizon in our estimation. We are eyeing first price objectives to $46.00/share or 17x P/E. We advocate owning the company based on the fundamental and structural tailwinds outlined here today. Net-net, rate buy. Risks include the following:

-

Industry and economic sensitivity. FLR does its business in the industry, which is highly sensitive to economic cycles and global economic conditions. We are amid a changing market cycle as I write.

-

Project execution risks. The success of Fluor is heavily dependent on the successful execution of large and complex projects. Delays, cost overruns, and so forth reduce capital turnover of the firm, therefore clamping business growth.

-

Dependency on energy and commodities markets. FLR’s performance is closely tied to the energy and commodities markets. Fluctuations in oil prices, changes in demand for energy-related projects, or disruptions in the supply chain of raw materials can significantly impact the company’s financial results.

Investors must realize these risks in full before proceeding any further.

Read the full article here