The global crop merchant Bunge is to buy competitor Viterra in a $8.2bn cash and shares deal, creating an agricultural behemoth to rival the largest trading houses that move grains, oilseeds and pulses from farm to consumers.

The combined group will compete with industry leaders Cargill and Archer Daniels Midland, strengthening Bunge’s presence in some of the world’s principal food supplying regions such as Canada and the US.

Shareholders in Glencore-backed Viterra will receive about $6.2bn in Bunge shares and $2bn in cash, and will control one-third of the company’s stock post-transaction.

The consolidation comes after a year of bumper profits for Bunge and Viterra, as the war in Ukraine led to severe volatility in grain and other commodities markets.

Bunge, founded more than 200 years ago, has long been known as the “B” in the so-called ABCD of global grain trading companies that link farmers with food importers. The others are ADM and Cargill, both headquartered in the US, and Europe-based Louis Dreyfus.

Bunge chief executive Greg Heckman said the merger would help the company diversify and insulate it from changes in the external environment — such as regional droughts brought about by climate change.

“By putting these two networks together, we have more diversification in geographies, and diversification in crops,” he said in an interview. “The asset footprints are very complementary.”

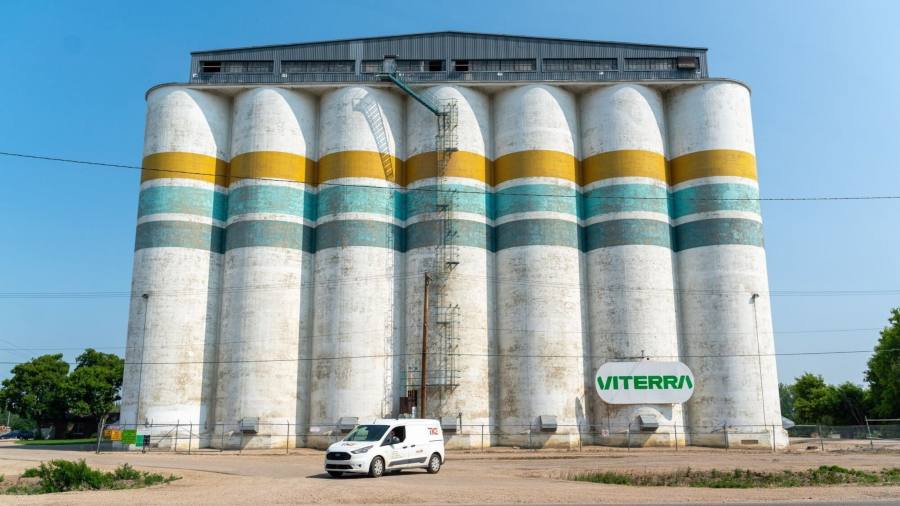

Viterra has its roots in grain-handling co-operatives in Canada’s Saskatchewan province and extensive operations across the US, which it gained through its 2022 acquisition of Gavilon.

Bunge will gain more than 270 storage and handling facilities, over 30 processing sites and a fleet of more than 200 ships, bolstering its presence in the fertile regions of Canada, the US, Brazil, Argentina and Australia.

Bunge-Viterra’s combined revenues totalled $121bn in 2022, which would put the merged group in the same league as Cargill, the world’s largest agricultural commodities company with revenues of $165bn in its fiscal year ended May 2022.

Heckman declined to say whether regulators might require any asset disposals as part of antitrust reviews. “We look forward to engaging on the regulatory front,” he said.

For Viterra shareholders — Glencore, Canada Pension Plan Investment Board, and British Columbia Investment Management Corp — the deal represents a chance to cash in at a time when commodities trading houses are enjoying big profits.

Shares in Glencore, the Swiss mining and trading giant, climbed 5.3 per cent in London on the news. Bunge shares rose 1.9 per cent in New York.

Bunge will assume Viterra’s debt of $9.8bn, which is linked to about $9bn worth of readily marketable inventories. The transaction will be funded by a $7bn financing commitment provided by Sumitomo Mitsui Banking Corporation.

“We believe there is a ratings upside to this transaction, because it strengthens the positions of the two companies,” said Chris Johnson, portfolio analyst at debt rating agency S&P Global.

The deal marks an end to Glencore’s agricultural trading arm, which was previously known as Glencore Agriculture. Glencore acquired Viterra for $6.1bn a decade ago. In 2016, Glencore sold down its stake in Viterra to just under 50 per cent, with the remainder held by CPPIB and British Columbia Investment Management Corp.

The sale will bolster Glencore’s financial firepower as it pursues a takeover of Canadian steelmaking coal, copper and zinc producer Teck Resources.

Glencore had previously held discussions with Bunge about a possible Viterra merger in 2017, but was rebuffed.

The companies said the deal would generate about $250mn of pre-tax cost savings annually within three years of its completion, which is expected in mid-2024.

Read the full article here