Summary

Readers may find my previous coverage via this link. My previous rating was a buy, as I believed ManpowerGroup Inc.’s (NYSE:MAN) performance for 4Q23 was going to be poor given the weak performance in 3Q23 and management comments. I would also like to note that I have been staying on the sidelines for MAN for a while now, given the weak macro conditions in Europe, where MAN is heavily exposed. I am reiterating my hold rating for MAN as the business fundamentals have not recovered at all, and any hope for recovery in FY24 seems limited given how the European macro conditions are progressing today.

Financials / Valuation

MAN saw its revenue continue to fall by 3.7% to $4,63 billion in 4Q23, which was slightly better than the consensus estimate of a 5% decline. That said, the 3.7% decline saw positive benefits from FX, and when adjusted for it, revenue was actually down 5.2% on an organic basis, in line with consensus expectations. Profitability continues to see compression, where EBITA margins further contracted by 100 bps y/y to 2.5% due to gross margin headwinds from perm placement declines, negative operating leverage, and reinvestment activity. MAN ended the quarter with EPS of $1.45, beating the consensus estimate of $1.19.

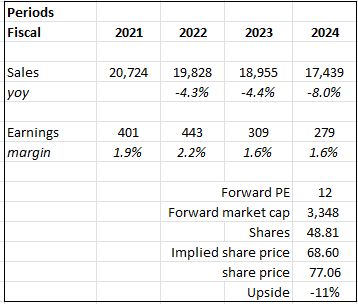

Based on author’s own math

Based on my updated view of the business, reflecting management FY24 guidance, I now expect MAN to see a revenue decline of 8% in FY24, a major downgrade from my 1% growth expectation previously. 4Q23 results showed no signs of improvement, and management guidance suggests the same. At the macro level, there are no strong catalysts to drive growth as well. For margins, I give MAN the benefit of doubt that their margin improvement initiatives will net off further operating deleverage from revenue decline in FY24; hence, margins remain flat at 1.6%. On valuation, I think MAN valuation will drift down from here as the market starts to reset expectations that any recovery in FY24 is unlikely. MAN is currently trading at 13x forward PE (its average), which I believe is too high as the business fundamentals have certainly not normalized yet.

Comments

I prefer to remain on the sidelines for MAN, just as I did for the past few quarters, as there are no signs of recovery at the moment. Growth remained negative across all regions on an organic basis: Southern Europe revenue decreased 4.1%, and Northern Europe revenue declined 10.1%. Americas revenue fell 4.5% year over year, and APME revenue declined 2.7%. Management guidance for 1Q24 also suggested no signs of improvement; 1Q24 is expected to decline by 6% at the midpoint.

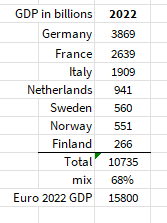

I expect broader macro pressures to continue weighing on top-line performance at MAN, especially in Europe. There are still red flags in various regions of the region, including Italy and France, and in Northern Europe (which includes the Nordic countries, the Netherlands, and Germany). Note that these are the key regions of Europe where they are the major drivers of economic growth (collective GDP represents nearly 70%). The fact that MAN needed to take a $55 million goodwill impairment in 4Q due to market declines in recent quarters in the Netherlands is a major red flag, in my opinion, that underlying conditions are much worse.

Based on author’s own math

I expect MAN to continue seeing challenges ahead in Europe. Unlike Korn Ferry (KFY), MAN is heavily exposed to the European economy (>60% of revenue comes from Europe), and this area of the world is still very weak despite avoiding a major recession (i.e., no economic growth). The high energy costs that continue to plague the region will continue to have headwinds on businesses and consumer spending, which drives business growth. Finally, it appears that the European government is not going to lend a huge helping hand to drive growth in FY24. All of these three major factors led me to believe that recovery in FY24 is unlikely, which is very negative for MAN. Looking ahead, management has also specifically called out that they are not seeing any inflection point of improving demand for services in the US or Europe, which is limiting visibility into the timing of a revenue recovery.

This is most noticeable in Europe and in North America, and we haven’t seen any inflection point yet of improving demand for our services and solutions in those regions. Source: 4Q23 earnings

The weak outlook was well communicated in management guidance. They guided for 1Q24 guidance revenue to be down 5-9%, which reflects negative growth across all regions. I highlight that this guidance was below consensus expectations, which suggests that the market is still too positive on the outlook for MAN and expectations have not reached trough levels yet.

One last point I like to touch on is MAN’s margin outlook. The qualitative comments that management gave were positive, in that they are tracking well in their technology transformation initiative to centralize systems and processes across finance and technology and expected to see productivity gains per employee (a 9% year-over-year headcount reduction in 4Q23, but sales capacity remains the same). However, the reported results showed no signs of these positives. The reality is that EBITA margins contracted 100 basis points y/y in 4Q on negative operating leverage associated with revenue declines. I believe until MAN reports margin growth, the market will not attach any value to these margin improvement initiatives.

Risk & conclusion

The key upside risk is a major recovery in macroeconomic conditions in Europe. This will not only lead to a recovery in fundamentals; the stock valuation will likely see a huge upgrade as the market starts to price in recovery.

I am maintaining a hold rating on MAN given the persistently weak macro conditions in Europe. The overall business fundamentals have also not shown signs of improvement based on 4Q23 results, and the fact that MAN had to write down goodwill in Netherlands is a very bad sign for underlying business conditions. Management guidance for 1Q24 also suggests weakness to continue into FY24. I also think that MAN’s 13x forward PE is too high considering the challenging economic landscape.

Read the full article here