The iShares Investment Grade Corporate Bond Buywrite Strategy ETF (BATS:LQDW) seeks to track the investment results of an index that reflects a strategy of holding the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) while selling one-month covered call options to generate income. Since it came to market in August 2022 it has actually lost money as losses on its LQD holdings have outweighed the impact of high income payments. We are likely to see a reversal of this performance in 2024 as high Treasury yields and rates of implied volatility result in strong income, while the scope for major directional moves that could cause the LQDW to decline and/or underperform the LQD has diminished.

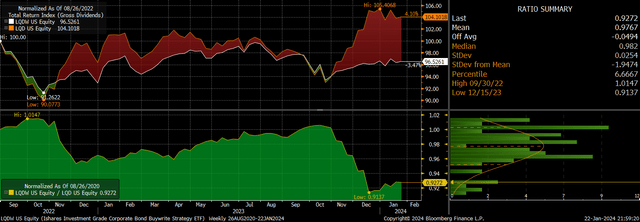

LQDW Vs LQD Total Return Performance (Bloomberg)

The LQDW ETF

The LQDW holds a portfolio of LQD, which is comprised of US dollar-denominated investment grade corporate bonds, which has a 5.2% yield to maturity and an average maturity of 13 years. The LQD’s high duration of 8.4 years, combined with its low default risk, means that it is driven mainly by changes in interest rate expectations. The LQDW then sells one month at the money calls on the LQD that allows it to generate high income, but means the fund does not participate in LQD upside. Its expense fee of 0.34% pales in comparison to the yield, which is currently 19.3%.

The LQDW employs the same strategy as the iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (TLTW) and the iShares High Yield Corporate Bond BuyWrite Strategy ETF (HYGW), which also use covered calls to generate high income. The LQDW has a slightly lower yield than the TLTW’s 20.3% due to the latter’s higher volatility which results from its longer duration. However, the yield is higher than the HYGW’s 15.9%, despite being exposed to lower credit risk.

Declining Rate Volatility To Support LQDW Outperformance

If the LQD manages to post 12 consecutive months of positive returns it should be expected to generate 19.3% over the next year due to the combination of the LQD’s yield and call option income. This is of course a best case scenario but even significant losses on the LQD would still allow the LQDW to post positive returns. The LQDW should outperform the LQD unless we see a large degree of volatility, which seems unlikely.

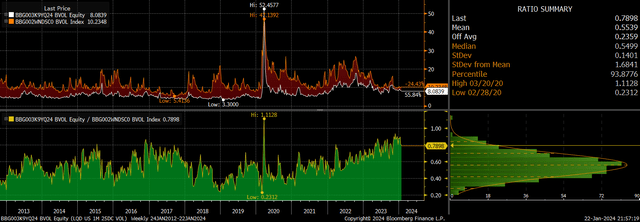

While equities have seen a collapse in implied volatility over recent months and years, levels of implied volatility on the LQD remain elevated. The following chart shows 1 month 25 delta call option volatility on the LQD versus the S&P500. The spread is now near its narrowest level over the past decade. Considering that the LQD has been far less volatile than the S&P500 historically, this provides a potential opportunity.

LQD vs SPX Implied Call Volatility (Bloomberg)

This view is supported by the outlook for US Treasuries, where a large directional move seems unlikely. Upside risks to Treasury yields appear capped by the need for the Fed to keep government funding costs from spiralling out of control. While the Fed’s official mandate is price stability and full employment, its role as lender of last resort to the Treasury means it stands ready to prevent a surge borrowing costs that would otherwise result from persistently high fiscal deficits. The Fed’s policy reversal in October last year in response to the disorderly rise in yields was a clear indication of this and it is unlikely to allow a similar spike in yields again.

Meanwhile, on the downside, market expectations for rate cuts this year seem too aggressive, with 150bps of easing priced in over the next 12 months. It would take a significant decline in inflation and/or growth for rates to be cut sufficiently to drive down Treasury yields. Even if this were to happen, it would likely mean that credit spreads would rise, tempering gains in the LQD and allowing the LQDW to outperform.

Renewed Inflation Pressures Pose The Biggest Risk

The main risk to the LQDW comes from a renewed rise in inflation. Not only would this put upside pressure on corporate yields to the detriment of the LQD, but it could also lead to a rise in volatility. In contrast to most of the past decade, LQD volatility has become positively correlated with market implied long term inflation rates, and a spike in oil, for instance, could trigger a move higher in both inflation and volatility.

Summary

The LQDW has had a tough time over the past 18 months, with the buywrite strategy suffering capital losses during last year’s yield spike but failing to partake in the subsequent rally since October. 2024 is likely to be much kinder to the ETF as a higher yield on its LQD and a more subdued outlook for rate volatility allows it to outperform.

Read the full article here