The Apollo Senior Floating Rate Fund (NYSE:AFT) stood out to me because of its floating-rate nature. I think too few income funds are structured like this, and the high yield it brings is interesting, considering the credit quality of its assets. I therefore decided to take a deeper look and see if this is a fund whose yield may prove true in the long run.

Concept of the Fund

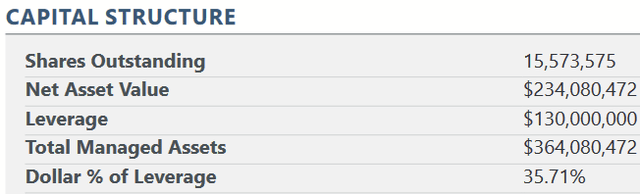

AFT is a closed-end, actively managed fund that primarily invests in senior secured loans with floating interest rates. This means the loans are backed by collateral and often supported by covenants, while the interest payable is routinely recalculated as the base rate (usually SOFR) fluctuates. The borrowers behind these loans usually have a credit rating that places these loans below investment grade. The fund typically utilizes some leverage to make these investments.

AFT Official Fact Sheet

As such, it may help investors to think of this like a junk bond fund, where the managers actively use discretion to get good deals for the fund, in spite of the apparent credit risk.

Dividend History

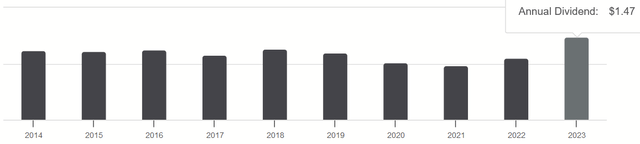

The company has consistently distributed dividends to shareholders over the past decade.

Seeking Alpha

There has been some ebb and flow to its dividend rate. Most of the years saw the dividend north of $1.20 per share. COVID and the immediate aftermath of that saw the annual drop to around a dollar. The more favorable situation of 2023 saw the dividend reach a high of $1.47.

There are different things that affect this, one of the largest being interest rate fluctuations that roughly follow the trends of the dividends. Similarly, higher loan defaults (liked during COVID) would have limited the dividend more in those years.

Portfolio

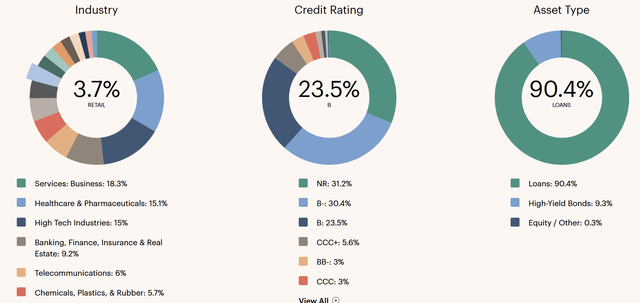

Portfolio as of Dec. 2023 (apollofunds.com)

As the company shows in the breakdown of its portfolio, it’s very diversified across many industries, with the largest concentration in Services at 18.3%. Credit quality is as stated: below investment grade. Additionally, folks will do well to note that NR stands for Not Rated. This means 31.2% of the portfolio has a credit quality that is unknown to us by standard measures.

Strategy

The fund outlines in its Prospectus a number of methods by which it invests in floating-rate, senior, secured loans:

- Direct Assignments

- Loan Participations

- Prefunded Letter of Credit Loans

These arrangements give the fund some flexibility as being either purchases of loans or a partner in their origination. It may also, at times, go outside of senior debt into subordinated loans, corporate bonds, CLOs, and other things.

Company Fact Sheet

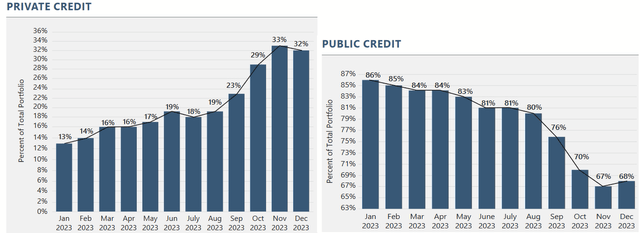

As the events of 2023 have shown, the fund is flexible with its capital allocation. It has been shifting it assets from public to private credit over the course of 2023. As they stated in their Dec. 2023 fact sheet:

Given tightening credit conditions and stalling loan growth for U.S. banks, we believe that the trend of private credit capital providers stepping in as a senior lender across a range of uses including buyouts, add-on acquisitions, recapitalizations and dividends – areas once occupied by banks or the syndicated loan market, will continue.

This says to me that the fund looks at prospects with a discerning eye. Where some funds might stick to a narrow set of investments and simply hedge more if they are unlikely to do well, AFT shifts its focus to newer assets that allow for higher yields but where the principal is properly secured by collateral and protective covenants.

A Look to the Future

I believe that the business’s capital structure, portfolio strategy, attractive yields on its assets, and history of distributions make AFT a dependable source of income for investors over a long period of time. That said, folks should bear in mind the impact of cyclicality with interest rates. Since the company uses leverage, declining rates means that the spread between their interest incomes and expenses will narrow, and so distributable earnings can decline as well.

While it will depend on how often they issue new shares to raise capital, $100K invested could generate annual income that fluctuates in these ranges:

- Currently: ~$14,000

- Near-zero rates: ~$12,000

- Distressed (as with COVID): ~$10,000

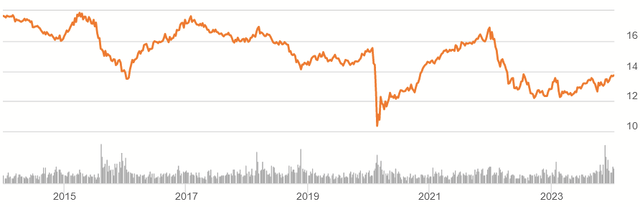

Nevertheless, the fund offers reasonable safety of principal. Price fluctuations over time have been largely an interest rate game.

Seeking Alpha

Even though the income is quite high right now, increasing rates over the last two years caused share prices to decline. If rates reverse and begin to decline, I believe AFT share prices will likely appreciate and provide some capital gains to offset any possible dividend cuts. It will require the investor to wait for a good price to sell these gains, assuming they find a better yield elsewhere, but in general I think this is the likely course.

Similarly, as interest rates change and lending environments evolve, I expect AFT to continue to reinvest in assets that will be competitive and attractive in that environment. In the event of more distress in the banking sector (as observed in spring of 2023), funds like AFT can offer precious capital and command even more protection in their terms.

Conclusion

AFT is an income fund that doesn’t overcomplicate its mission. It looks for opportunities in lower-credit debt whose yields are high, with appropriate protection by collateral and covenants to account for the lower ratings. Results have shown that the fund can continue to survive and pay yields that are attractive even after a brief cut.

If income investors can embrace this cyclical and occasionally bumpy nature, they enjoy double-digit yields from a quality fund. In my view, that makes AFT a fairly textbook BUY, especially with the prices offered today.

Read the full article here