Aurinia Pharmaceuticals (NASDAQ:AUPH) markets Lupkynis (voclosporin) which was approved in January 2021 by the US Food and Drug Administration for the treatment of lupus nephritis. A recent preliminary update on Q4’23 and full-year 2023 financials provides an opportunity to look at where the company stands now.

Is it finally time for an AUPH buyout?

Buyout speculation isn’t new for AUPH, but many longs have been waiting years without any action. It is worth noting that on January 5, 2024, AUPH reported some preliminary numbers for Q4’23, but also provided a comment on its strategic review initiated in mid-2023.

As previously announced, the Company initiated a robust strategic review at the end of June 2023 and is continuing to review all strategic options for the Company, which include a variety of possibilities including, but not limited to, a potential sale, merger, or other strategic transaction. At this time, there are no further updates on the matter, other than that the process is continuing.

AUPH comments, January 5, 2024, press release.

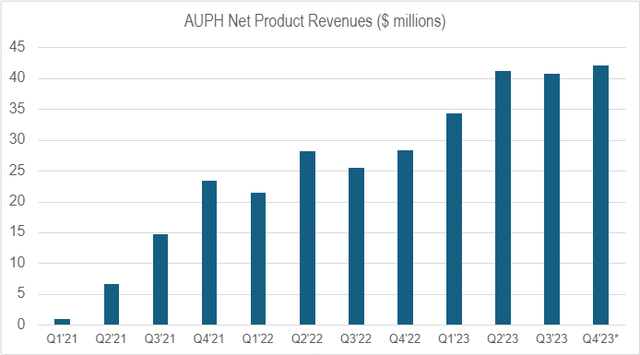

Looking at the financials, I found net product revenues of AUPH’s Lupkynis to be fairly flat the past few quarters, but a return to growth could happen in Q1’24.

Financial Overview

Q3’23 financials

Looking first at the Q3’23 financials, AUPH reported net product revenue of $40.8M for the quarter for Lupkynis, and total net revenue of $54.5M aided by a $10M milestone payment from ex-US partner Otsuka Holdings (OTCPK:OTSKF, OTCPK:OTSKY). SG&A expenses were $47.8M in Q3’23, R&D expenses were $13.6M in the same quarter. Net loss was $13.4M in Q3’23. AUPH finished Q3’23 with cash, cash equivalents, restricted cash and investments of $338.5M. The company estimates it has sufficient resources to fund operations for “at least the next few years.” Taking out restricted cash of $0.84M from the $338.5M number, and considering net cash used in operating activities of $47.8M in the first 9 months of 2023, AUPH could continue at the current rate of burn for over five years.

As of November 1, 2023, there were 143,608,164 shares of AUPH’s common stock outstanding, giving it a market cap of $1.15B ($8.04/share). There were also 12.4M stock options, 7M unvested restricted stock units, and 0.9M unvested performance awards outstanding as of September 30, 2023.

Q4’23 and full year 2023 preliminary financials

AUPH’s preliminary Q4’23 results came with news the company had cash, cash equivalents, restricted cash and investments of ~$351M at the end of 2023. The company expects to become cash flow positive in the second half of 2024 and has net product revenue guidance for 2024 of $200M-$220M.

Plotting the net product revenues, which come from AUPH’s only marketed product Lupkynis, we see that including the recent Q4’23 preliminary number of ~$42M paints a picture of a pretty flat few quarters. At the same time, I can see a similarly flat period in Q2/Q3/Q4 of 2022.

Figure: Quarterly net product revenues. (Earnings press releases, quarterly SEC filings, chart by Biotech Beast.)

AUPH enterprise value and sales multiple

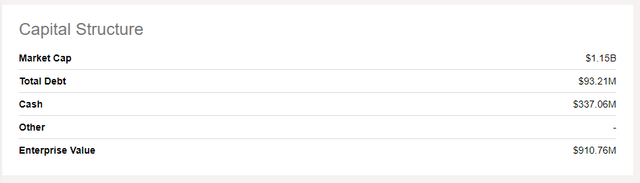

Considering the current market cap of $1.15B and including $93.21M worth of current and non-current liability related to operating and finance leases, yields an enterprise value of $910.8M. Comparing that to preliminary net product revenue for 2023 of $159M yields an EV to sales multiple of 5.73. Note that using net product revenue does mean we are ignoring royalty from OTSKF, although right now that isn’t huge, but could be considered to be part of product sales.

Figure: Screenshot from SA’s valuation tab for AUPH. (Seeking Alpha)

Even taking out the $93.21M from the leases, as it isn’t conventional debt, and some might calculate enterprise value like that, yields an enterprise value of $817.6M and an EV/sales of 5.14. If we want to get particularly aggressive, we can use preliminary year-end cash of $351M to calculate an enterprise value of $803M, and use forward estimates to get a lower multiple, but I’ll leave that up to the AUPH bulls. Seeking Alpha’s valuation tab notes a sector median of 3.82 for EV/Sales (trailing twelve months). That being said the sector median is going to be calculated from many companies where the average marketed drug isn’t just 3 full years into its launch. Indeed covering Coherus (CHRS) recently, Bhavneesh Sharma noted an EV/sales of 6 for biotech companies according to NYU-Stern data.

In any case, I’d say AUPH seems somewhat cheap given the sales numbers I’m using are from its third year on the market, at the same time, I can see why it might be a little cheap because of a few quarters of fairly flat sales.

Conclusions and Risks

AUPH’s preliminary Q4 sales numbers have come with the company’s guidance of achieving cash flow positivity in H2’24. Further, AUPH’s review of strategic options is continuing. While I consider these developments to be positives, a little more sales growth would help strengthen any buyout thesis, and indeed any bull thesis independent of a buyout.

I rate AUPH a hold here, but I will be keeping an eye on quarterly sales. Although I’m not rating it a buy, I can speak about a few risks that are obvious to me.

First among the risks would be underwhelming sales of Lupkynis. AUPH needs to move net product revenues into the $50M/quarter range to achieve 2024 guidance of $200M-$220M.

A second risk is that any strategic development actually involves a purchase that the market doesn’t like or a sale of part of the business on terms the market doesn’t consider favorable.

Lastly, trials in lupus nephritis aren’t unheard of. While many drugs under development for lupus aren’t oral therapies like Lupkynis, if they demonstrate favorable efficacy or safety relative to Lupkynis, the potential to steal market share could weigh on AUPH’s stock.

Read the full article here